Let’s face it. How many times have you set a savings goal and actually made it work? Most of us start with determination, only for it to wane a few weeks down the line. We know savings is never fun. However, your spending habits have a direct impact on your financial status – now and in the future.

You’ve probably read somewhere about financial planning – things like budgeting and cutting back on expenses. It’s easier said than done, right? Well, it is possible to save for a big goal. When starting your savings journey, it can be hard at first, especially when your goals feel so far away. However, having a savings tracker helps to keep you inspired and motivated.

Like with every journey, you have to start somewhere. Moreover, no matter how small your savings goal is, tracking your money allows you to visualize your growth. When you realize that your goal is achievable, your perspective will change. Slowly, you can see your dreams coming true right in front of your eyes. There are various money goal trackers on the market, most of them free. We’ll discuss more on these later.

First, we share several tips on money-saving to help you think like a saver:

Start with a Short-Term Goal

Starting out small is among the best tips to change your life. After all, people are more comfortable with what they feel is tangible. For example, saving $10 a week or a month for six months is more attainable compared to saving $400 a month for a year. So, start by setting a short-term savings goal, and when you hit your target, you can be proud of yourself for the effort you’ve made so far. Plus, you will have developed a savings habit, and you can gradually start to increase the savings amount and period.

Eat Out Less

How many times per month do you eat out? If you do it often, you probably spend a lot of money that would otherwise have gone to your savings. Home-cooked meals are not only more economical but also delicious! Plus, having leftovers for dinner or lunch is way cheaper than going to a hotel or restaurant.

If you must eat out, order smaller servings. For example, opt for appetizers or split an entrée with your dining companion to save money.

Consider shopping for groceries and cooking at home. However, before you set out to shop, check your pantry and make a list. This way, you will be able to buy only the necessary items that you will actually use.

Cut Back on Big Expenses

Creating a budget gives you a clear picture of your monthly expenses. For many families, housing and car payments are the largest expenses. Take a look at the big expenses and find a way to cut them back. Ask yourself if it’s possible to move in with roommates or find a cheaper place to live.

Here are more tips that could help you save on housing expenses:

- If you live in a big house, consider renting out a spare bedroom. You can earn extra cash if you rent rooms on Airbnb or Booking.com.

- Shop for lower homeowner’s insurance.

- Switch your alarm monitoring system to a more affordable option.

- Refinance your mortgage to get a lower interest rate.

If you are making car payments, consider refinancing your auto loan and take advantage of lower interest rates. You could end up saving a considerable amount of money over the life of the loan.

Find Ways to Reduce Your Utility Bills

Are you spending money on things that don’t give you value? It’s time to cut some utilities out. Try these simple tips to save money on utilities:

- Be sure to turn off the tap every time to save water.

- Switch off any lights, TV, and any other appliances when not in use. Likewise, unplug electronics when you are not using them.

- Draw your curtains during the day to take advantage of the warmth and light from the sun.

- Use cold water in your washing machines.

- Switch to energy-efficient lighting to reduce your electricity bill.

- Switch your cable package carrier. Opting for bundled cable and Internet services could save you hundreds annually in your cable bills.

- Cancel any unnecessary subscriptions. These include streaming services (Netflix, HBO, Hulu, etc.), streaming or satellite music (Spotify, Apple Music, and so on), magazine subscriptions, and security subscriptions, to mention a few.

Sign Up for as Many Free Customer Rewards Programs as You Can

There are plenty of retailers willing to reward customers who shop at their stores. All you have to do is sign up for every free customer rewards program you can find and collect a card. The next time you plan to go shopping, check that account for available coupons.

Likewise, you can use reward credit cards to earn points whenever you purchase at participating stores. You can then redeem the points for cash back or other benefits.

Stop Using Credit Cards: Pay Cash Instead

It is easy to overspend when paying via a credit card. The temptation is too much when spending money you don’t see. Switch to cash for most of your purchases. This way, you will have more control over your spending, and you can limit your choices.

Save Money on Transportation

When purchasing a car, pay cash instead of going for a loan. If you don’t have the money, consider saving until you can afford it. There are millions of loans floating around today, and instead of becoming one in a million, why don’t you hold off until you raise enough cash?

When refueling, use apps like GasBuddy to find the cheapest gas prices in town. You can even sign up for their card and save more when you use it.

Alternatively, consider carpooling when you can. For instance, when planning a night out, ride with your friends instead of driving yourself. Plus, there are rideshare apps like NuRide, Swift, and Hytch that reward you for carpooling.

