A standard work week is 40 hours long. An employee’s weekly pay is derived from their hourly wage multiplied by the number of hours worked in a week, which is what you need to determine before calculating overtime pay. This may vary slightly from country to country, as we take into account local labor laws, work culture, individual employer policies, and more. Plus, some employees may also work longer hours as part of their job, while others may work less.

In the United States, the federal overtime regulations are contained in the Fair Labor Standards Act (FLSA). Unless an employee is exempt, they are covered by the FLSA to receive overtime pay in the amount not less than time and one-half their regular rates of pay — provided they work over 40 hours a week.

Before we dive into the details of overtime terms, calculations and unexpected statistics, let’s make sure you are not underpaid for working beyond the standard working hours.

Are you a salaried or non-salaried employee? Choose the appropriate overtime pay calculator below according to your status.

Introduction to Overtime

Overtime pay is a crucial aspect of many employees’ compensation packages, and it’s essential to understand how it works. The Fair Labor Standards Act (FLSA) regulates overtime pay and requires employers to pay employees at least 1.5 times their regular hourly wage for overtime hours worked. Overtime hours are typically defined as hours worked beyond 40 hours per week, and employees who work overtime are entitled to receive overtime pay.

The overtime rate is calculated by multiplying the hourly wage by the overtime multiplier, which is usually 1.5 for time and a half. For example, if your regular hourly wage is $20, your overtime rate would be $30 per hour. Employers can use an overtime calculator to calculate total overtime pay and ensure compliance with overtime laws. This tool helps both employers and employees keep track of overtime hours worked and the corresponding pay, ensuring that everyone is fairly compensated for their extra efforts.

Overtime pay calculator for non-salaried employees

If you’re paid by the hour and you know your hourly rate, simply enter it in the calculator below, along with the weekly hours stipulated in your contract and the actual hours you’ve worked.

Fill in your hourly rate, weekly hours by contract and weekly hours actually worked and you will see how much you’re supposed to get in overtime pay for overworked hours.

The standard overtime pay rate for non-salaried employees is 1.5 times their regular hourly wage. This means that for each hour worked beyond the established threshold, they are paid 1.5 times their normal rate. This is also known as “time and a half pay”.

What is time and a half pay?

As the name suggests, “time and a half pay” refers to a pay rate that is one and a half times an employee’s regular hourly wage. This means the regular hourly wage plus an additional half rate. This higher pay rate is typically used to compensate employees for working overtime hours, which are hours worked beyond the standard workweek or workday threshold set by labor laws.

Overtime pay calculator for salaried employees

Overtime pay for salaried employees can be more complex than for hourly employees due to the exempt and non-exempt classification under labor laws. Salaried employees who are classified as “exempt” are typically not entitled to receive overtime pay, while those classified as “non-exempt” are eligible for overtime pay when they work beyond certain thresholds.

In some states, employees may be exempt from federal overtime laws if they earn at least double the state minimum wage, highlighting the variability in wage and labor regulations across different states.

Here’s how overtime pay works for salaried employees in both classifications:

Exempt Salaried Employees

Exempt salaried employees are typically those in executive, administrative, professional, and certain other specialized roles. These employees are not entitled to overtime pay regardless of the number of hours they work beyond their standard working hours. They receive a fixed salary regardless of the number of hours worked.

To qualify for the executive exemption, employees must primarily manage a customarily recognized department or subdivision of the enterprise, highlighting the criteria used to classify employees as exempt based on their roles and responsibilities.

Exempt employees are paid for their job responsibilities rather than for the hours worked. They are often expected to work additional hours as needed without receiving additional compensation beyond their salary.

Non-Exempt Salaried Employees

Non-exempt salaried employees are entitled to overtime pay when they work beyond a certain threshold, just like hourly employees. These employees are typically in roles that do not fall under the exempt categories defined by labor laws.

For non-exempt salaried employees, overtime pay is calculated based on their regular hourly rate, even though they receive a salary. The process involves determining their hourly rate by dividing their weekly salary by the number of hours in a standard workweek (usually 40 hours). The annual salary is divided by the number of workweeks in a year to find the weekly salary, which is then divided by the standard workweek hours to determine the regular hourly rate. Then, any hours worked beyond 40 hours in a week are paid at the overtime rate, which is usually 1.5 times their regular hourly rate.

Fill in your monthly salary, weekly hours by contract and weekly hours actually worked and you will see how much you’re supposed to get in overtime pay for overworked hours.

How much is my overtime pay rate?

Is it always as simple as to multiply the overtime rate by 1.5?

No, you should multiply your regular hourly rate by 2.0, also known as double pay, when you exceed 12 hours on any workday or work more than 8 hours on the seventh day of the workweek.

So, if your standard hourly wage is $15, your regular overtime rate (1.5x) would be $22.50 per hour.

For overtime worked beyond 12 consecutive hours (and beyond 8 hours on the seventh workday), the rate would be $30 per hour.

In this case, use this Calculator:

Am I eligible for overtime pay?

Employees under the FLSA fall into two categories: “exempt” and “nonexempt.” Nonexempt employees are eligible for overtime pay, while exempt employees are not. The majority of FLSA-covered employees are in the nonexempt category, but some are not.

