What is a Salary Calculator?

A salary calculator is a powerful tool that converts your pay between different frequencies like hourly, weekly, bi-weekly, semi-monthly, monthly, and annually. This versatile calculator helps you understand your total compensation by calculating your gross and after taxes and deductions are removed from your earnings.

The calculator provides both adjusted and unadjusted salary figures, accounting for vacation days, holidays, and actual working days per year. Most calculators assume 52 working weeks or 260 weekdays per year for accurate conversions, giving you a realistic picture of your annual salary potential.

This tool proves essential for comparing job offers, creating accurate budgets, and understanding your true earning potential. When you’re considering a new job or evaluating your current compensation, a salary calculator removes the guesswork and provides clarity about your monetary value in the marketplace.

The rest of Traqq’s online productivity tools

Whether you want to quickly convert decimal hours to regular time or calculate your overtime pay, our suite of online tools has you covered.

Undestanding Salary Calculations

How to Use a Salary Calculator

Using a salary calculator effectively requires entering accurate information about your current compensation and work schedule. Start by entering your current pay amount in any frequency – whether that’s an hourly rate like $25/hour, weekly salary like $1,000/week, or annual salary like $65,000/year

Next, select your current pay frequency from the dropdown options. The calculator needs to understand your starting point to perform accurate conversions across different pay period structures.

Input your working hours per day (typically 8 hours) and days per week (usually 5 days for full-time positions). These details help the calculator determine your total working hours and create precise conversions between hourly and salary-based pay structures.

Add vacation days and holidays you receive annually – the average worker receives 15-25 days combined. This information allows the calculator to provide both adjusted and unadjusted figures, reflecting your actual paid working time versus theoretical full-year employment.

Choose your target pay frequency to see converted amounts across different payment schedules. Review both adjusted and unadjusted salary calculations to understand the difference between gross annual potential and realistic take-home expectations.

For accurate results, make sure you:

- Use your gross pay before any deductions

- Include all guaranteed compensation

- Account for actual working days in your calculation

- Consider your specific tax situation and filing status

Understanding Pay Frequency Conversions

Different employers use various pay frequencies, and understanding these conversions helps you compare opportunities effectively. Each pay frequency has distinct characteristics that affect your cash flow and budgeting approach.

| Pay Frequency | Pay Periods Per Year | Example: $52,000 Annual |

|---|---|---|

| Weekly | 52 | $1,000 per week |

| Bi-weekly | 26 | $2,000 per pay period |

| Semi-monthly | 24 | $2,167 per pay period |

| Monthly | 12 | $4,333 per month |

- Annual salary represents your total yearly compensation before taxes and deductions. This figure serves as the baseline for all other calculations and typically appears in job offers and employment contracts.

- Monthly pay equals your annual salary divided by 12 months. For example, a $60,000 annual salary translates to $5,000 per month in gross earnings before any withholdings.

- Semi monthly pay provides 24 pay periods per year, typically paid on the 15th and last day of each month. This schedule offers consistent payment dates but varying numbers of days between paychecks.

- Bi weekly payments occur every two weeks, resulting in 26 pay periods annually. This frequency means you’ll receive two “extra” paychecks during the year compared to semi monthly schedules.

- Weekly pay delivers 52 paychecks per year, providing the most frequent income but smaller individual amounts. This schedule works well for hourly workers and those who prefer consistent weekly cash flow.

- Daily rate calculations divide your annual salary by working days (usually 260 days), while

- Hourly rate conversions use total working hours (typically 2,080 hours annually for full-time employees).

