With more companies opening their doors to employees from different regions, one significant concern is payroll. Things can get even more complicated when members of a team are scattered across different countries. This presents a challenge in managing payroll, especially since administering the salary may depend on a worker’s location.

In this article, we share some of the important factors you need to consider when your employee works from home in another state or country. We will discuss everything you need to know about processing your remote worker’s payroll, how to handle their taxes, and how to pay remote employees.

What Are the Types of Remote Workers?

Before we discuss anything about payroll processing in the remote work environment, you need to know the types of remote workers you can hire for your business. They are as follows:

- Employees – When you have a remote working employee in your team, you need to withhold taxes from their paycheck. Moreover, you need to pay a portion of their payroll taxes.

- Independent Contractors – Now, if you pay independent contractors, you don’t need to withhold taxes from their payments. Instead, they will be responsible for filing and paying their own taxes.

How to Pay Remote Employees: 4 Easy Options

If you’re managing a remote team, here are the four easy payment options you can choose from:

Option 1: Using a Local Partner

If your company has a local affiliate or partner in your worker’s country, you can ask them to include the employee in their payroll. Essentially, the worker will be considered your partner’s legal employee. Since the worker is part of your partner’s payroll, they will be covered by the company’s benefit and tax withholding system. Meanwhile, the employee will still receive direct supervision from the home company.

Option 2: Including Them in Your Payroll

Even if your remote worker is thousands of miles away from you, you can include them in the company’s home country payroll. However, this is only acceptable under certain circumstances. In some countries, people are not legally permitted to be included in payroll if they are in a foreign country. Even so, there may be laws that allow them to as long as the company registers them in the business’s home country. Consequently, they can pay the employee while complying with the withholding requirements in the company’s host country.

Option 3: Outsourcing the Payroll Process

One of the most convenient options is to seek a company that offers payroll services for outsourced workers in your remote employee’s country. This solution is also ideal if you need to process payroll taxes for out-of-state employees. The local payroll provider will calculate withholding taxes and compensation. Moreover, they will be responsible for releasing the remote worker’s salary. It won’t matter if they’re using a paid or free time tracking and invoicing software. They will handle everything—including local taxes—for you.

Option 4: Paying a Worker as an Independent Contractor

From the company’s end, the payment process can be simplified by classifying a remote worker as an independent contractor. As we’ve mentioned, the worker will be responsible for filing their government benefits and taxes. Meanwhile, all the company needs to do is remit their payment to the contractor under the terms and schedule both parties agreed upon. Here are some of the ways you can pay an independent contractor:

- An ACH or bank wire transfer – You can use international bank wires, but the service can be expensive. In most cases, ACH transfers are free.

- Electronic payment platforms – Payoneer and PayPal are the most popular options when it comes to instantly transferring money to contractors. Your remote worker will have several options for withdrawing funds from their digital wallet.

- Western Union – You can also use conventional remittance services, but remember that frequent transfers may incur higher fees.

- Freelancing platforms – Some job platforms also have built-in billing functions, which can be ideal if you’re working with first-time remote workers.

As you can see, it is generally simpler to consider a remote worker an independent contractor. After all, your company won’t have to deal with payroll taxes. However, there are exceptions if a person works from a non-resident state. You may be required to collect backup withholding taxes in the state they are located in. We have written a separate article about tax considerations when working remotely from another state. Make sure you check that out to avoid confusion.

Now, even if you’re not withholding state payroll taxes from your remote contractor, you’ll still have to deal with some paperwork. Here are some of the important forms you need to file:

Form 1099-MISC

If you’re paying a contractor more than $600, you’ll need to file a 1099-MISC form every year. This form reports how much nonemployee compensation you’ve paid to an individual during a particular year. Remember that this form is due every 31st of January, and you need to send copies to the IRS and the contractor.

Form W-9

The IRS requires companies to have their remote contractors fill out Form W-9. This form allows them to request a Taxpayer Identification Number (TIN). If they already have one, the form will serve as a request for a TIN certification. The information you get from the certificate will give you all the details necessary for filing Form 1099. It will also tell you if you’re not required to send your contractor Form 1099.

Paying remote workers as independent contractors is fairly easy. You simply need to transfer or remit the amount you owe them. Even so, you still need to keep accurate records of your payments. If you want an easier way to track the amounts that your remote workers have earned, we recommend using Traqq.