Many employers offer additional compensation for hours worked outside of standard times, such as evenings, weekends, or holidays, even when not mandated by law.

Certain jobs are automatically considered exempt. For instance, “outside sales” employees are exempt, while “inside sales” employees are nonexempt. However, for most employees, whether they are exempt or nonexempt depends on:

- their salary,

- how they are paid,

- the nature of their work.

In general, for an employee to be considered exempt, they must:

- earn at least $23,600 annually ($455 per week),

- receive a salary,

- perform job duties that meet the criteria specified in the FLSA Regulations set by the U.S. Department of Labor.

In most cases, meeting all three of these conditions is necessary for exemption.

Eligible for overtime payThe majority of employees protected by the FLSA can qualify for overtime compensation.

This applies to both salaried and hourly employees as long as they meet the FLSA criteria mentioned earlier. Exempt employees often manage other employees as part of their job responsibilities, including directing the work of at least two full-time employees and having authority over hiring and firing decisions. Here are a few examples of eligible workers:

- Freelancers

- Interns

- Retail staff

- Contractors, and so on.

Non-eligible for overtime pay

Those who do not qualify for overtime pay are commonly referred to as “exempt” because they are exempt from these regulations. This group includes:

- Salaried employees earning over $684 per week or more than $35,568 per year.

- Professionals in “white-collar” roles, such as managers, administrators, and desk job workers.

- Seasonal employees.

- Independent contractors, and more.

Exemptions are defined by the Fair Labor Standards Act and include specific job roles and salary thresholds. For a comprehensive list of professions that do not qualify for overtime pay, you can consult the document provided by the U.S. Department of Labor.

Working beyond regular hours without receiving additional compensation, known as “working off the clock,” can lead to potential issues for both employees and employers. It’s important to stay informed about federal and state laws and regulations to ensure compliance.

Double Time Pay Rules

Double time pay is a type of overtime pay that is paid at a rate of 2 times the regular hourly wage. This means that for every hour worked under double time conditions, an employee earns twice their standard hourly rate. Double time pay rules can vary depending on the employer, industry, and location.

For instance, in California, double time pay is required for hours worked over 12 hours in a day or over 8 hours on the seventh consecutive day of work. Other employers may offer double time pay for work on holidays or for employees who work exceptionally long hours. The double time pay rate is calculated by multiplying the hourly wage by 2. So, if your regular hourly wage is $20, your double time pay rate would be $40 per hour.

It’s essential to check with your employer or relevant labor laws to determine the specific rules and regulations regarding double time pay. Employees who work overtime hours may be eligible to receive double time pay, and understanding these rules ensures that you are fairly compensated for your extra work.

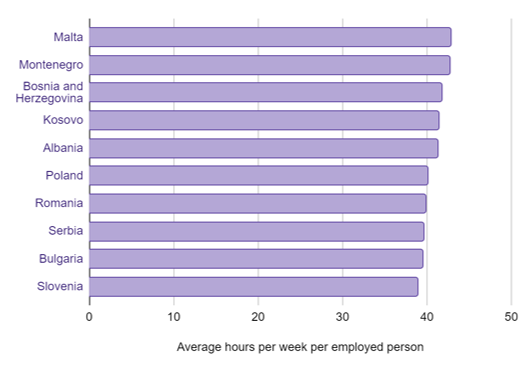

In what countries do people have the longest work hours per week?

Throughout history, individuals have strived to secure their labor rights, with many European and American nations notably reducing their work hours significantly. Nevertheless, numerous countries continue to have workweeks that far exceed the typical 40-hour norm. In some states, employees who work more than eight hours in a single day are eligible for overtime compensation. Take a look at the chart below to identify the top 10 countries where weekly work hours are notably extended.

Top 10 Countries with the longest work hours per week

When it comes to European nations, you might assume that overtime work is uncommon due to the historical labor rights movements. Nevertheless, there are still European countries where the standard 40-hour workweek is regularly exceeded. To gain insights into European countries with extended work hours, take a look at the chart provided below.

TOP 10 European countries with the longest work hours per week

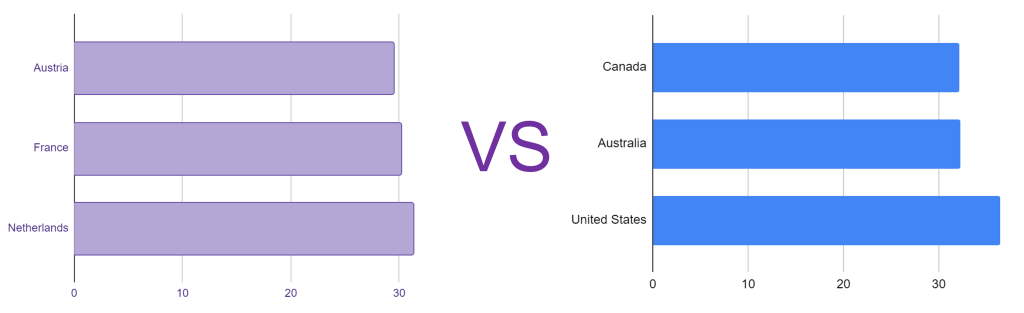

Meanwhile, Austria, France and the Netherlands are the countries with the shortest work hours per week. Here is how they compare to Canada, Australia and the US.

