Who Is an Hourly Employee?

An hourly employee is a worker who is paid based on the number of hours they work, rather than a fixed salary. Their pay is calculated by multiplying the number of hours by their hourly rate. Hourly job roles can be found in various industries, such as retail, hospitality, and manufacturing.

Hourly workers also be entitled to overtime pay for hours worked in excess of the standard 40-hour work week, as defined by the Fair Labor Standards Act in the United States.

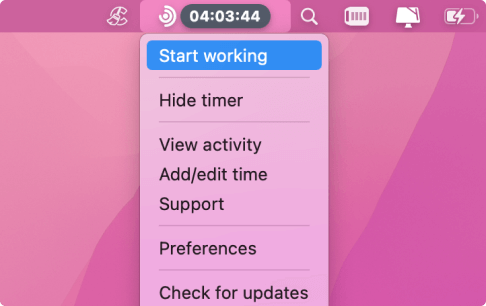

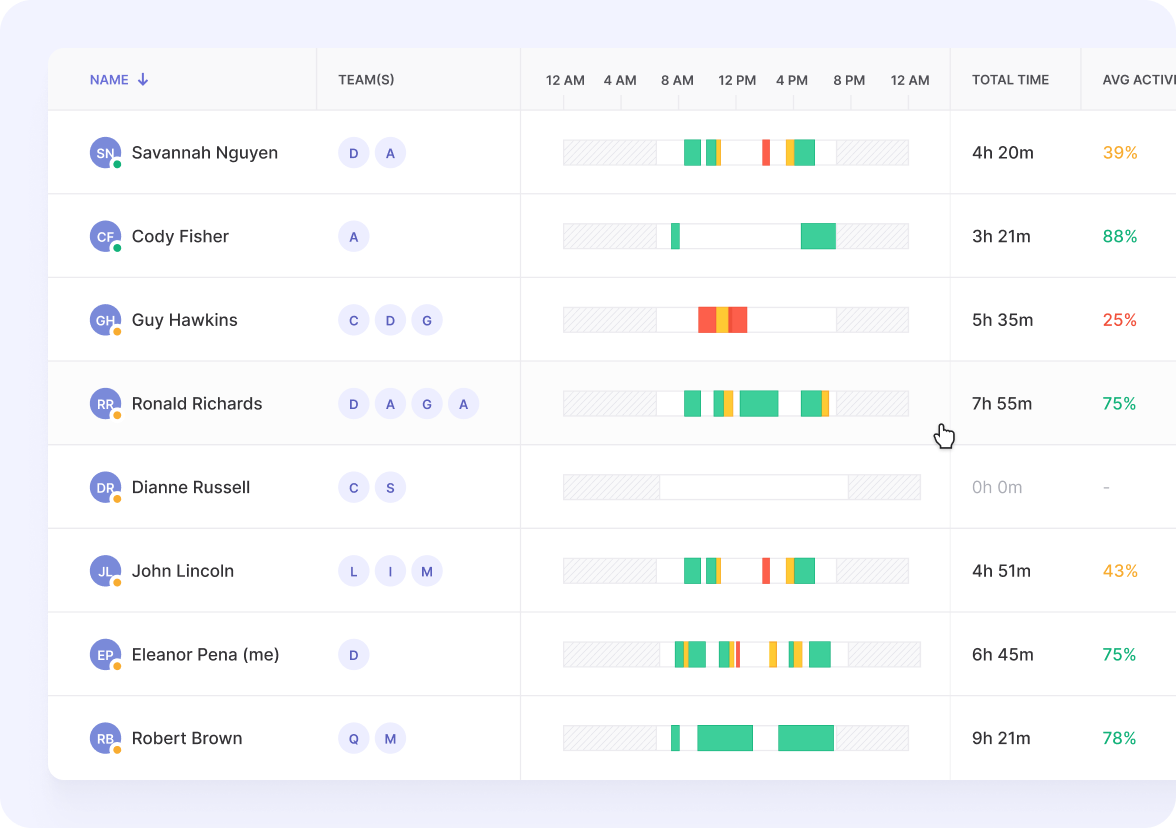

Hourly employment implies careful tracking of work hours in order to ensure employees are paid correctly. Traqq is a special tool to monitor employee performance and document time and activity.

Who Is a Full-Time Hourly Employee?

A full-time employee is someone who works a regular schedule, usually around 35-40 hours per week. They are paid based on the number of hours they work. These employees do not have a fixed annual salary, but instead, their earnings for each pay period depend on the hours they actually work. They may also receive overtime pay for hours worked in excess of the regular schedule, as required by the Fair Labor Standards Act in the United States.

What Is Hourly Compensation?

Hourly compensation is the amount of money an employee earns for each hour they work. It is determined by multiplying the number of hours worked by their hourly wage rate.

For example, if an employee works 40 hours per week and earns $15 per hour, their weekly compensation would be $600. Hourly pay allows for precise tracking of an employee’s earnings based on the actual time they worked. It also takes into account overtime pay, which is typically calculated at 1.5 times the regular hourly rate for hours worked outside of the standard work week. The calculation of overtime pay may vary depending on local labor laws and company policies.

