Free Pay Stub Templates

A pay stub template is an income document for businesses that need to add transparency to their payroll process. While federal laws don’t always require employers to provide payment statements, a lot of state and local jurisdictions do. Employers provide pay stubs to employees and contractors to document the wages they have been paid on a monthly or weekly basis – it all depends on how frequently they pay their employees.

What are Pay Stubs?

Pay stubs provide a comprehensive overview of payment and withholdings for each paycheck, offering a better understanding of financial transactions. They are versatile: it doesn’t matter if you’re a small business owner, managing independent contractors or handling payroll for a large organization, having access to customizable stub templates ensures accurate and organized payment documentation. Traqq has created numerous free pay stub templates, including those with PTO, overtime, calculators and pre-tax/post-tax deductions. Customizable pay stubs enable businesses to include unique items like bonuses or PTO balances. These pay stub examples should help you organize payment processing for your workforce.

Pay Stub Templates

Pay Stub Calculators

It Depends on the State:

Most pay stubs requirements are regulated based on the categorizations listed below. It might be useful to look up the category that fits the state that your business is located in. Either way, Traqq’s pay stub templates are versatile enough to fit any state requirement.

Opt-In States

Employees in these states receive printed pay stubs by default unless they consent to receive an electronic version.

Opt-Out States

Employees can receive electronic pay stubs, but employers must provide a printed version upon employee request.

Access/print States

Employers that use electronic pay stubs need to make sure that employees can easily view/print them.

No Requirement States

Employers may decide themselves whether to provide printed or electronic paystubs without government oversight.

Types of Pay Stub Templates

There are various types of pay stubs and pay stub templates available, with different designs and layouts. Since all businesses operate differently, there isn’t a one-size-fits-all solution. However, the options below should help you choose the pay stub template that works best for you. As an employer, it is your responsibility to provide tangible proof wages have been received, which will protect you from potential legal disputes. Employers must accurately include federal, state, and local deductions on pay stubs to comply with legal requirements. Traqq has created a set of versatile stub templates that fit various business needs.

Free Pay Stub Templates

If you need to save time while maintaining accuracy in your payroll operations, consider downloading one of our many available free pay stub templates. Traqq’s paystub generators cover a wide range of employee types: we have check stub generators and templates compatible with Google Sheets. Look through our list to select a check stub template that fits your needs – you’ll be able to customize them according to your preferences.

What Kind of Pay Stubs Do You Need?

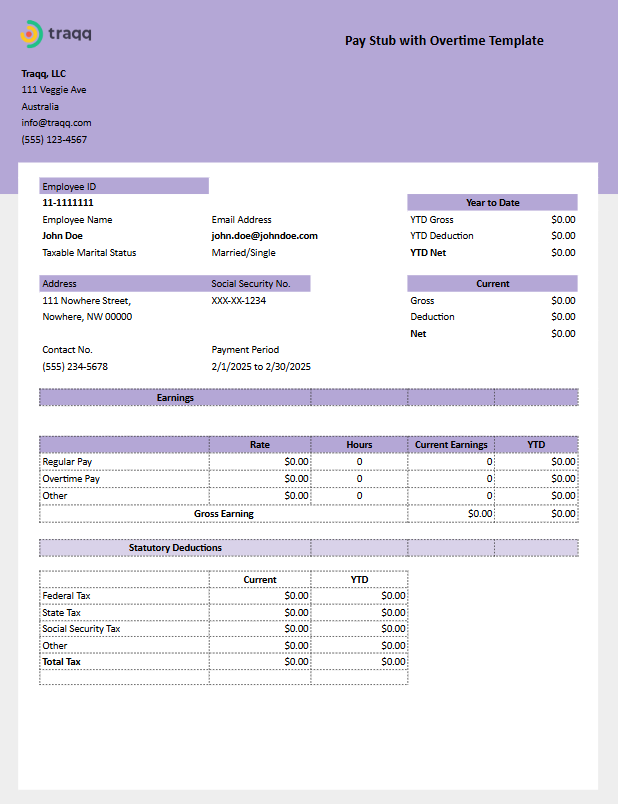

Basic Pay Stub Template with Overtime

The Basic Pay Stub Template is a simple and customizable option for businesses that need a simple solution for keeping account of employee payments. This is the most basic pay stub template that lets you fill out information over a specific pay period.

Key Features:

– The basic pay stub template has fields for employee details, employer details, gross pay and net pay.

– Payment details can be entered as needed: open-ended fields allow entering direct deposit information as well as other types of bank account transfers.

– Stub template with deductions such as federal tax, state tax, and social security tax.

– Year-to-date (YTD) totals for earnings and tax deductions.

Why This Pay Stub Template is Useful:

– The basic pay stub template is perfect for employers looking for a simple, professional pay stub that keeps track of payment information.

– Employers can document payment information during the current pay period.

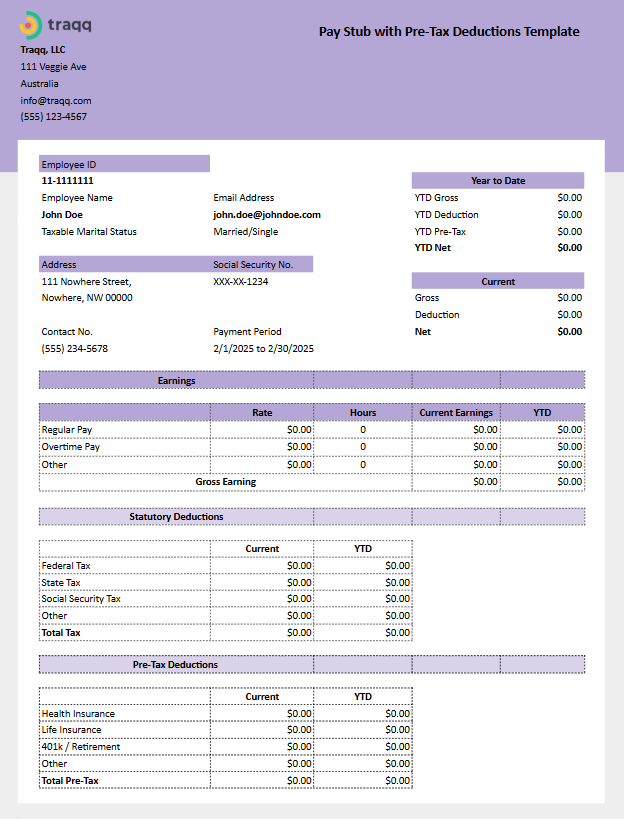

Basic Pay Stub Template with Overtime and Pre-Tax Deductions

This simple pay stub template has fields for deductions such as health insurance premiums and retirement contributions, which are calculated before taxes are applied. This pay stub provides an overview of payment and withholdings within a paycheck, which should offer clarity to financial transactions.