Adjusted vs Unadjusted Salary Calculations

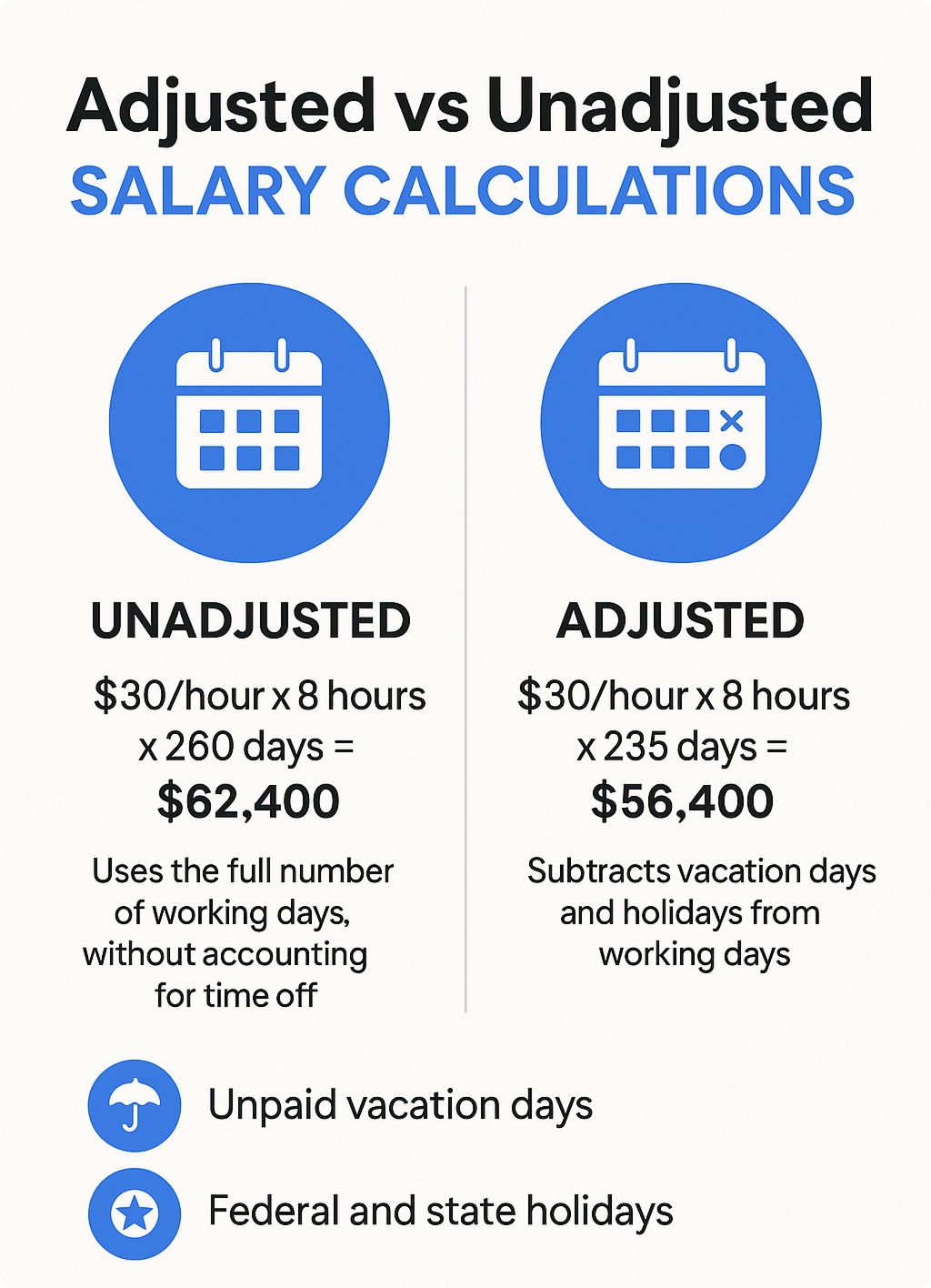

Understanding the difference between adjusted and unadjusted salary calculations helps you set realistic expectations about your earnings and plan your finances accordingly.

Unadjusted salary uses the full 260 working days without accounting for time off. For example, $30/hour × 8 hours × 260 days equals $62,400 annual unadjusted salary. This calculation assumes you work every possible business day throughout the year.

Adjusted salary subtracts vacation days and holidays from working days, providing a more realistic figure. Using the same example: $30/hour × 8 hours × (260 – 25 days off) equals $56,400 adjusted salary. This $6,000 difference significantly impacts your actual annual income.

Adjusted calculations provide more realistic take-home pay estimates because they account for:

- Unpaid vacation days (Vacation days per year)

- Federal and state holidays (Holidays per year)

You can also use the “vacation days per year” field to estimate your:

- Personal days

- Sick leave

- Other unpaid time off

Use adjusted figures for accurate budgeting and financial planning. When comparing job offers, always consider the total paid time off package, as this directly affects your effective hourly rate and annual earnings.

