According to research from PayScale, the majority of U.S. workers do not know if they’re being paid fairly. The study revealed that 49.7% of employees who think they’re underpaid are likely to switch jobs within the next six months.

However, these days, salary is not the only thing that attracts and retains top talent. It has become crucial for organizations to create a compensation plan that offers holistic benefits.

Some of the incentives that companies provide include flexible work hours, 401(k) plans, healthcare, and home office allowances. All of these can be considered part of competitive employee compensation plans.

So, if you want to attract and keep top talent, you need to have an effective compensation planning strategy.

What Is a Compensation Plan?

Also known as a ‘total compensation plan,’ a compensation plan can include salaries, wages, and benefits. However, it can also include fringe benefits, raise schedules, employer-provided vendor discounts, and union perks.

When you have a compensation planning strategy, you’re keeping up with the current and relevant labor laws. At the same time, you’re considering several business operation components:

- Business goals and budget

- Operational strategy and needs

- Challenges in the industry

- Incentive plan for supporting talent retention

The Different Types of Compensation Plans

There are two primary types of compensation:

- Direct compensation – financial

- Indirect compensation – monetary and non-financial

In the U.S. direct compensation includes salaries, wages, and commissions. However, it can also be combined with indirect compensation like health benefits. According to SHRM’s 2016 Employee Job Satisfaction and Engagement report, 39% of new hires are satisfied with a compensation package if it comes with stock options. Meanwhile, 71% prefer paid time off and 52% are happy with wellness programs.

Now, whatever you include in your total compensation plan, make sure that each component fits your business strategies and needs. Here are some of the types of compensation you can choose from:

Direct Compensation

Salary

With a salary plan, your employees get a set amount of annual compensation. It is paid at regular intervals, usually twice a month or every two weeks. It’s worth noting that regardless of the number of hours a person works, the salary amount will not change. Moreover, under the Fair Labor Standards Act, most salaried employees are exempt workers. This means that they are not entitled to overtime pay.

Managers and employees can review the salary package at the end of a contracted period or year. During this time, both parties can negotiate increases.

Salary plans are advantageous for the following reasons:

- Security and stability in payments – A salaried position ensures consistent earnings regardless of market behavior and employee performance.

- Consistent payment amount – The employee has confidence in planning for their future because they know the exact amount that they’ll earn per pay period.

- Bigger compensation than hourly jobs – In general, salaried positions receive higher wages than hourly work with the same responsibilities.

- Flexible work location and schedule – Because salaried employees do not need monthly timesheets to track their work hours, they usually have more freedom in choosing their location and schedule.

Salary + Commission

Salary plus commission is considered to be among the most reliable kinds of compensation plans. With this payment structure, an employee receives a base salary plus a bonus when they meet performance targets or exceed goals.

Most companies usually tie the bonus to a budget or other target that has minimal importance to the worker. What’s more, this compensation plan usually comes with higher income tax rates. Even so, there’s always a guarantee that the employee will receive a base salary even during low sales season.

Commission

With a straight commission plan, employees get a payment structure that will depend on their job performance. Commission computation will depend on the company’s nature and the industry it operates. Here are the different types of commissions:

- Gross profit – This structure involves paying the employee a percentage of the gross profit from their sales. Let’s say Adam sells a bag that cost the company $200 to produce. If he sells that bag for $2,000, the gross profit is $1,800. Now, if his commission is at 5%, then he earns $90.

- Profit margin – Start-up companies usually use this payment structure. This plan involves compensating people based entirely on the profits that the business makes. Because of the compliance issues and the complexity of the structure, companies rarely offer stock or equity with this plan.

- Placement fee – This payment structure is commonly used in car sales. Employees get a set compensation for every unit they sell. Let’s say Adam has a $400 placement fee at the car dealership he works in. For every car he sells, he will earn $400.

- Revenue gates – Also referred to as performance gates, revenue gates involve commission tiers. The more a person sells, the higher the revenue percentage they bring in. Let’s say Adam works for a large enterprise specializing in air conditioning units. If he brings in around $0 to $5,000 in revenue, he will earn a 4% commission. Now, if his total sales reach between $5,001 to $15,000, he will earn a 7% commission. Meanwhile, for the next tier, he’ll get a 9% commission for any sales he makes over $15,000.

Commission-based employee compensation plans also bring a host of benefits:

- Motivation – Since their job performance determines their earnings, employees tend to get motivated to reach or exceed goals. What’s more, when you recognize top performers, you can create a healthy competition between the workers.

- Potential to earn more – While salaries are fixed, commission-based compensation plans offer bigger earning potential. The harder an employee works, the larger their earnings will be.

- Realistic company value – The company will only pay for the revenue that workers bring in. As a result, the payroll will illustrate the real value of the business.

Territory Volume

If your company promotes a team-based culture, this compensation plan may work for you. This payment structure involves calculating territory volume. You add up the total sales and divide the commissions between all the sales team members. This compensation plan only works if:

- You put emphasis on team-building and discourage individual performance.