Key Features:

– Pre-tax deduction fields for benefits such as 401(k) plans.

– This check stub template tracks total gross pay and other applicable deductions.

– Includes sections for employer and employee information.

Why This Pay Stub Template is Useful:

– Helps track pre-tax deductions, reducing errors in tax calculations. Our pay stub template has pre-tax deductions organized separately, which helps reduce confusion.

– Perfect for businesses with health insurance benefits.

– Customize the pay stub template as needed based on your internal policy.

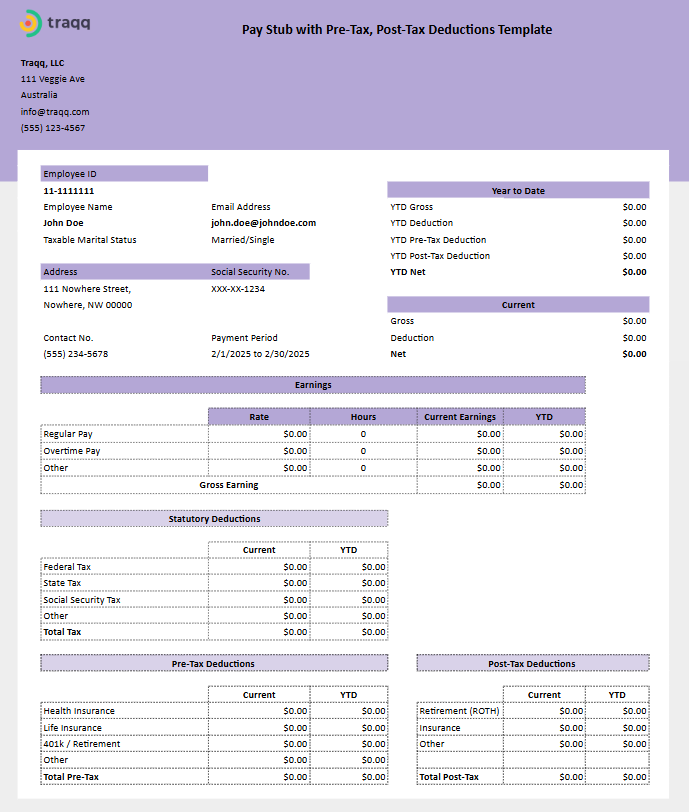

Basic Pay Stub Template with Overtime, Pre-Tax, Post-Tax Deductions

This simple pay stub template has fields for all applicable deductions including statutory, pre-tax and post-tax deductions.

Key Features:

– Statutory deduction fields for all applicable taxes.

– Pre-tax deduction fields for health insurance and 401k plans.

– Post-tax deduction fields such as Roth IRA, among others.

– Includes sections for employer and employee information.

Why This Pay Stub Template is Useful:

– Tracks all applicable deductions.

– This pay stub template has pre-tax and post-tax deductions organized separately, which helps reduce confusion.

– Perfect for employees with insurance benefits and/or Roth IRA.

– Pay stub template customizable based on your company’s needs.

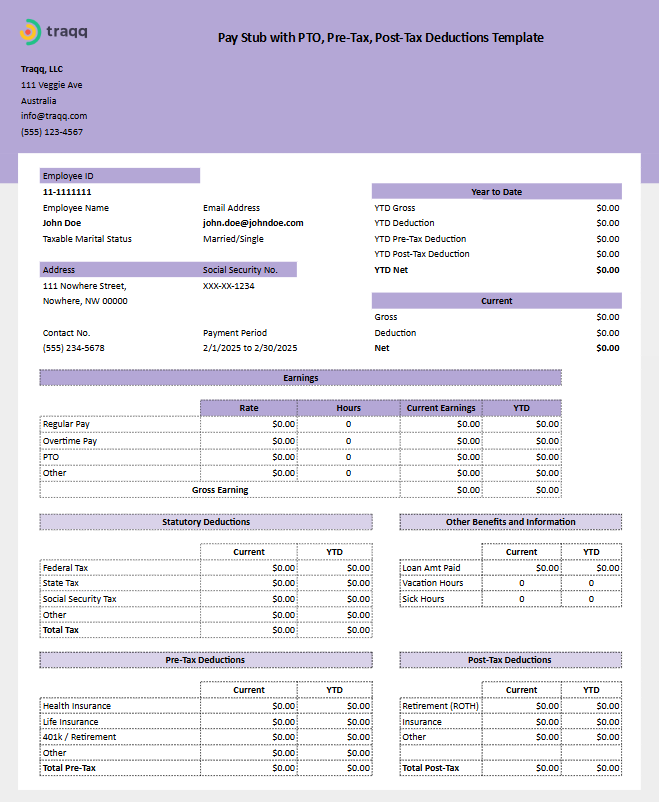

Basic Pay Stub Template with PTO, Overtime, Pre-Tax, Post-Tax Deductions

This is a perfect pay stub template for businesses that need to account for both PTO policies and all applicable deductions. Most companies with full-time employees can use this pay stub, since they are eligible for PTO and deductions. However, some organizations may extend these to part-time or contract workers as well – it all depends on a company’s internal policy.

Key Features:

– Fields to record PTO balances, including hours used and remaining.

– Pre-tax and Post-Tax deduction fields for health insurance and retirement contributions.

– Check stub template tracks year-to-date totals for gross earnings, deductions and net pay.

Why This Pay Stub Template is Useful:

– Helps employers manage and account for PTO earnings and balances to maintain accurate pay stubs.

