Overtime calculator instructions

What is an overtime calculator?

An overtime calculator is a digital tool that computes your total pay including overtime based on your regular hourly rate and extra hours worked. It automatically calculates overtime pay using a multiplier like time and a half (1.5x) or double time (2x) for hours beyond your regular schedule.

Since all the data processing in the calculator is automated, you can be sure to get accurate compensation for the hours worked beyond your standard workweek by applying the appropriate overtime rate to your additional hours.

Beyond accuracy, this tool serves multiple purposes:

- Error Prevention: Eliminates manual calculation mistakes that could result in underpayment

- Transparency: Provides clear breakdowns of regular pay versus overtime compensation

- Compliance: Helps employers meet federal and state overtime laws requirements

- Financial Planning: Allows employees to calculate potential earnings when considering extra shifts

Simply input your hourly wage, regular hours, and actual hours (overtime hours are calculated automatically) to get instant pay calculations that account for all applicable overtime rates and multipliers.

Jump back to calculator

How to use the overtime calculator

Using an overtime calculator is straightforward and requires just a few key pieces of information about your work schedule and pay rate.

- Step 1: Enter your regular hourly wage (Rate) Input your standard hourly rate (e.g., $18 per hour) in the designated field. This should be your base pay rate before any overtime multipliers are applied.

- Step 2: Enter your standard (contracted) weekly hours Enter your regular work schedule, typically 40 hours per week for most full-time positions.

- Step 3: Add weekly hours worked Input the number of total hours worked for the week and the calculator will automatically determine your overtime hours by subtracting the contracted hours from the total hours worked.

- Step 4: Select your overtime multiplier Choose the appropriate rate, usually 1.5 for time and a half, which is the federal standard. Some situations may qualify for double time (2.0x) depending on your employer’s policies or state laws.

- Step 5: Review your results The calculator will display the week number, overtime hours, hourly overtime rate, regular pay, overtime pay, and total weekly earnings.

- Step 6 (optional): Save your results: By clicking “Save” you can add your results to a table and work on the calculations for the another week. You can also select a week to adjust the inputs and export the table to a .csv file when you’re finished your calculations for your desired pay period.

The rest of Traqq’s online productivity tools

Whether you want to quickly convert decimal hours to regular time or calculate your overtime pay, our suite of online tools has you covered.

Deep dive on overtime

Who is entitled to overtime pay?

In the US, non-exempt employees covered by the Fair Labor Standards Act are entitled to overtime pay for hours over 40 per week. Most hourly workers, including those in retail, food service, and manufacturing, qualify for overtime compensation under federal law.

The key distinction lies between exempt and non-exempt status. Non-exempt employees must receive overtime pay regardless of whether they’re paid hourly or receive a salary. Many employers assume that paying someone a salary automatically exempts them from overtime, but this is incorrect.

Some salaried employees earning less than $684 per week (as of 2024) may also be eligible for overtime pay, even if they perform administrative or professional duties. The salary threshold serves as an automatic qualifier – anyone earning below this amount cannot be exempt from overtime, regardless of their job duties.

State laws may provide additional overtime protections beyond federal requirements. Some states have lower salary thresholds for exemption, daily overtime requirements, or expanded coverage for specific industries. Workers should check both federal and state regulations to understand their full rights to overtime compensation.

Contract workers, seasonal employees, and part-time staff typically qualify for overtime if they work more than 40 hours in a workweek, assuming they meet the non-exempt criteria. The total number of hours worked, not employment status, determines overtime eligibility.

Understanding overtime pay

Overtime pay is additional compensation for hours worked beyond your regular schedule, typically over 40 hours per week. The Fair Labor Standards Act requires employers to pay at least 1.5 times the regular rate for overtime hours worked by eligible employees.

This federal law, enacted in 1938, established the foundation for overtime compensation to protect workers from exploitation and ensure fair wages for extended work periods. The standard 40-hour workweek became the benchmark, with any hours beyond this threshold qualifying for premium pay.

Miscalculated overtime can cost workers hundreds of dollars per year while exposing employers to costly compliance violations. Whether you’re an hourly employee wanting to verify your paycheck or an employer ensuring Fair Labor Standards Act compliance, understanding overtime calculations is essential for fair compensation.

Overtime ensures workers receive fair compensation for extended work hours that exceed standard expectations. The time and a half requirement means that for every hour worked over 40 in a workweek, eligible employees must receive their regular hourly rate plus an additional half of that rate.

Most non-exempt employees are entitled to overtime pay when working more than 40 hours weekly, regardless of whether they’re paid hourly or receive an annual salary below the federal threshold. This protection extends to millions of workers across various industries, from retail and food service to manufacturing and healthcare.