- You ensure that everyone puts in the same level of effort.

Hourly

In this compensation plan, the employee earns a set amount for every hour they work. This payment structure is common in service and retail businesses. Here are some of the benefits of an hourly compensation plan:

- More earnings for longer work hours – As we’ve mentioned, salaried workers earn a fixed amount and they’re not entitled to overtime pay. Meanwhile, if an hourly employee logs more than 40 hours per week, they usually get 1.5 times their regular hourly pay.

- Holiday rate – On official holidays, hourly employees get double their regular pay.

- Flexible work hours – Hourly jobs usually allow people to have time for other commitments. Employees can find hourly work that fits into their schedule.

Pro Tip: Use a Time Tracker for Monitoring Hourly Jobs

Tracking hourly work can be complicated, especially when you’re doing it manually. How can you compensate employees fairly if you’re not logging time accurately?

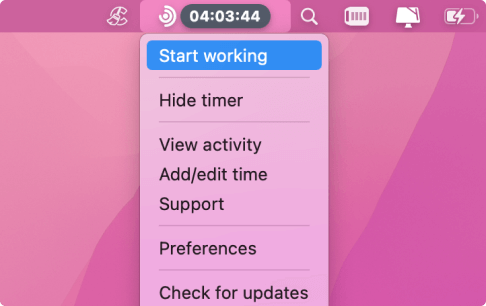

Well, you can make the entire process convenient by using a time tracking app like Traqq. This tool automatically records an employee’s work hours as soon as they click Start. At the end of their shift or before their breaks, they can click Stop and Traqq will stop logging time.

What’s great about Traqq is it is more than a simple time tracker. It also has monitoring features that let you measure productivity and efficiency. It can monitor web and app usage to ensure that every minute paid is a minute worked. Traqq even shows you how active your employees are during work hours.

With Traqq, you have a reliable companion for ensuring fair compensation.

Indirect Compensation

Equity

A compensation plan with an equity package allows employees to get a portion of ownership in the company. They can get the option to earn stocks and shares.

Start-up companies usually offer equity packages because they’re low on funding or cash. So, they need other incentives to attract and keep workers.

Stocks

With this payment structure, workers can purchase shares at a fixed price after a certain period. What makes this different from an equity package is the employee won’t have part-ownership of the company.

Also, most of the time, businesses only open stock options to employees who have been with the company for three to five years.

Benefits

Usually, employee benefits include life insurance, healthcare, retirement plans, and even pet insurance. As we’ve mentioned, healthcare is a common benefit that U.S. companies offer. After all, purchasing one can be costly. On the other hand, this is not a common benefit in the U.K. After all, the NHS offers free healthcare to citizens.

Meanwhile, for companies who are set on retaining employees, pension plans and retirement funds are common benefits. These compensation plans are attractive to those who are planning to settle down.

According to a Glassdoor survey, 48% of U.S. job seekers said that good benefits make a job enticing. So, while you’re focused on creating an ideal base pay for employees, you should also consider the benefits that come with the total compensation package.

Non-Financial Compensation

You can also offer non-monetary compensation like:

- Flexible work hours

- Paid or unpaid time off

- Professional development opportunities

- Company-sponsored cars

- Parental leave

- Childcare

- Laptops or phones

- Meals

According to a Fractl survey, 88% of American workers consider better health, dental, and visual insurance as the most important employment benefit. Even so, they reported other forms of compensation as essential in choosing the company they’ll work for. These benefits can range from tuition reimbursement and daycare to extra vacation time to work-from-home options.

5 Steps in Creating a Compensation Plan

You may be tempted to focus on finding the right way to create an employee compensation plan. However, what’s important is you consider what will be good for your workers and the goals of the company. These are the steps you can take in compensation planning:

First Step: Work out the Basics

When creating a good compensation plan, you need to address the following:

The employees who will be compensated

Some compensation plans are performance-based. In this case, you need to strategically decide who will be given the additional benefits. You wouldn’t want to be seen as being partial to anyone. So, the compensation plan should clearly state what types of employee behavior will be rewarded with extra benefits.

The types of compensation

You also need to decide the types of compensation that will work for your employees and business goals. You can choose employee incentive programs like bonuses, retirement plans, extra paid time off, and more. Another thing to consider here is how frequently the compensation package will increase.

The reasons behind the compensation package

Establish targets and objectives for your compensation plan. This is also a great time to invest in job analysis. After all, this process will serve as the foundation of your compensation plan. To perform a job analysis, you’ll need:

- Research – Identify all the roles in your organization and determine all the daily responsibilities, skills, and tasks.

- Job description – Specify each role’s primary requirements (work location, schedule, salary range, and conditions).

- Job specification – Determine the minimum qualities required for each role (level of education, skills, years of experience, and personality traits).