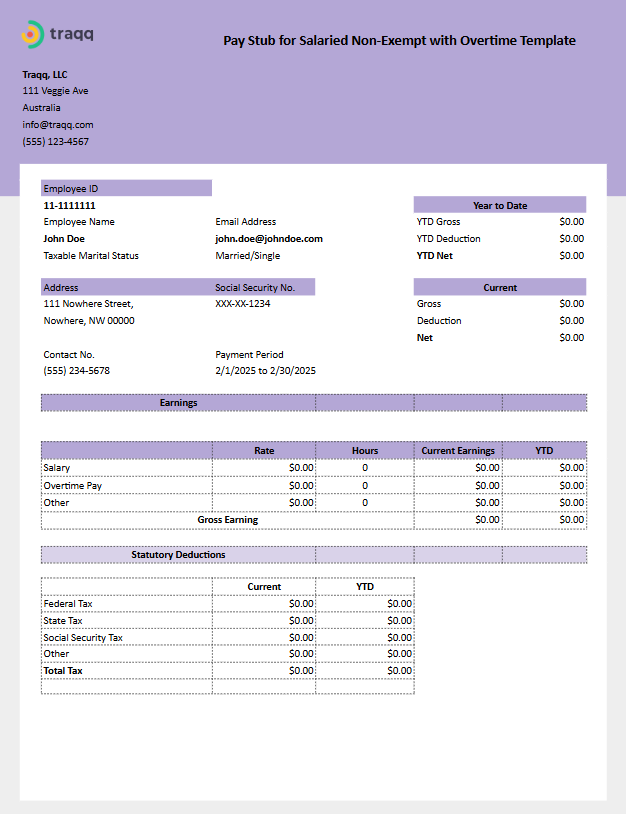

Basic Pay Stub Template for Salaried Nonexempt with Overtime

This pay stub online template is ideal for salaried employees with overtime pay opportunities. Feel free to download this paycheck stub as needed to enter payment information.

Key Features:

– Fields to record regular salary and overtime hours worked.

– Salary is taken into account, as opposed to hourly pay that is common for contract workers.

– Tracks gross pay, deductions, and net pay.

Pay stub includes employer information and employee data fields.

Why This Pay Stub Template is Useful:

– This paycheck stub template has all fields and calculations necessary for salaried non exempt employees.

– Ideal for documenting payments of salaried employees who work overtime. This functions as a great overtime pay stub template.

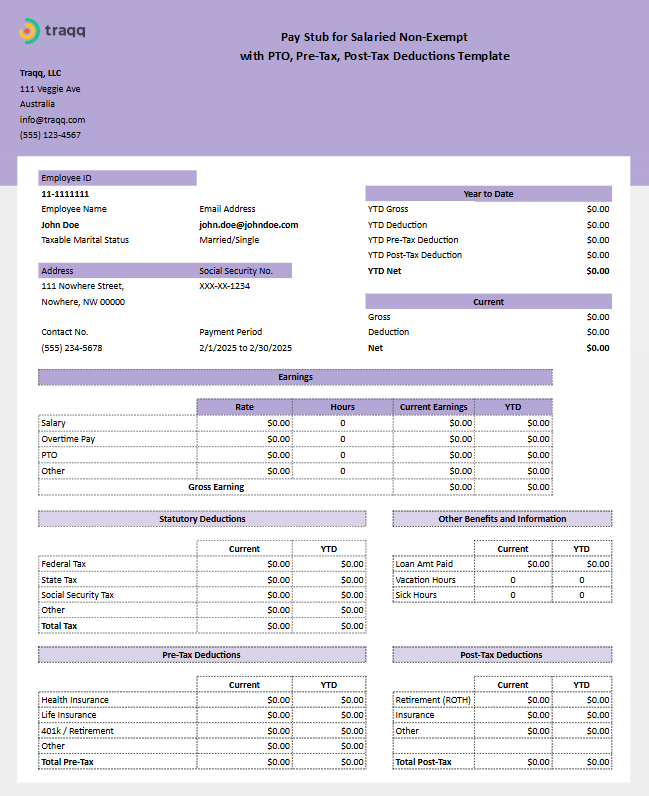

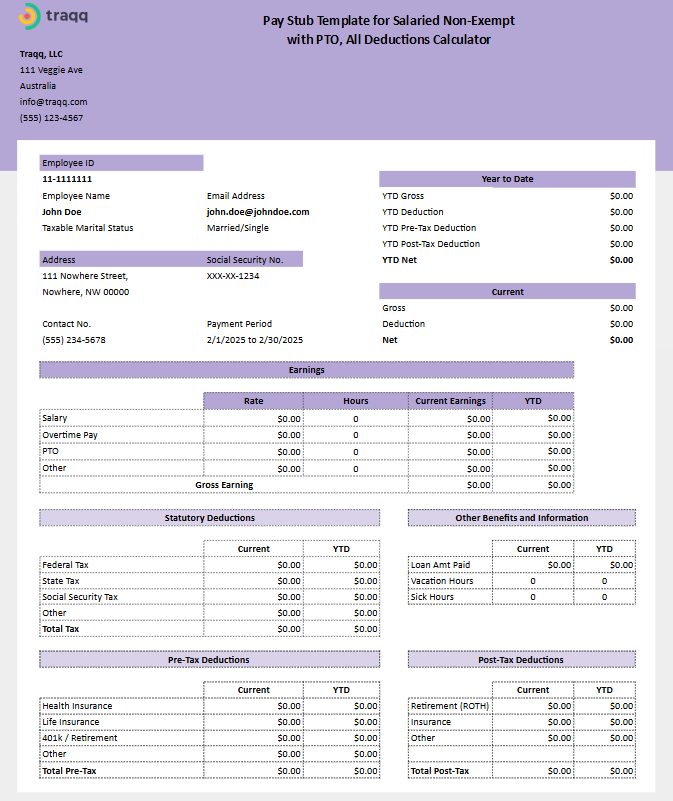

Basic Pay Stub Template for Salaried Nonexempt with PTO, Overtime, Pre-Tax, Post-Tax Deductions

Combines features of the salaried nonexempt pay stub template with PTO tracking. This overtime pay stub template allows for the recording of hours beyond the weekly norm.

Key Features:

– Paystub template tracks PTO balances alongside regular salary and overtime payments.

– Includes fields for applicable deductions like federal tax and local taxes.

– All necessary paystub fields, including pay date and pay rate.

Why This Paycheck Stub Template is Useful:

– This PTO pay stub template is a useful tool for businesses offering paid time off to salaried nonexempt employees.