The federal government sets minimum standards, but many states have enacted more generous overtime laws. Some states require overtime after eight hours in a single day, while others mandate double time for excessive daily hours or work on holidays.

Common overtime scenarios and examples

Real-world examples help illustrate how overtime calculations work across different industries and pay rates. These scenarios demonstrate the financial impact of overtime compensation on workers’ total pay.

Restaurant server example: A server earning $12 per hour works 50 hours in a week:

- Regular pay (40 hours): 40 × $12 = $480

- Overtime pay (10 hours): 10 × $12 × 1.5 = $180

- Total weekly pay: $480 + $180 = $660

Construction worker scenario: A construction worker earning $25 per hour with 15 overtime hours:

- Regular pay (40 hours): 40 × $25 = $1,000

- Overtime pay (15 hours): 15 × $25 × 1.5 = $562.50

- Total weekly pay: $1,000 + $562.50 = $1,562.50

Retail associate example: A retail worker earning $14 per hour with 8 overtime hours:

- Regular pay (40 hours): 40 × $14 = $560

- Overtime pay (8 hours): 8 × $14 × 1.5 = $168

- Total weekly pay: $560 + $168 = $728

Factory worker calculation: A factory employee earning $18 per hour working 55 hours weekly:

- Regular pay (40 hours): 40 × $18 = $720

- Overtime pay (15 hours): 15 × $18 × 1.5 = $405

- Total weekly pay: $720 + $405 = $1,125.

These examples demonstrate how overtime can significantly increase take home pay, often adding 20-40% to weekly earnings depending on the number of extra hours worked and the base hourly pay rate.

Overtime Pay Rates and Formulas

Understanding the mathematical formulas behind overtime calculations helps ensure you receive proper compensation for your extra hours worked.

Basic overtime formula:

- Time and a half: Regular hourly rate × 1.5 × overtime hours worked

- Double time: Regular hourly rate × 2 × overtime hours worked

- Total weekly pay: (Regular hours × hourly rate) + (Overtime hours × overtime rate)

Example calculation: A worker earning $20 per hour who works 10 overtime hours would receive:

- Regular pay (40 hours): $20 × 40 = $800

- Overtime pay (10 hours): $20 × 1.5 × 10 = $300

- Total weekly pay: $800 + $300 = $1,100

Time and a half calculation

Time and a half means earning 1.5 times your regular hourly wage for overtime hours worked beyond the standard workweek. If you earn $16 per hour regularly, your overtime rate becomes $24 per hour ($16 × 1.5).

This is the most common overtime rate mandated by federal law and applies to most non-exempt employees across the United States. The calculation is straightforward: multiply your regular wage by 1.5, then multiply that result by the number of overtime hours to determine your overtime compensation.

Many employers offer this as their standard overtime policy, though some may provide higher rates as part of their compensation packages or union agreements. The time and a half rate ensures that employees receive meaningful additional compensation for sacrificing personal time to meet business needs.

For employees with varying pay rates within the same workweek, employers must calculate a weighted average of all rates, then apply the half rate premium to overtime hours. This ensures fair compensation regardless of job complexity or multiple role responsibilities.

Double time calculation

Double time pays twice your regular hourly rate for specific overtime situations, often applying to work on holidays, Sundays, or after excessive daily hours exceeding 12 hours. A worker earning $15 per hour would receive $30 per hour during double time periods.

Double time rules vary significantly by state, employer policy, and union agreements. While not federally mandated, many states require double time for work exceeding certain daily hour thresholds or for work performed on recognized holidays.

California, for example, requires double time for hours worked beyond 12 in a single day or for more than eight hours on the seventh consecutive day of work. This provides substantial additional compensation for employees working extremely long shifts or extended work periods.

Some employers voluntarily offer double time as an incentive for holiday work or emergency situations. This premium rate helps ensure adequate staffing during critical periods while providing significant extra money for employees willing to work during these times.

State-specific overtime laws

Several states enhance federal overtime protections with stricter standards that provide additional benefits to workers. Understanding your state’s specific requirements is crucial for ensuring proper overtime compensation.

California requires overtime pay after 8 hours daily and double time after 12 hours daily, in addition to the standard weekly overtime after 40 hours. This means a California employee working 10 hours in a single day receives 2 hours of overtime pay even if they work fewer than 40 hours that week.

Alaska and Nevada mandate overtime after 8 hours per day, providing daily overtime protection similar to California but without the double time provision. These daily overtime laws recognize that excessively long workdays can be just as demanding as high weekly hour totals.