The adjustment becomes particularly important for:

- Hourly workers whose pay depends on actual hours worked

- Contract workers who don’t receive paid time off

- Professionals comparing salaried positions with different vacation benefits

- Anyone creating detailed financial plans or loan applications

Gross vs Net Salary Calculations

The difference between gross and net salary represents one of the most crucial aspects of compensation planning. Gross salary is your total pay before any taxes or deductions are removed, while net salary (take home pay) is what you actually receive after all withholdings.

Federal Tax Withholdings

Federal income tax withholding follows 2024 tax brackets ranging from 10% to 37%, depending on your taxable income level and filing status. Your employer calculates this withholding based on information from your W-4 form, including your filing status, dependents, and any additional withholdings you’ve requested.

FICA taxes include two components that affect every employee:

- Social Security tax: 6.2% on wages up to $168,600 (2024 wage cap)

- Medicare tax: 1.45% on all wages, plus an additional 0.9% tax on income over $200,000

State and Local Tax Considerations

State and local taxes vary dramatically by location. Some states impose no income tax, while others charge up to 13.3% on high earners. Local governments may also impose additional taxes, creating significant variation in take home pay based on where you live and work.

When using a salary calculator, accurate location information ensures proper tax estimation. Consider these factors:

- State income tax rates

- Local city or county taxes

- Reciprocity agreements between states

- Tax treatment of different income types

Common Payroll Deductions

Beyond taxes, several other deductions typically reduce your gross pay:

Health insurance premiums often range from $200-600 per month for individual coverage, with family plans costing significantly more. Many employers offer pre tax deduction options that reduce your taxable income.

Retirement contributions through 401(k) plans allow up to $23,000 annually (2024 limit) in pre tax contributions. These reduce your current taxable income while building long-term savings.

Other benefits might include:

- Health Savings Account (HSA) contributions

- Flexible Spending Account (FSA) deductions

- Life insurance premiums

- Disability insurance

- Union dues

- Parking or transit benefits

| Deduction Type | Tax Treatment | Impact on Take-Home Pay |

|---|---|---|

| 401(k) contribution | Pre-tax | Reduces current taxes |

| Health insurance | Pre-tax | Reduces current taxes |

| Roth 401(k) | Post tax | No current tax benefit |

| Loan payments | Post tax | Direct reduction |

Different Employment Types and Pay Structures

Understanding various employment types helps you use salary calculators more effectively and make informed career decisions. Each employment structure affects how you calculate and receive your compensation.

Salaried vs Hourly Employees

Salaried employees receive fixed annual compensation regardless of hours worked, providing predictable income but potentially limiting overtime earnings. These positions often include additional benefits and career advancement opportunities.

Hourly workers are paid based on actual hours worked and typically qualify for overtime pay at 1.5 times their regular rate for hours exceeding 40 per week. This structure offers flexibility but requires careful budgeting due to variable income.

Contract and Freelance Work

Contractors set their own pay rates but lack traditional employee benefits and protections. When comparing contract work to full-time employment, factor in:

- Self-employment taxes (additional 7.65% for Social Security and Medicare)

- Lack of employer-provided benefits

- Irregular income patterns

- Business expense responsibilities

Overtime and FLSA Regulations

The Fair Labor Standards Act (FLSA) determines overtime eligibility:

- Non-exempt employees receive overtime pay at 1.5 times regular rate for hours over 40 per week

- Exempt employees earning at least $684 per week may not receive overtime compensation

- Double-time pay may apply for holiday work or extended overtime hours

Federal minimum wage remains $7.25/hour, though many states and cities mandate higher rates. For example, Washington DC requires $17.50/hour as of 2024, significantly impacting salary calculator results for minimum wage workers.

Using Salary Calculators for Career Planning

Strategic use of salary calculators extends far beyond simple pay conversions. These tools serve as powerful career planning instruments that help you make informed decisions about your professional future.

Comparing Job Offers

When evaluating multiple opportunities, convert all compensation to the same pay frequency for accurate comparison. A $75,000 salary with excellent benefits might actually provide less value than a $70,000 position with superior health insurance, retirement matching, and paid time off.