Hourly Employee Benefits

Hourly employees can receive a variety of benefits depending on their employer, the industry they work in, and their employment status (full-time vs. part-time). Here is a detailed list of common benefits that may be offered to hourly employees:

Health insurance

- Medical Insurance: Coverage for doctor visits, hospital stays, surgeries, and prescription medications.

- Dental Insurance: Coverage for routine dental check-ups, cleanings, and certain dental procedures.

- Vision Insurance: Coverage for eye exams, glasses, and contact lenses.

Retirement plans

- 401(k) Plans: Retirement savings plans where employees can contribute a portion of their wages, often with employer matching contributions.

- Pension Plans: Defined benefit plans that provide a fixed payout upon retirement, although less common in recent years. 3. Paid Time Off (PTO)

Paid Time Off (PTO)

- Vacation Days: Paid days off that employees can use for any purpose. – Sick Leave: Paid time off for illness or medical appointments.

- Personal Days: Additional days off that can be used as needed beyond vacation and sick leave.

Family and medical leave

- Maternity/Paternity Leave: Paid or unpaid leave for new parents.

- Family Medical Leave Act (FMLA): Up to 12 weeks of unpaid, job-protected leave for certain family and medical reasons, if the employer meets specific criteria.

Holiday pay

- Paid Holidays: Paid time off for recognized holidays such as New Year’s Day, Independence Day, and Christmas Day.

- Floating Holidays: Additional paid days off that employees can use at their discretion.

Overtime compensation

Extra pay (typically 1.5 times regular hourly wage) for hours worked beyond the standard 40-hour workweek.

Bonuses and profit sharing

- Performance Bonuses: Additional pay based on individual, team, or company performance.

- Profit Sharing: Distribution of a portion of the company’s profits among employees. 8. Life and Disability Insurance.

Life and disability insurance

- Life Insurance: Financial protection for an employee’s beneficiaries in the event of the employee’s death.

- Disability Insurance: Coverage that provides income if an employee is unable to work due to a disability. Employee Assistance Programs (EAPs)

- Counseling Services: Access to professional counseling for personal or work-related issues.

- Support Resources: Resources for legal advice, financial planning, and stress management.

Education and training

- Tuition Reimbursement: Financial support for continuing education or job-related courses.

- On-the-Job Training: Training programs to enhance skills and career development.

Flexible scheduling

- Flexible Hours: Options to adjust work hours to better fit personal schedules.

- Telecommuting: Opportunities to work from home or remotely on a regular or occasional basis.

Other perks

- Employee Discounts: Discounts on company products or services.

- Wellness Programs: Access to fitness programs, gym memberships, and wellness initiatives.

- Commuter Benefits: Assistance with transportation costs, such as public transit passes or parking.

These benefits can significantly enhance the overall compensation package for hourly employees and contribute to their job satisfaction and retention. Employers may offer a combination of these benefits based on their resources, company size, and industry standards.

How Do You Calculate Pay for Hourly Employees?

There’s a set rate at which an hourly worker is compensated. That rate is then multiplied by the number of hours they logged during any given pay period. Let’s say an employee’s hourly rate is $8 and they worked for 40 hours in a given week. In that case, their week’s wage would be $320 (40x$8=$320).

Under the Fair Labor Standards Act (FLSA), all hourly workers are entitled to overtime pay. So, for every hour exceeding 40 hours per week, they must be paid time and a half. Let’s say the same employee with an $8 hourly rate logged 45 hours in a given week. In this case, their wage would be calculated this way:

Regular pay: 40x$8=$320

Overtime rate: 1.5x$8=$12

Overtime premium: 5x$12=$60

Total pay: $320+$60=$380

Unless an hourly worker is covered by a labor contract, they are not guaranteed a set number of hours per week. Often, their hours per week depend on their shift schedule. In this case, they cannot expect a consistent amount week after week.

Other Factors to Consider in Hourly Work

Most of the time, hourly workers are considered non-exempt automatically. Moreover, they are usually offered “at-will” employment. This means that for any reason at any time, both parties can leave the professional relationship. There will be no legal liabilities as long as the grounds for terminating the connection do not involve any form of discrimination.

Determining whether an employee is exempt or non-exempt includes running certain tests. These tests are usually applied to administrative, executive, outside sales, and computer-related roles. Now, if the worker meets the income and other criteria, they can be considered exempt. This means that provisions for overtime pay do not apply to them. Even if they work over the standard workweek, they are not entitled to extra wages.

It’s also worth noting that regulations on overtime pay may vary from state to state. There are locations wherein workers are subject to both federal and state labor laws. In this case, their extra hours will be paid according to the standard that will offer the higher amount.

Meanwhile, employers can voluntarily compensate exempt employees for overtime work. However, they must still follow regulations covering payment for additional hours. For example, they can offer extra compensation like flat sums, bonuses, or extra paid/unpaid time off.

Another thing to note is that employers can decide that the standard workweek for their non-exempt employees is not 40 hours. For example, in a department store, managers can consider 30 hours as the regular work hours for the week. Anything exceeding that can be considered as overtime work.

Wrapping Up

While both state and federal laws define which employees are salaried and which are compensated hourly, there’s still some room for adjustment. Consult with a lawyer to help you decide what will work best for your business. What’s important is to keep your workers happy while you ensure your business runs smoothly.