Some states have higher state minimum wage rates that affect overtime calculations, since overtime is calculated based on the regular rate of pay. States like Washington, Massachusetts, and New York have minimum wages significantly above the federal level, resulting in higher overtime rates.

Other state variations include:

- Different salary thresholds for overtime exemptions

- Specific industry protections (healthcare, agriculture, domestic workers)

- Enhanced penalties for overtime violations

- Unique calculation methods for certain types of compensation

Always check your state’s Department of Labor website for specific overtime requirements in your location, as these laws can change and may provide more generous protections than federal standards.

Benefits of using an overtime calculator

Using an overtime calculator provides numerous advantages for both employees and employers in managing wage calculations and ensuring compliance with labor laws.

- Accuracy and Error Prevention: Overtime calculators eliminate manual calculation errors that could result in incorrect pay expectations or compliance violations. Mathematical mistakes in payroll can be costly, leading to underpayment claims, penalties, and damaged employee relations.

- Quick Verification: Employees can quickly verify their paychecks against expected overtime compensation, helping identify potential wage theft or payroll errors. This transparency builds trust between employers and workers while protecting employee rights.

- Financial Planning: Workers can calculate expected overtime income when considering extra shifts or extended hours, enabling better personal financial planning. Understanding potential earnings helps employees make informed decisions about work-life balance and financial goals.

- Compliance Assurance: Employers can use calculators to ensure proper overtime payment and avoid costly violations of federal and state overtime laws. With the Department of Labor collecting millions in back wages annually for overtime violations, accurate calculations are essential for legal compliance.

- Multiple Scenario Modeling: Advanced calculators allow users to model different overtime scenarios, comparing various hour combinations and pay rates. This helps both employers and employees understand the financial implications of different scheduling decisions.

- Tax Planning Support: By calculating gross overtime pay, workers can better estimate their income tax obligations and plan for potential changes in their tax bracket due to increased earnings from extra hours.

The overtime calculator serves as an essential tool for maintaining fair labor practices, ensuring accurate compensation, and protecting the rights of workers across all industries. Whether you’re verifying your paycheck, planning your work schedule, or ensuring compliance with overtime laws, these calculators provide the accuracy and transparency needed for effective wage management.

Regular use of overtime calculators helps create a more transparent workplace where both employees and employers understand their rights and obligations under federal and state labor laws. This transparency ultimately benefits everyone involved in the employment relationship while ensuring fair compensation for all hours worked.

