Remote Work State Taxes

There is a physical presence nexus when an employee working remotely in another state. Consequently, in this case, the company will be subject to the labor tax laws of that jurisdiction. They will have to comply with that state’s regulations on income taxes, sales and use taxes, and gross receipts taxes. In general, being subject to a different state’s labor laws requires the proper preparation, filing, and payment of taxes.

However, it’s worth noting that for remote work on behalf of out-of-state employers, certain states have waived business tax nexus. These states include Minnesota, Ohio, Indiana, New Jersey, Mississippi, North Dakota, and the District of Columbia.

Other Local Labor Laws to Consider

Aside from local and state taxes, businesses should also consider the labor laws in the states where their remote employees are working. This can involve rules on non-competition, wages, hourly rates, trade secrets, overtime pay, and leaves, among others. In general, a business should review local and state regulations that apply to the following:

- Workers’ Compensation Insurance – In general, states require employers to register for and acquire workers’ compensation insurance. They should obtain this from the state wherein their employee is performing their services. Employers will face liabilities if they fail to do so. Moreover, non-compliance will entail penalties according to workers’ compensation laws in the state.

- Unemployment Insurance – Employers with out-of-state employees also need to register and pay for unemployment insurance. They should acquire an insurance program from the state wherein their remote employee works. Again, non-compliance will entail penalties according to the unemployment insurance laws in that state.

Double Taxation

If an employee is working out of state, they will usually receive a credit on their resident return. They can use this to offset their non-resident tax liability. However, that does not apply to everyone. For instance, if your company is based in New York and you’re working in a different state, you’re likely liable for taxes there. The same rules apply if the business is based in Connecticut, Arkansas, Nebraska, Delaware, or Pennsylvania.

The aforementioned states follow the ‘convenience rule’. This rule subjects the employee to the income tax regulations of the state where their job is based. This is applicable if the person works in a different state for convenience and not because their employer requires it. Let’s say you’re telecommuting from another state yet your employer is based in New York. In that case, you still owe full income tax to New York. Now, if the state you’re in taxes your income too and doesn’t give you a tax credit, then you will likely be double taxed.

- Leadership & Management

- Jul 26, 2024

What Can You Do to Avoid Tax Confusion?

If you’re planning to work from a different state for an extended period, make sure you study payroll taxes for remote employees. Moreover, to avoid penalties, maintain detailed records of the time you spent in a particular state. Also, don’t forget to indicate the days you worked there and the time when state-mandated travel restrictions affected you.

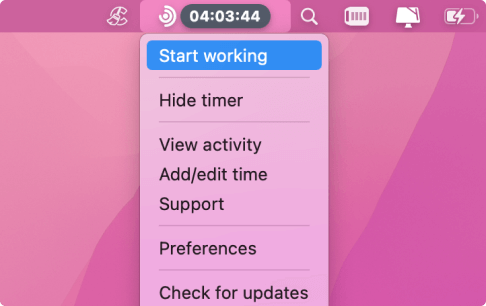

Keeping comprehensive records of work hours will help you determine to which state you should pay your income taxes. However, we won’t sugar-coat the process and tell you that it’s easy to do it manually. If you want to ensure accuracy, we recommend that you use a time tracker such as Traqq. Once you download and install this app, you can let it run automatically in the background while you work. At the end of the week or month, you can go to the dashboard and export the records to a CSV file. Using Traqq is an easy way to generate accurate and detailed records of your work hours.

Review Local and State Tax Laws

When hiring out-of-state employees, companies must review the tax laws in other jurisdictions. Employees who work in a different state during the pandemic should do the same. Usually, there are two ways to know if you are subject to taxes as a resident in a particular state. You either need to pass a statutory test or prove that you have your domicile in that state. Here are the details:

- Statutory test – To qualify for this, you need to maintain permanent residency in that state for more than half a year (at least 183 days out of 365 days).

- Domicile – A property can only qualify as your domicile if you consider that place as the center of your life—the home where you plan to return or settle. There are multiple factors to consider when determining your domicile. It should include quotidian factors like where you cast your vote, your kids attend school, you keep your pets, or your car is registered.

Now, if you move to a different state temporarily, you’re likely still required to pay income tax to the state you left. What if you don’t have any intention to stay permanently in a different state? Well, you may end up owing taxes to that state if you meet all the requirements of a statutory resident.

Remember that there are online resources that teach you about state tax withholding for remote employees. Reading these will keep you abreast of the tax requirements imposed by the state you’re temporarily located in. For example, accounting and business consulting firm Wipfli has a chart that details state and local tax authority positions on telecommuting.

Seek Professional Help

Indeed, payroll taxes for remote employees who work out of state can raise confusion and concerns. So, your best bet is to discuss these tax issues with a professional. A reputable business and accounting firm should be able to work with you closely and help you avoid double-taxing and other financial hiccups. Always explore potential complications when working remotely, especially if you moved to a different state during the pandemic.