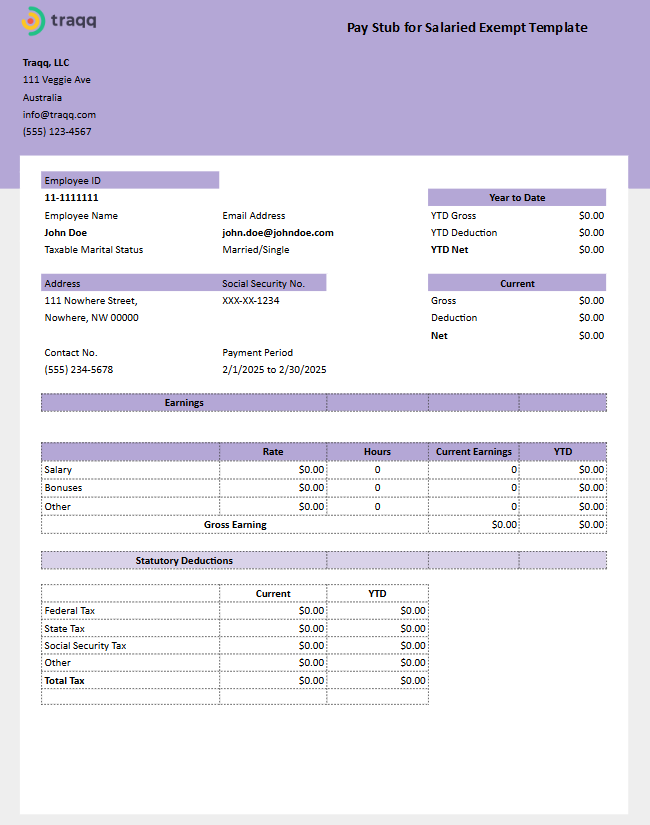

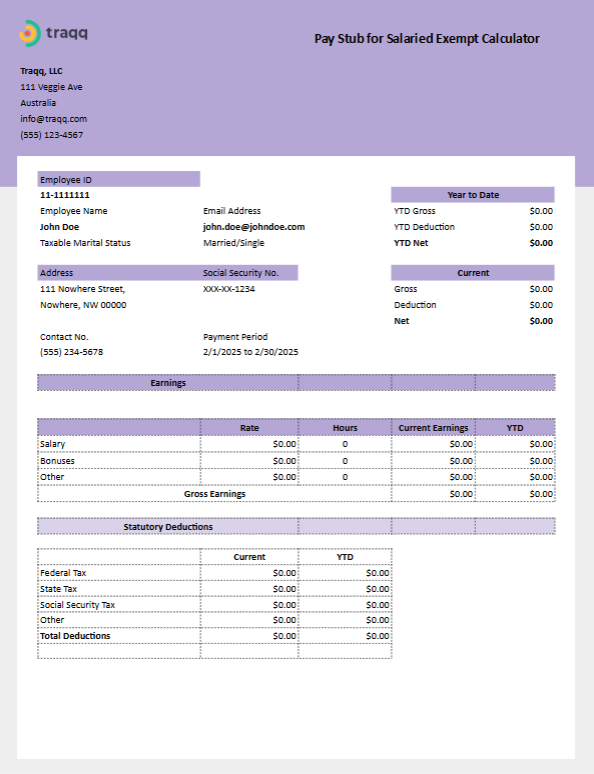

Basic Pay Stub Template for Salaried Exempt

Pay stub template designed for salaried exempt employees who do not qualify for overtime or PTO.

Key Features:

– Fixed salary fields with options to add bonuses or adjustments within this paystub template.

– Includes year-to-date totals and tax withholding fields.

– Basic paystub template with all necessary fields for salaried exempt employees.

Why This Pay Stub Template is Useful:

– Paystub template that simplifies payroll operations by focusing on fixed salary payments.

– Fully customizable check stub template.

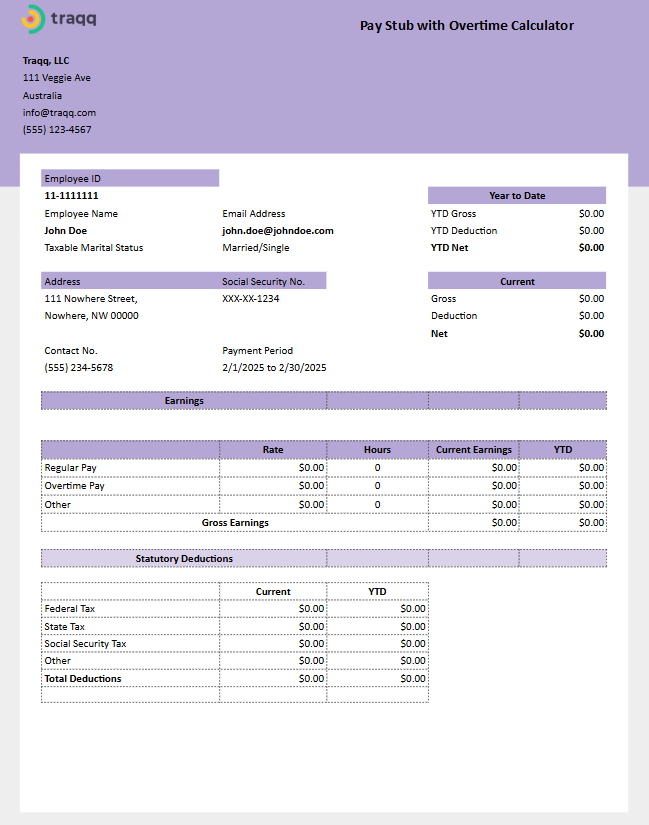

Pay Stub Template with Overtime Calculator

For employers needing to calculate overtime pay automatically, this overtime pay stub template should save time that is usually needed for manual calculations.

Key Features:

– Paystub template with built-in calculator to compute overtime earnings based on hours worked.

– Tracks gross pay, deductions, and net pay accurately.

Why This Paycheck Stub Template is Useful:

– Eliminates manual calculations, ensuring accurate payroll management.

– Google sheets pay stub calculator with formulas for simplicity.

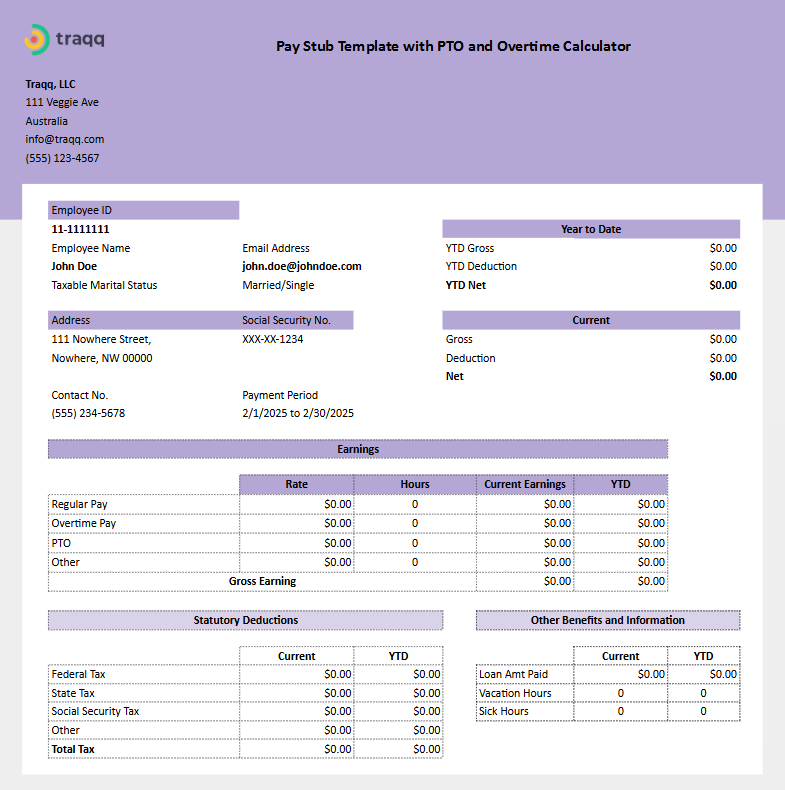

Pay Stub Template with PTO and Overtime Calculator

This PTO pay stub template handles both PTO tracking and overtime calculations seamlessly.