Using Traqq to track hours and calculate pay

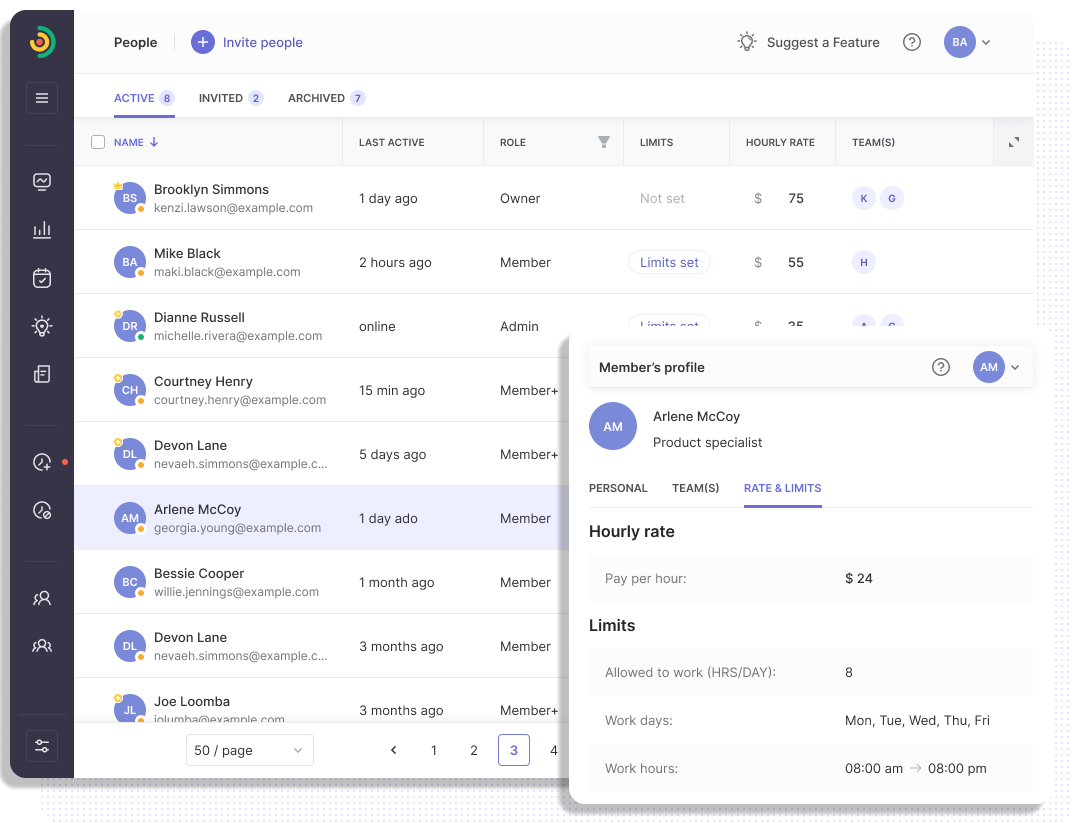

While this overtime calculator helps you estimate earnings with time-and-a-half or double-time rates, Traqq gives you the tools to accurately track work hours and apply custom hourly rates across your team.

With Traqq, you can:

- Assign individual hourly rates for each team member

- Automatically calculate total earnings based on actual time tracked

- Export timesheets with precise breakdowns for payroll and invoicing

And counting 5-star reviews

Countries used across the globe

Hours tracked

New teams monthly

Traqq’s reviews speak for themselves!

Frequently Asked Questions

about Overtime Calculators

What is an overtime calculator?

An overtime calculator is a digital tool that helps workers and employers compute total pay based on regular hours worked, hourly wage, and extra hours beyond the standard workweek. It applies the appropriate multiplier (such as time and a half) to determine overtime compensation, ensuring fair payment for extended shifts.

Who qualifies for overtime pay under the Fair Labor Standards Act?

The Fair Labor Standards Act (FLSA) mandates that most non-exempt workers in hourly jobs receive overtime pay (typically 1.5 times their regular wages) for any hours worked beyond 40 in a week. Some employees may be exempt based on salary level, job duties, or being part of a customarily recognized department.

How is overtime calculated for hourly jobs?

To calculate overtime, multiply your hourly pay by 1.5 (known as time and a half) for any hours beyond your regular hours. For example, if your standard wage is $20/hour and you work 10 extra hours in a pay period, your overtime compensation would be $300 (10 hours × $20 × 1.5). Use a calculator like the one above to get an exact breakdown.

Does overtime affect my taxes or income tax?

Yes, overtime earnings increase your gross pay, which can impact income tax, Social Security, and other deductions. However, even with higher taxes, your take home pay generally increases because overtime pay is still taxed like your regular wages—not at a higher rate.

Can salaried workers receive overtime?

Some salaried employees can qualify for overtime pay, especially if they earn below the FLSA salary threshold. Exemption depends on factors like job role, income level, and responsibilities. Assuming you’re non-exempt, even monthly or semi-monthly workers may be eligible for additional money based on excess hours per week worked.

How often should I calculate overtime?

Ideally, review your overtime compensation each pay period, whether that’s bi-weekly, semi-monthly, or monthly. Tracking your paycheck regularly helps ensure other employees are also being compensated fairly and allows you to flag errors in your account before they compound over time.

Why does my take home pay seem lower than expected?

If your take home pay seems lower than your expected total pay, it’s likely due to deductions for income tax, Social Security, and employer benefits. Even with overtime, your paycheck may not reflect the full hourly pay increase unless you review both gross and net wages. Use an overtime calculator to estimate your real earnings before and after taxes.

Can Traqq help calculate overtime pay?

Traqq makes it easy to track hours per week and monitor actual time worked, but it does not automatically apply overtime rules like time and a half. However, by exporting your regular hours worked and total time from Traqq, you can use an external overtime calculator (like the one above) to apply the correct hourly wage multipliers and ensure accurate overtime compensation.

How does Traqq support Fair Labor Standards Act compliance?

While Traqq doesn’t calculate overtime pay directly, it helps employers stay compliant with the Fair Labor Standards Act by accurately tracking hourly jobs, standard wage schedules, and total time worked. This allows for proper identification of non-exempt workers who are owed overtime and helps reduce the risk of wage violations.

Does Traqq show total pay for a pay period?

Yes. Traqq can calculate total pay based on each employee’s assigned hourly pay rate and the actual time they worked during a pay period (whether weekly, bi-weekly, or monthly). This lets you easily verify paycheck details and export records for use with an overtime calculator or payroll software.

How can I use Traqq and an overtime calculator together?

Use Traqq to track all regular hours worked and export the data at the end of the week. Then, input those hours into an overtime calculator to apply your chosen multiplier (e.g., 1.5 times for overtime). This two-step process ensures your take home pay reflects both regular wages and any additional earnings you’re entitled to.