Consider the total compensation package:

- Base salary or hourly rate

- Bonus potential and commission structure

- Health insurance coverage and costs

- Retirement plan matching

- Paid time off policies

- Professional development opportunities

Salary Negotiation Preparation

Understanding market rates in different pay structures strengthens your negotiation position. Research comparable positions and use salary calculators to determine equivalent compensation across various employment types.

Key negotiation factors include:

- Current market rates for your role and location

- Your experience level and unique qualifications

- Company size and industry standards

- Geographic cost of living differences

- Total compensation value beyond base pay

Financial Planning and Budgeting

Accurate take home pay calculations enable effective budgeting and financial goal setting. Use these insights to:

- Plan major purchases and determine affordability

- Calculate the financial impact of pay raises or promotions

- Evaluate whether contract work pays better than full-time employment

- Assess the monetary value of benefits packages

- Determine savings rates and investment capacity

Making Informed Financial Decisions

A salary calculator serves as more than just a conversion tool – it’s your gateway to understanding true compensation value and making confident career decisions. By mastering these calculations, you gain the insights needed to evaluate opportunities, negotiate effectively, and plan your financial future with precision.

Whether you’re comparing a $30/hour position to a $65,000 annual salary, planning for a career change, or simply trying to understand your paycheck better, these tools provide the clarity you need. Remember that take home pay varies significantly based on your location, filing status, and benefit elections, making accurate calculations essential for realistic planning.

The key to maximizing your earning potential lies in understanding not just what you’re paid, but how different compensation structures, tax implications, and benefit packages affect your actual financial picture. Use salary calculators as your starting point, but always consult with tax professionals for complex situations or major financial decisions.

Start calculating your true earning potential today – your future self will thank you for the informed decisions you make now.

Track Every Billable Minute with Traqq

A salary calculator tells you what your earnings should be while Traqq makes sure you actually capture them. Whether you work hourly, on salary, or juggle multiple contracts, Traqq’s intuitive time tracking app automatically logs your work hours with precision. No manual entry, no missed minutes.

With clear reports, you can see exactly where your time goes, compare earnings across projects, and make informed financial decisions. It’s the perfect companion to your salary calculations. Make sure that your pay on paper matches the reality of your work.

Salary Calculator FAQ

What does this salary calculator do?

This salary calculator converts your salary or wages between hourly, daily, weekly, bi-weekly, semi-monthly, monthly, quarterly, and annual pay rates. It also calculates both unadjusted and adjusted amounts based on your working hours, holidays, and vacation days.

How does the calculator handle different pay rates?

No matter what unit you enter — hourly, weekly, monthly, or annual — the calculator first normalizes it to an hourly rate. From there, it can calculate all other pay frequencies accurately.

What is the difference between adjusted and unadjusted salary?

Unadjusted salary assumes you work every week of the year without time off. Adjusted salary deducts your holidays and vacation days from total workdays, giving a more realistic income figure.

Can this calculator estimate my paycheck after taxes?

No. This tool focuses on gross income only. It does not deduct federal income tax, Social Security, Medicare, or other withholdings. To calculate net pay, you’ll need a separate tax calculator or payroll service.

How do holidays and vacation days affect my salary calculation?

The calculator subtracts your entered holidays and vacation days from your total workdays per year. This lowers the adjusted work hours and adjusts your annual, monthly, and weekly income accordingly.

Does the calculator follow government pay regulations?

While it uses standard work year assumptions (52 weeks per year) and common hours-per-week defaults, it does not enforce minimum wage or federal regulations. You can set custom hours and days per week for your situation.

Can I use this salary calculator for career planning?

Yes. By entering different pay rates and working schedules, you can compare income scenarios for job offers, contract work, or changes in location that may affect your wages.

Does this calculator account for allowances or dependents?

No. It does not factor in allowances, dependents, or tax forms such as the W-4. It strictly calculates gross pay across different pay periods.

How can Traqq help alongside this salary calculator?

Traqq automatically tracks your actual work hours, so you can compare your real earnings to the salary rates calculated here. This helps employees verify paychecks and employers ensure accurate payments.

Can Traqq save me money and time on pay tracking?

Yes. Instead of manually completing timesheets, Traqq records every billable hour automatically. This data can be matched with the pay rates from the calculator to ensure you’re earning exactly what you should.