Key Features:

– Automated calculations for gross earnings, including PTO hours worked and overtime pay.

– Paystub template that tracks applicable deductions such as federal tax and social security tax.

Why This Pay Stub Template is Useful:

– Ideal for businesses with complex payroll needs involving multiple variables.

– This pay stub calculator is formatted in google sheets with added formulas: all you have to do is enter the numbers, we do the calculations for you!

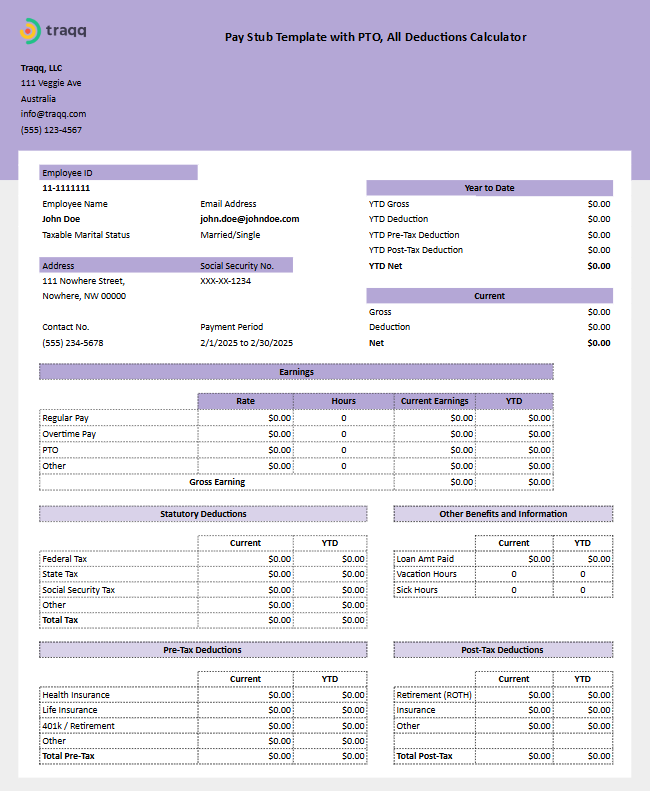

Pay Stub Template with PTO, Overtime, Pre-Tax, Post-Tax Deductions Calculator

This sample pay stub document with pre-tax and post-tax deductions is designed to simplify the process of calculating all applicable deductions automatically.

Key Features:

– Paystub template with fields for health insurance premiums and other pre-tax and post-tax benefits.

– Automatically adjusts gross pay based on pre-tax and post-tax deductions before calculating net pay.

– This pay stub template has fields for PTO, overtime and pre-tax deductions.

Why This Pay Stub Template is Useful:

– Reduces errors in tax filing by automating deduction calculations.

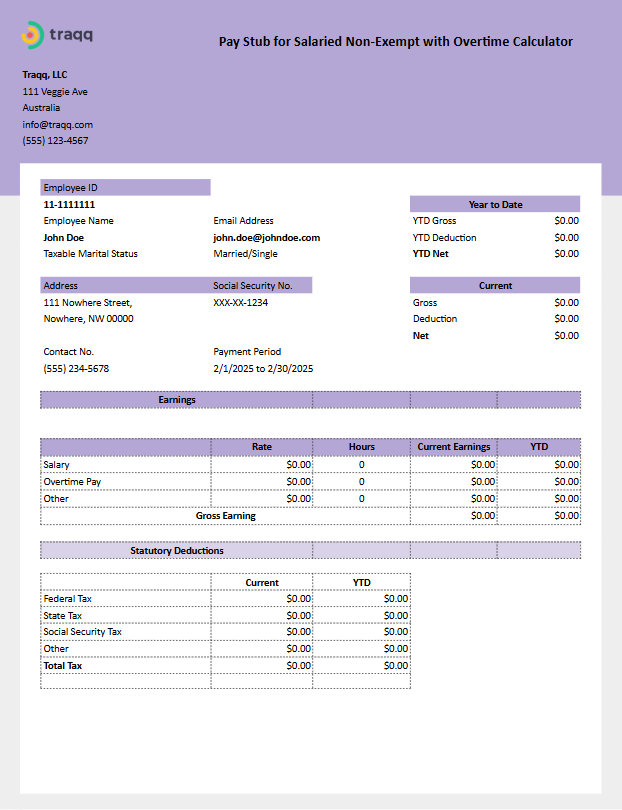

Pay Stub Template for Salaried Nonexempt with Overtime Calculator

A sample pay stub calculator that combines automation with detailed tracking of payments made to salaried nonexempt employees.

Key Features:

– Built-in calculator to handle regular salary plus overtime earnings.

– Tracks gross pay, net pay, and applicable taxes seamlessly.

– Paystub template has a downloadable Google Sheets format.

Why This Pay Stub Template is Useful:

– Traqq’s paystub template saves time and ensures accurate documentation of complex payroll scenarios.

– Has all necessary fields and pay stub calculations for salaried nonexempt employees.

Pay Stub Template for Salaried Nonexempt with PTO, Overtime, Pre-Tax, Post-Tax Deductions Calculator

A specialized pay stub template that accounts for both pre-tax, post-tax benefits and overtime payments automatically.

Key Features:

– Combines applicable tax deduction fields with automated overtime calculations.

– Tracks year-to-date totals for hours worked alongside current pay period details.

Why This Pay Stub Template is Useful:

– This paystub template is the perfect solution for employers managing multiple payroll variables efficiently.

– Simplify your payroll process with this check stub template that does the calculations for you.

A detailed pay stub template that’s easy to print.

Pay Stub Template for Salaried Exempt Calculator

Focused on simplifying payroll management, this pay stub template has the most common fields needed to track your payroll process for salaried exempt employees.