The average working hours vary depending on the industry. As shown in the table below, the industries exceeding 40 working hours per week in 2023 are mining and logging, manufacturing durable goods and utilities.

Is Working Overtime Worth It?

This depends on a few things.

Overtime work does come with its own set of undeniable benefits.

- First, overtime work comes with overtime pay. In most cases, working overtime means you will be making 1.5 to 2 times your regular hourly rate. Needless to say, this is a great way to make more money to cover your expenses: everyday spending, travel, savings, etc.

- Second, working overtime can help you get promoted. By consistently taking on extra hours, you will show your employer that you are reliable and committed to your role. This will translate into a good reputation at work and, hopefully, lead to new opportunities and maybe even a pay raise.

- Finally, overtime gives you a chance to get more valuable work experience and improve your skill set. As you spend more time at work completing tasks and projects, you naturally become better at what you do. This hands-on experience can contribute to your professional development and make you more skilled in your field.

Then again, working overtime isn’t without downsides.

- Working long hours often leads to decreased levels of concentration. As you spend more time at your desk, you may find it more and more challenging to stay focused and productive. And this means you may need to start taking more breaks.

- Depending on what you do, longer hours can also come with health and safety risks. Regularly spending too much time at work can have a negative impact on your work-life balance, increase the risk of burnout, and even affect your health. This is especially true if your job involves spending long hours in front of the computer. To address these risks, some companies have limitations in place when it comes to working hours – specifically, in roles such as truck driving.

- With only 24 hours in a day, working overtime will often leave you with less time for your life outside of work. This means less time spent with family and friends, less time for hobbies, travel, the gym, etc.

How to decide if you should work overtime

Whether or not you should take on overtime work is a very personal decision. But there are some helpful practices that can help you arrive at the right conclusion.

- Start by reviewing your company’s policies when it comes to overtime work and overtime pay. Some organizations may have caps in place on weekly overtime hours. Learn about your company’s overtime policies and ask your HR manager for details.

- Take a look at your schedule and tasks. Look for projects or time periods that may require you to commit additional hours. Evaluate and plan your potential overtime: make sure your extra working hours translate into better productivity, as opposed to stress and burnout.

- Find out when you are most productive during the day. If you learn that you get more done in the morning, use these hours for overtime work. Knowing your peak productivity times can help you stay focused throughout your regular working day as well as overtime hours.

- Do you need an extra source of income? Working overtime can often be an easier way to boost your earnings without the need to look for a second job and adjust to a new environment and responsibilities.

- Before you commit to a schedule that includes overtime, check whether extra hours are something your manager will appreciate. If you notice that your colleagues are getting promoted and recognized for taking on extra work, this may be a clear sign that your hard work could lead to more opportunities.

3 Best tips for working overtime

Don’t go overboard with overtime

Getting to work at 8 AM and leaving at 7 PM every day may indeed show your manager that you are a dedicated employee. But it’s important to not make it a routine practice.

In some cases, working longer hours can come with more cons than pros. For instance, it could inspire questions about time management skills.

Working overtime consistently can sometimes have adverse consequences. This may happen if your overtime efforts go from being appreciated to being expected by management. Do your best to approach overtime as an exception rather than the norm and strategically plan out your additional hours. A suitable example would be staying late during critical moments for the company, such as handling major accounts or navigating through a crisis.

Ensure you get the recognition you deserve

You may be taking on extra hours to cope with deadlines. However, these extra efforts on your part may feel unrewarding if they are not recognized by your management. It gets even worse if your employer occasionally uses specific tactics to avoid paying overtime. This may be asking you to work “off the clock,” expecting you to be on call after work hours, taking work home, etc.

Even if you prefer not to say it outright, the reason you are working overtime is probably because you want to be recognized for your work. But if your efforts go unnoticed, you may never get the appreciation you deserve.

A paycheck calculator can help verify that all overtime hours are accurately compensated by calculating your net pay, factoring in variables such as hourly wages, salaries, and tax withholdings.

Say, there is no one else around in the office. There are a few ways to make sure your superiors recognize you are staying after hours:

- You can send a time-stamped email from the office to your boss or leave a note on their desk (only if you have a legitimate reason to do so, of course).

- You can also suggest that your office starts using time tracking software. This way, all the hours and minutes you put in at the office are accounted for.

Be honest with yourself and with your boss about your productive hours

Some people are more productive in the afternoon, or even in the evening. If this is when your productivity peaks, you will naturally feel happier, more creative and enthusiastic when doing your job.

If this is the case, it may be a good idea to talk to your manager about the possibility of adjusting your work hours. For example, you may ask to come in later and extend your afternoon work hours. Your schedule can be even more flexible if you have the privilege of remote work.

Ultimately, as long as you meet your deadline and keep up the quality of your work, your boss should be open to this arrangement.