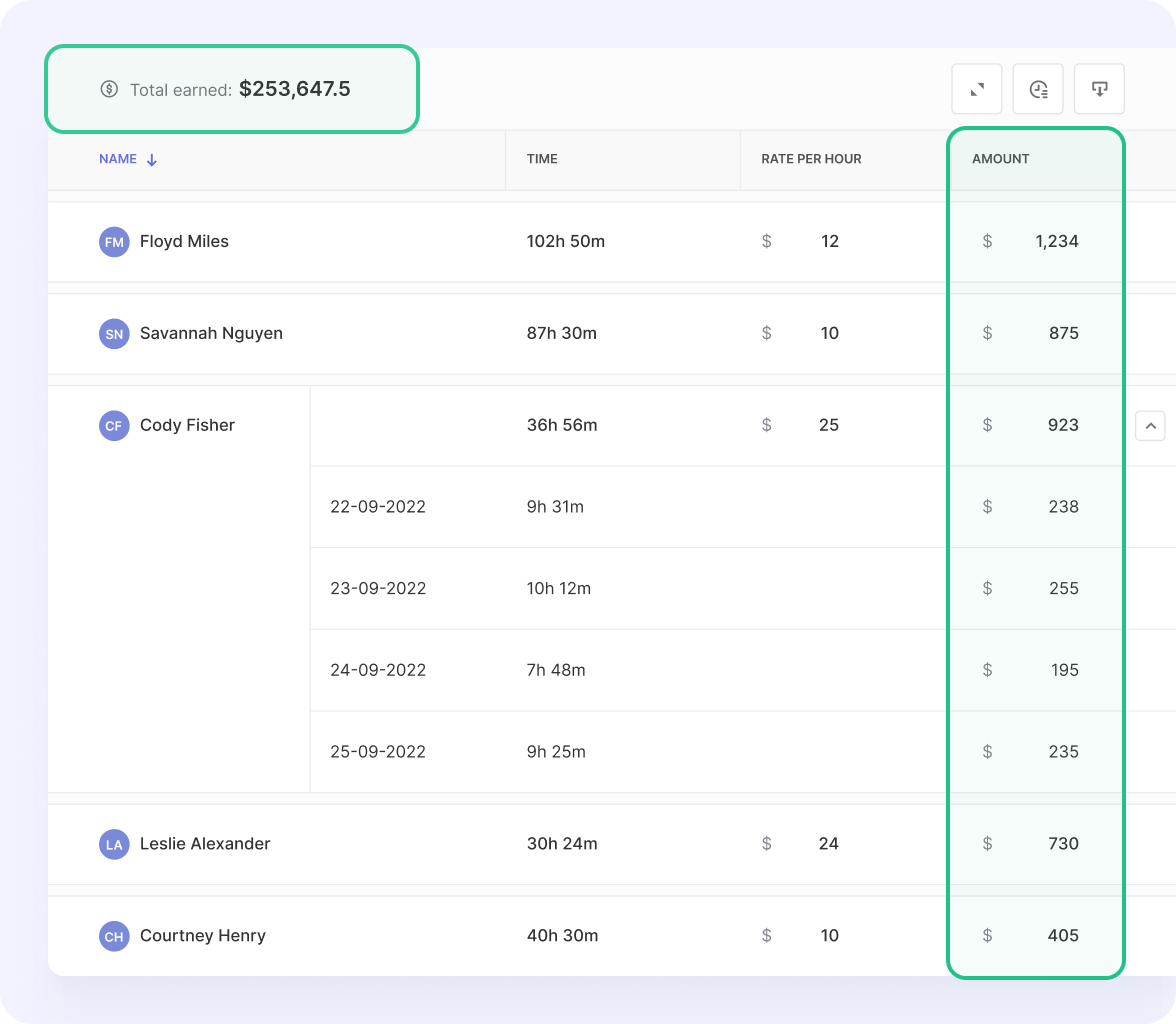

Traqq is employee monitoring software that is easy to install and use. Once your contractor has downloaded it, all they need to do is click Start and the tool will log their work hours automatically. At the end of the week or month, you can check your dashboard and get an accurate report of their billable hours. Simply click Reports on the left pane, then select Amounts Earned on the right pane. There, you will see the total hours they’ve worked and the amount they earned for the selected period.

Traqq does more than just track time. It is also a tool that can help increase productivity among your remote workers. It monitors the websites they visit and the apps they use, allowing you to identify common time wasters. Moreover, you will see their activity levels based on their keyboard movements and mouse clicks and scrolls. At the end of the month, you can export the data into a CSV file for easier productivity and performance reporting.

What to Avoid: Paying Remote Workers Under the Table

What if your remote worker is an hourly employee? You may be tempted to pay them ‘under the table’ to avoid tax obligations. We understand why this option can be enticing to you considering the following factors:

- You don’t have to contribute taxes or enroll in workers’ compensation insurance.

- By paying cash, you can hire people who are not authorized to work in the United States.

- You can avoid the hassle of record keeping.

- By paying cash, you can manipulate your employment tax returns.

- You can use the employment taxes that you should be withholding to settle personal expenses or debt.

If you think that the IRS may never find out, consider what will happen to your business if one of the scenarios below plays out:

- An employee files for social security benefits and gets a lower payment than expected. Then, they file an inquiry with the Social Security Administration.

- An employee gets injured on or off the job and files a workers’ compensation claim for insurance.

- A disgruntled employee, a past employee, or one going through a divorce or child custody issues files for unemployment benefits. This can trigger a chain of events that could lead to your business being audited.

The IRS has a large database that it can use to find irregularities in business owners’ income and lifestyle. The auditors are trained to detect things that raise red flags, which can form the basis of an investigation. As you may be aware, any kind of investigation from the IRS could hurt your business.

All in all, the consequences of paying unreported wages can be severe. They include the following scenarios:

- Upon discovery of tax evasion following an IRS audit, you’ll be required to pay back all money owed, plus applicable interests and fines.

- You risk being put out of business. If you have been paying employees “under the table” and they are injured on or off the job, they have the right to file a claim for workers’ compensation. The ensuing investigation may uncover the unreported wages, and you’ll be in big trouble.

- You risk jail time for fraud. According to the IRS, there’s a high chance that you’ll be incarcerated for the malpractice of paying employees under the table.

The Bottom Line

When it comes to paying remote workers, it’s always best that you consult an accountant or a lawyer. While classifying your remote worker as an independent contractor is the most convenient payroll option, you still need to file some paperwork with the IRS. In this case, seeking professional advice is the ideal solution. This way, you can come up with the best payroll option for your remote workers.