Get Rid of Debts

While there are plenty of overtime benefits, working extra hours shouldn’t be something you regularly do to pay off your debts. If you have debts weighing you down, find better ways to clear them. Don’t let debts rob you off of your income. The interest you pay on your debt each month could go to your savings account instead. So, the sooner you eliminate debts and gain financial freedom, the better.

Money Goal Trackers

As noted earlier, a savings goal tracker helps to keep you on track on your way to financial freedom. You might be wondering why you need a savings tracker when you can simply save money. You see, monitoring your progress is crucial if you want to save more. You don’t even have to be a professional bookkeeper just to monitor your earnings and expenses. After all, there are templates and apps out there to help you get started.

When you keep track of your daily expenses, you will realize how much you are spending and what expenses are unnecessary. This way, you can cut on those expenses and spend less. In turn, you end up saving more.

Why You Need a Savings Tracker

Trust us when we say it is much harder to save money without a goal or a savings tracker. Of course, you know you have to set some money aside, either for a rainy day, emergency, vacation or to buy your dream house/car. You might even start saving a few dollars each week. But, sticking to it can be challenging, because, well, life happens!

A savings tracker helps to keep you on track. Among other things, when you save using a tracker:

- You keep your eyes on the prize.

- You can watch your savings grow and celebrate your small wins, increasing your motivation to save more.

- You can keep track of your progress. For instance, if you stop saving somewhere along the way, you can easily identify the problem and try to fix it.

- You will save more money. Just try writing down how you spend your cash daily, and you will be surprised to find out that you spend way too much money on things you could do without. A savings tracker opens your eyes to your spending habits, helping you to save more money.

Saving is not easy. However, you can implement these four effective ways to get your savings back on track:

- Put your savings in an account that earns interest.

- Set realistic goals. Set aside some money each month towards your goal. Start by saving small amounts of money, gradually increasing it with time.

- Budget. How can you decide the amount you want to save if you don’t know how you spent money? The answer is budgeting. Simply list all your monthly expenses, such as bills, grocery, entertainment, eating out, transportation, housing, etc., to get a clear picture of how much money you spend each month. With that information, you can start cutting back on certain expenses like entertainment and eating out.

- Track your money. You need to monitor your spending trend so that you know how much money you can manage to squeeze each month and shift it towards your savings.

Thanks to technology, there are countless savings trackers designed to help you reach your financial goals, the smart way. You can create your own savings tracker or grab one of these free printable savings trackers.

How to Use a Savings Tracker

Having a money savings tracker is one thing, but using it effectively and being able to actually save, is another. To succeed, you need to develop the habit of filling it out weekly. To achieve that, keep your tracker where you can easily see it every day – your fridge could do just fine. Whenever you see it, you’ll be reminded of your goals.

A savings tracker is simple to use. Regardless of the tracker that you are using, you must set your goal, what you are saving for, how much you want to save each week or month, and for how long. Write everything down and commit to it.

Every week, when you put the money into your savings account, color the box for that week. As the weeks fly past, your sheet will start to fill (you can use different colors to make it more fun). When you see your progress on the chart, your motivation to save will increase.

Final Thoughts

Sometimes, due to certain unavoidable circumstances, you might not be able to meet your savings goal. Rather than think of the blank boxes as a failure and quit, sweep that negativity to the back of your mind, and save whatever little you can. Remember, quitters never win, and winners never quit.

So what are you waiting for? Start saving today – your future depends on it.

On a final note…

We’d like to remind you of the importance of tracking time in everything you do. Proper time management reduces time wastage and allows you to do more. As a result, you become more efficient at your work, hence more productive.

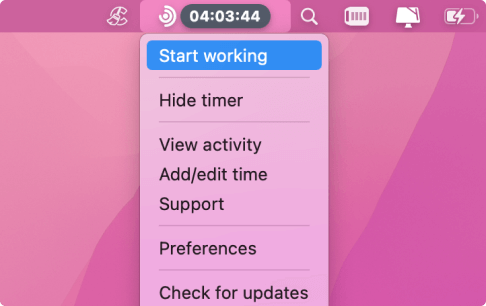

Try Traqq, an efficient time-tracking solution that monitors your progress on projects and helps you to avoid overworking yourself. The time tracker notifies you of the next item on your to-do list, ensuring that you stay on top of your tasks.

The best part about this tool is that it automates the payment process. It records all the hours you’ve worked through the week or month, automatically creating an invoice within that period. It even allows you to send invoices to clients directly from the app.

With such convenience, inaccurate payments will be a thing of the past.