Key Features:

– Fixed salary calculations with options to include bonuses or additional adjustments.

– Automatically calculates net pay after deducting taxes like federal tax or local taxes.

Why This Pay Stub Template is Useful:

– Streamlines payroll operations by automating routine calculations.

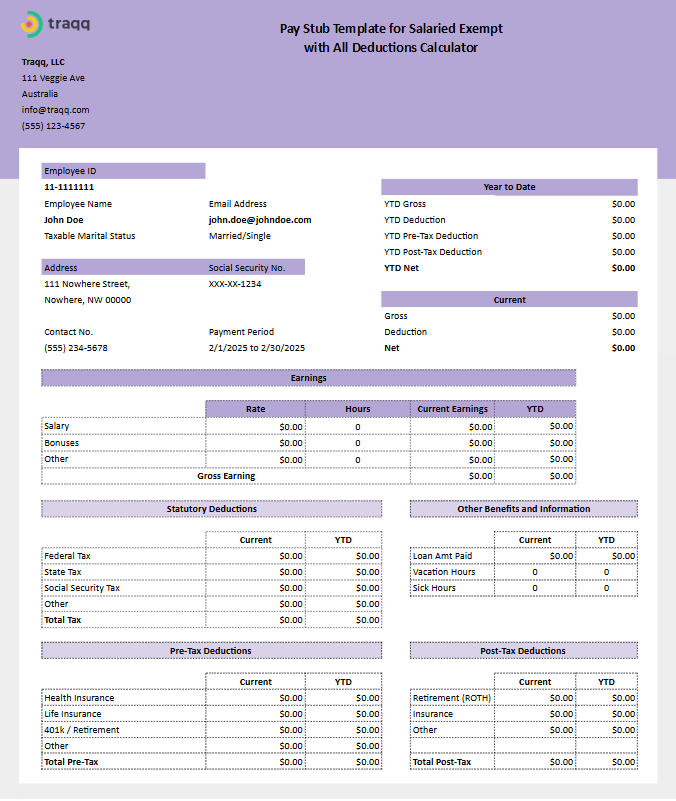

Pay Stub Template for Salaried Exempt with Pre-Tax, Post-Tax Deductions Calculator

This pay stub template is useful for salaried employees without PTO or overtime opportunities. In certain cases, these types of employees are eligible for pre-tax and post-tax deductions.

Key Features:

– This calculated pay stub template takes fixed salary employees into account.

– Included fields for 401k and other pre-tax/post-tax deductions.

– Automatically calculates net pay, accurately taking into account deductions that precede taxation.

Why This Pay Stub Template is Useful:

– Straightforward and easy to understand.

– Pay period takes into account monthly or weekly salaried employees.

– Customizable pay stub template that can be edited as needed.

Turbocharge Your Payroll Process with Traqq

Having a set of paystub templates to use for payroll is awesome – but it’s even better to not have to crunch the numbers yourself. Traqq simplifies the process of filling out paystubs with our set of tools and reports that have been created to make your life easier.