Second Step: Come up with a Compensation Budget

Perform due diligence on your competitors and see how much compensation they offer for different roles. You should also find out the common incentives that other companies provide. This way, you will get an idea of what to offer to attract top talent.

Now, when deciding on a budget, don’t forget to factor in overtime. Some employees may have to work overtime while others don’t. Remember that overtime will cost more, which will naturally affect your bottom line.

Third Step: Document the Compensation Plan

During this phase, you need to come up with a document that lists all the details of the compensation plan. The document will include:

- The individual compensation for each role

- The frequency of the increase

- The benefits and incentives

When you write everything out in a document, it will be easier for you to share the details with new hires. What’s more, both parties will have a file to go back to during performance reviews.

Fourth Step: Regularly Review the Compensation Plan

From time to time, you should review your compensation plan to ensure that it stays relevant to the current conditions in the market. Let’s say there’s a shortage of specialist employees. In this case, you’ll need to come up with a higher base pay to attract the right candidate. You can support this need by updating your compensation plan.

Moreover, the policies covering your compensation plan should be transparent, fair, and equitable. They should comply with state, federal, and local labor laws. Now, if there are updates to these laws, your policies should align with the changes.

You also have to come up with a plan for communicating the compensation package and policies to your workers. Remember that methods for communication change with advancements in technology. So, your compensation plan should adapt accordingly.

Fifth Step: Review the Goals and Ensure that They’re Attainable

It can be frustrating for your employees if you’ve set goals that are unreachable. Besides, unattainable goals can lower employee engagement. People will be demotivated if they’re doing more than their best yet they’re still far from the targets.

It’s worth noting that various studies have revealed that job dissatisfaction can be associated with burnout. So, if you keep on pushing your employees to work hard, but they never get to those promised rewards, engagement will drop.

You’ll have a fed-up and frustrated workforce along with a high staff turnover. While it’s important to set the standards high, you should still ensure that they’re realistic.

Employee Compensation Plan Template

Get your Employee Compensation Plan Templates for Google Sheets or Excel below.

Why You’ll Need a Compensation Plan

If you’re still on the fence about compensation planning, let’s go over why it’s important in the ever-changing, modern workplace.

To Motivate Employees

With a detailed compensation plan, workers have a career roadmap that can drive them to achieve more. After all, these compensation packages are usually tied with job performance.

As we’ve mentioned, some compensation plans can involve a financial bonus when reaching sales targets. When you offer incentives like this, you can motivate employees to work harder.

To Boost Employee Engagement

Various factors can drive employee engagement. However, according to a TalentMap survey, compensation is one of the biggest reasons why engagement can rise or drop. When workers think they are fairly compensated as other employees from other companies, they are 4.5 times more likely to be engaged.

To Improve Profitability and Productivity

When employees are engaged, they are motivated to be more productive. According to Gallup’s State of the American Workplace report, companies experience 21% higher profitability with highly engaged workers. Moreover, the longer an employee stays with an organization, the more skills they acquire and the more efficient they become.

To Reduce Staff Turnover

A PayScale survey revealed that higher compensation is one of the drivers that lead employees to switch jobs. Now, organizations must realize the cost of staff turnover:

- Replacing an entry-level employee costs 30% to 50% of the same role’s annual salary.

- Replacing a mid-level employee costs 150% of the same role’s annual salary.

- Replacing an executive-level employee costs up to 400% of the same role’s annual salary.

Thankfully, strategic compensation planning can lower staff turnover. The process ensures that each worker feels valued because they are being paid fairly.

To Foster a Healthy Company Culture

Organizations naturally attach a monetary figure to every employee. This principle affects how an employer values the workforce and how the employees perceive themselves. Indeed, compensation is one of the most important elements of company culture.

The policies you draft for compensation will reflect the culture in your organization. If you pay employees competitively and maintain an open dialog, you’re building trust in the workplace. Aside from that, having a healthy work culture can be appealing to job seekers.

To Attract Top Talent

If you want to improve other people’s perception of your company, you need to come up with an appealing compensation plan. As we’ve mentioned, the base salary and the benefits you give your employees will reflect how you treat them.

So, if you have a reputation for providing competitive compensation packages, you’re likely to attract and recruit top talent. After all, one of the reasons why candidates reject job offers Is because the benefits and base salary do not align with their expectations.

If you want to get ahead of the competition, you can do so by being transparent about a job opening. You can share the entire compensation package to prevent surprises once you deliver the offer. This way, candidates are aware of what they can get at the very beginning of the recruitment process.

To Promote Inclusivity

These days, promoting diversity in the workplace has become crucial. So, if you want to promote inclusivity in your company, you need a compensation planning strategy that minimizes wage gaps between various demographics.

When a compensation plan is transparent and structured, you can eliminate unconscious biases in the workplace. Gender, race, and age will not be the basis for compensation. Everyone will know that the base salary and benefits are based on performance, skills, years of experience, and expertise.