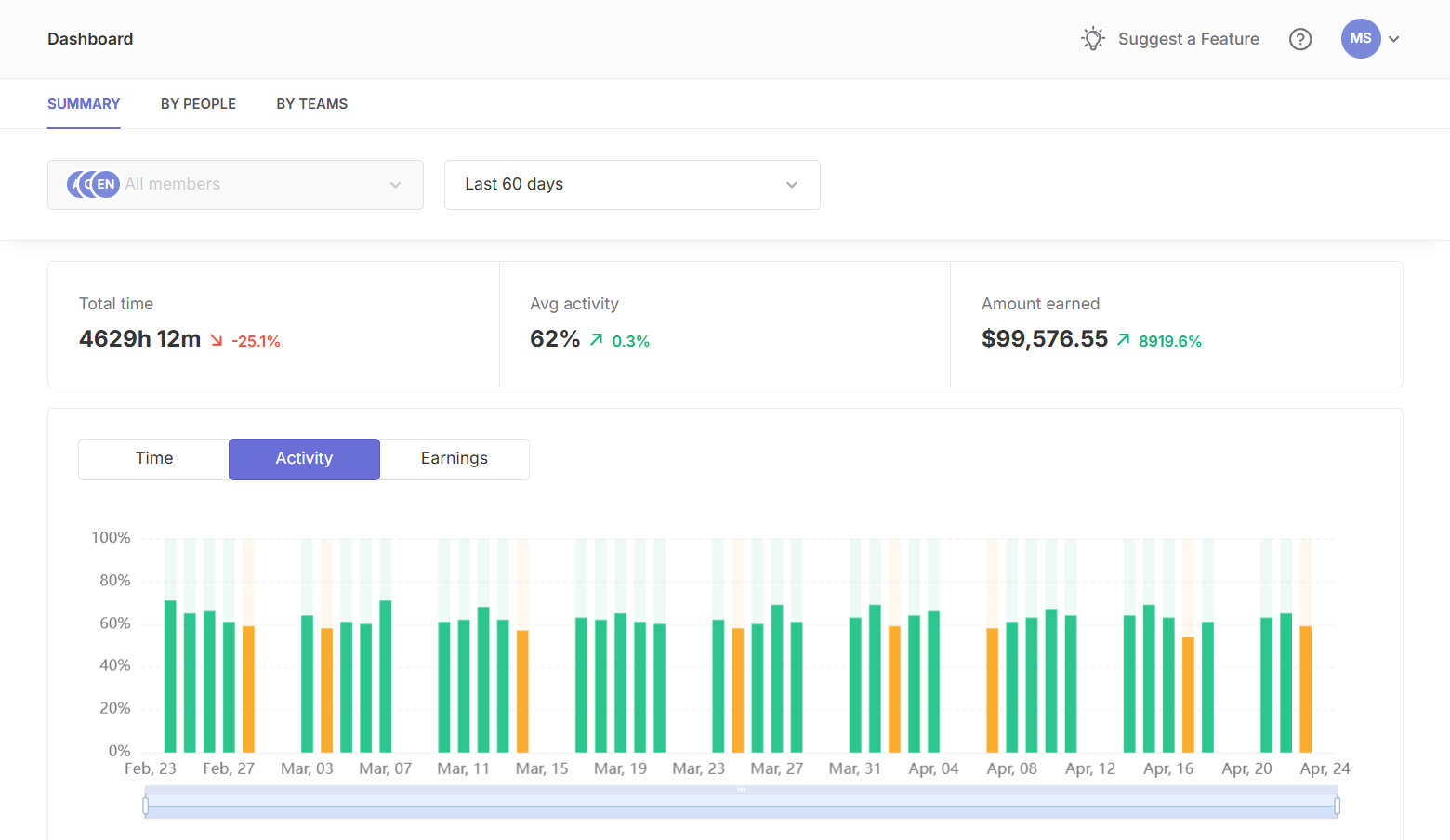

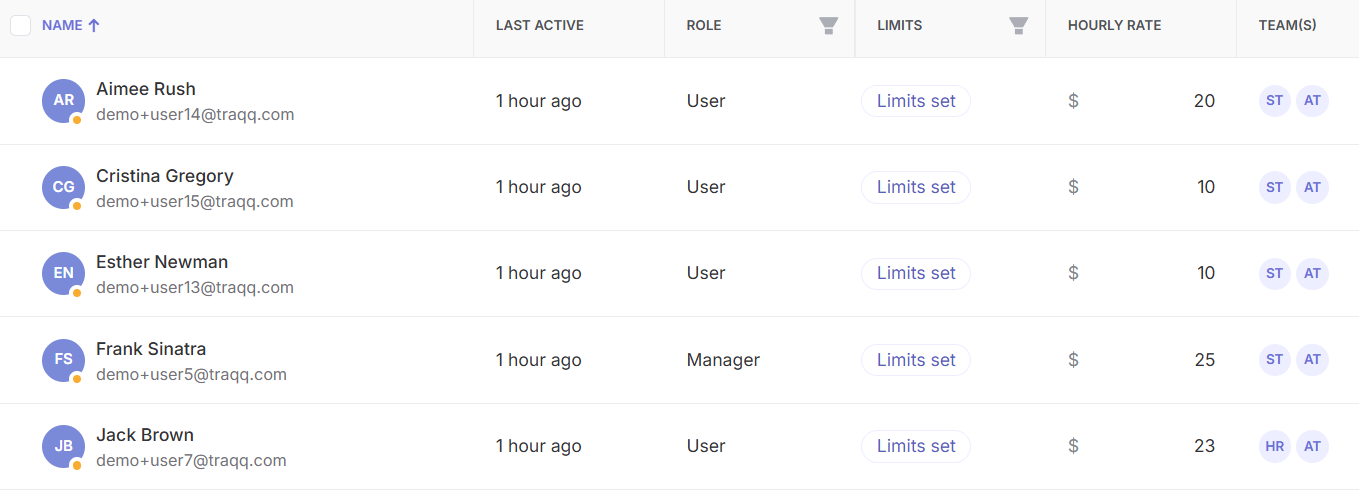

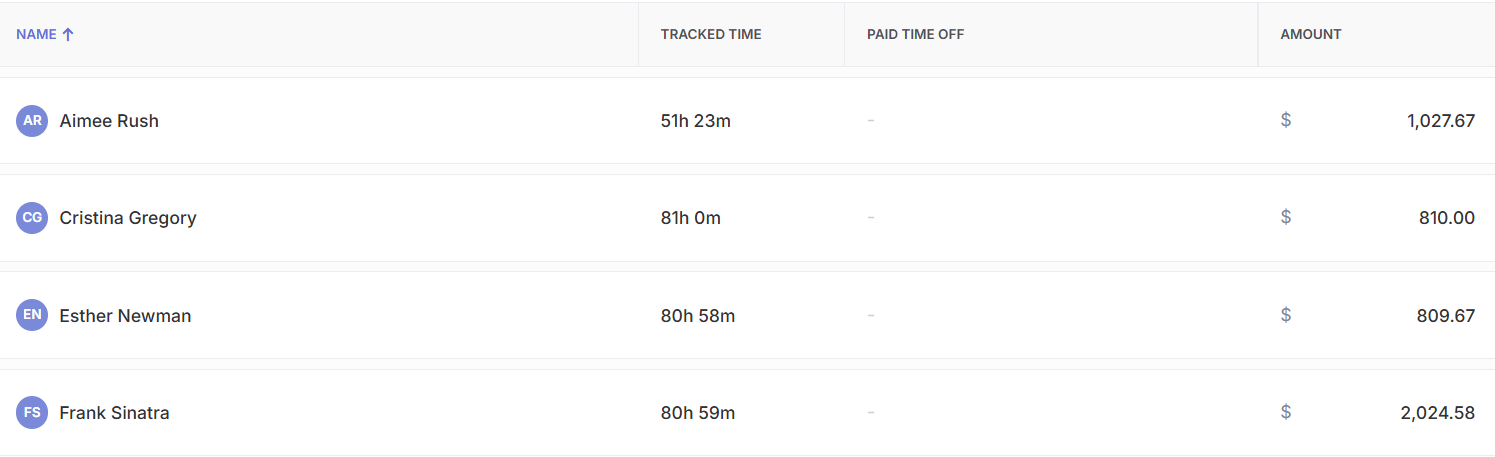

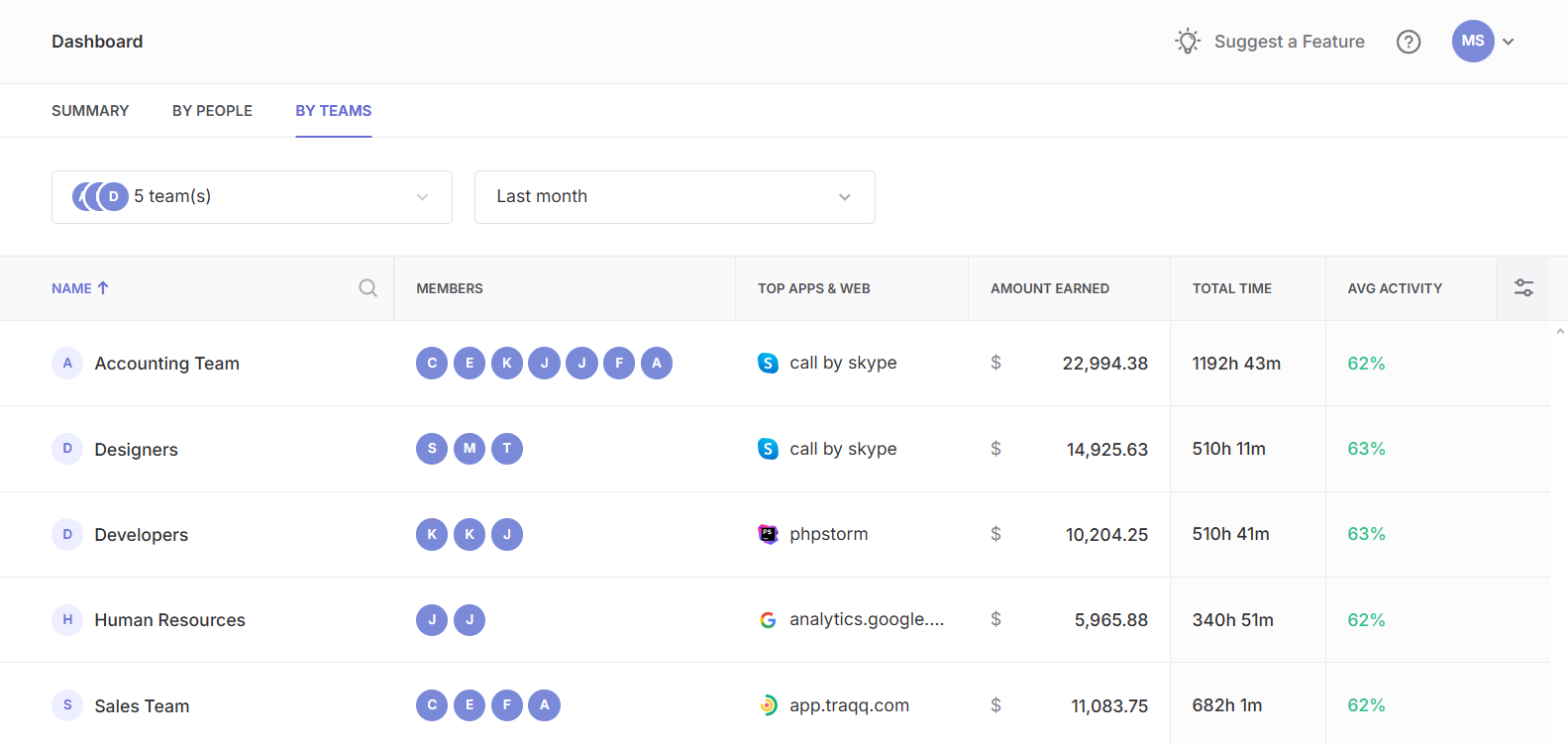

It’s even better if you have an organization with multiple teams. In a few clicks, you can generate an earnings report by team or by individual users. If you need to account for cross-team payroll processing, all you need to do is choose the individual members and Traqq will do the heavy lifting for you. After that, just add the information to the paystub template accordingly.

1. Set up Pay Rates

Enter individual pay rates for your employees and teams within Traqq. The “People” tab will let you enter employee information and add users to your organization.

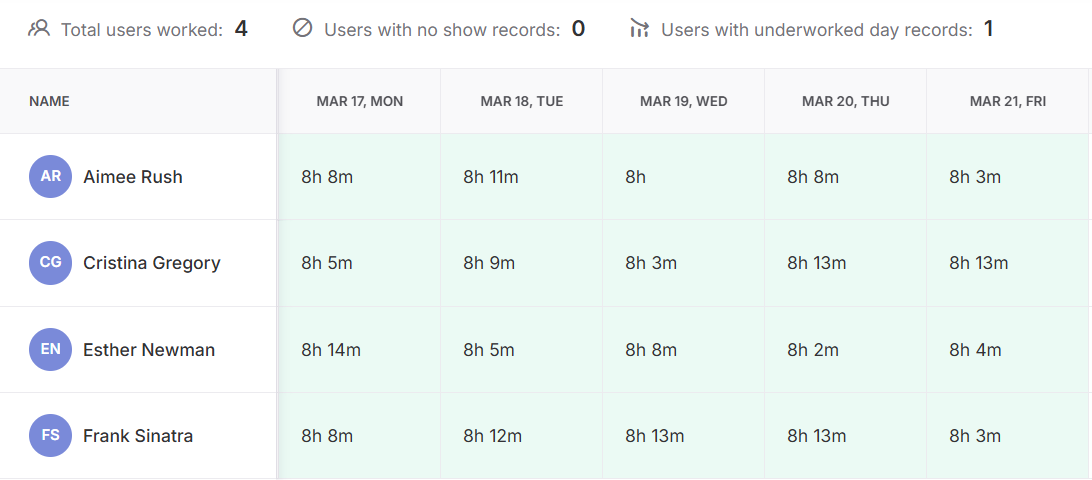

2. Track Data

All your employees have to do is clock-in by starting the tracker and clock-out by stopping. Furthermore, we even have an auto tracking option to have Traqq turn on upon system start.

3. Generate Reports

Once historical data is recorded, you’ll be able to use this information to generate an accurate report of hours worked along with your team’s earnings for a specific pay period.

Feel free to use this report in tandem with our free pay stub templates to turbocharge your payroll.

Simplify the process of creating pay stubs in just a few clicks using Traqq’s online paystub maker with an intuitive user interface.

All necessary fields included: get your payroll process organized from employee name to net pay with all applicable deductions.

Our paystub generator ensures compliance with tax filing requirements by including all necessary details.

Save time by automating calculations related to gross earnings, net pay and year-to-date totals.

Provide professional pay stubs for your employees that can be customized with your company logo.

Organized pay stubs are the key to support payroll management across various employee types—from self employed individuals to salaried workers.

Generating pay stubs is way easier for business owners that use our ready-made check stub maker.

Guidelines

A well-designed pay stub template can make your payroll process more efficient while ensuring compliance with legal requirements. Whether you need a basic pay stub template with employee details or advanced features like calculators, PTO tracking, or pre-tax deduction fields, our stub templates cater to every business need. You’ll be able to use these pay stub examples to create accurate and professional pay stubs that are easy to use.

Simple instructions on how to use our free pay stub templates:

1. Change the company logo as needed for personalization purposes. You don’t have to use the Traqq logo – we won’t mind.

2. Fill out employee details and employer information. Add the employee name and pay date.

3. Make sure the pay period dates are clearly indicated. Your payment method should also be included along with the payment details.

4. Enter gross pay based on hours worked or salary, as needed.

5. Calculate applicable deductions or use our paystub template calculators to improve efficiency.

6. Calculate tax withholdings.

7. Enter the net pay in accordance with the abovementioned deductions and withholdings. Double-check values to make sure the information is accurate.

8. Fill out YTD values as needed.

It only takes 15 minutes

To set up your organization, enter pay rates and let Traqq do the heavy lifting for you.

You’ll be able to see all pertinent information within the dashboard: team and employee-specific revenue will be calculated based on rates that you set up.

Time Tracking and Employee Management in One Tool

Traqq is a unique ethical time tracker: our customers love us for our easy-to-use interface and simple, effective timekeeping for all users.