58% of freelancers have encountered a client who didn’t pay them, a survey commissioned by PayPal revealed. So, it’s important that you use an effective billing process, especially when you’re paid an hourly rate. Moreover, you must know how to create an invoice for the hours you worked.

How Do Companies Establish Compensation for Hourly Remote Workers?

Keep in mind that there is no universal approach to determining hourly compensation for remote workers that suits all types of businesses. An organization must consider several factors before establishing how much they will pay contractors or work-from-home employees. Here are some elements to look at:

- The salaries at the reporting office or company headquarters

- The average compensation or pay grade where the employee lives

- The national hourly average for remote workers

As a freelancer or someone working on an hourly basis, you also need to review these factors. They will also help you determine how much you will charge your clients. If you’re a remote worker, you’re likely living in a different state from your employer. The calculation can get even more complicated if you are located in a different country. So, you should also review the cost-of-living adjustments (COLAs) to be able to come up with a reasonable hourly rate. This way, you can make adjustments to your hourly rate based on your geographical area’s Consumer Price Index.

How Do You Get the Details for Your Invoice?

Once you’ve determined your hourly rate, you can start working. At the end of the week or month, you’ll need to calculate your billable hours. It will help if you prepare an hourly invoice template to speed up the billing process. This template will include details such as your work’s start and end times, the day of the week, lunch breaks, your regular hourly rate, and your overtime rate.

As you can see, filling out a timesheet manually can be tedious and time-consuming.

Thankfully, you can use a time tracker that can automatically log your billable hours. For example, Traqq will record every minute you work and even analyze where you spend your time.

It also comes with a feature that lets you generate timesheet reports for accurate billing.

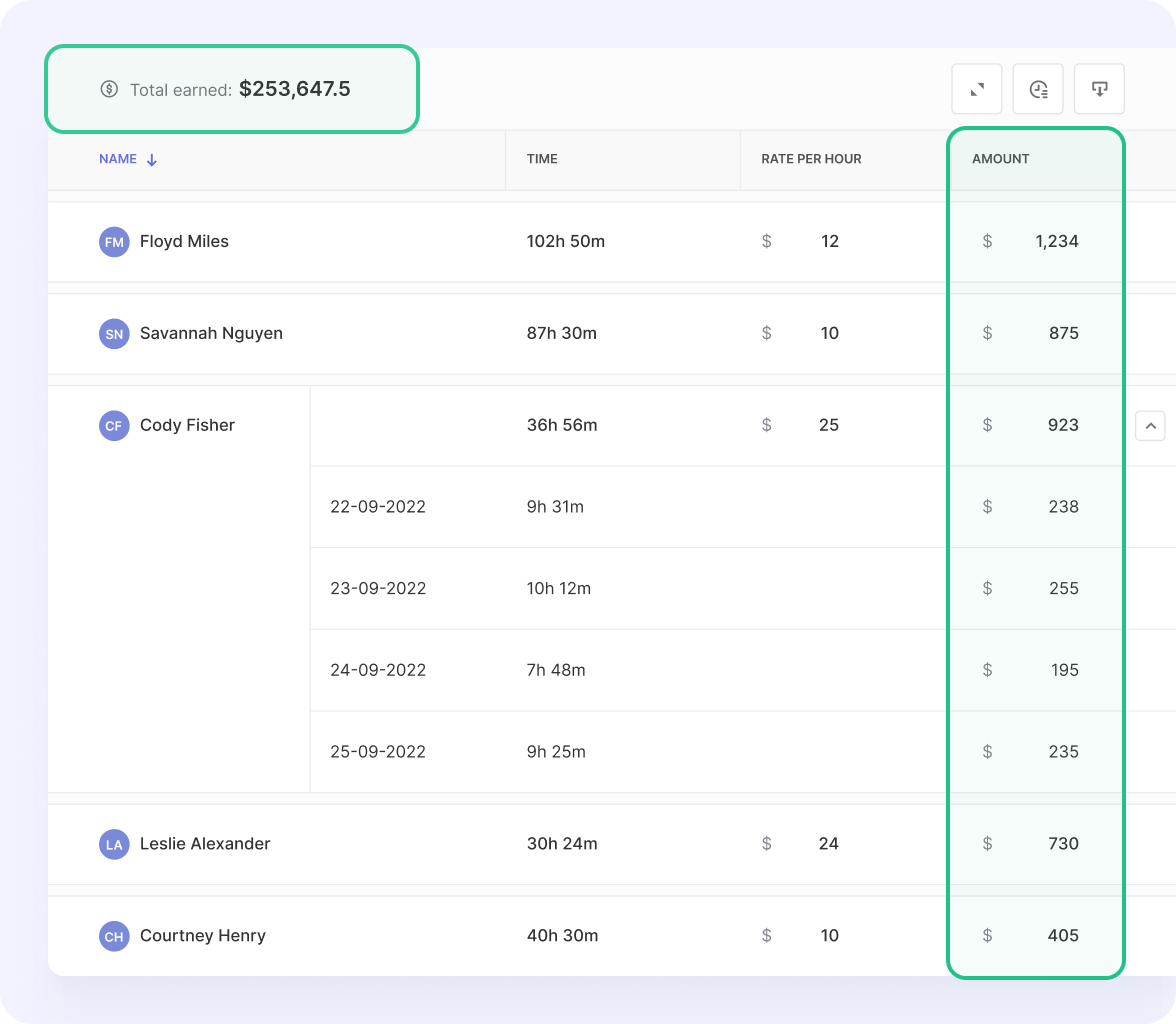

When you go to the dashboard, simply click on Reports in the left-pane menu. On the right pane, you will see Amounts Earned. Click on that and adjust the period accordingly. Once you’ve done that, you will see the total time you’ve worked along with the total amount you’ve earned. You can then export the data as a CSV file to get the accurate information you need for your invoice.

How to Create an Hourly Invoice for Your Clients

Whether you’re creating a monthly or weekly invoice for your client, the process is simple enough. As long as you have the necessary information, you can start generating an invoice for your hourly work. Also, when creating invoices, you need to remember the following:

Accurate Records

Without an accurate record of the hours you worked, you won’t be able to create a correct invoice. Keep in mind that this is something you should be doing as you work. It’s not advisable to rely on memory when you’re creating invoices at the end of the week or month. So, we recommend that you use a time tracker like Traqq.

After installing Traqq, all you need to do is click Start on the taskbar widget. The tool will run discreetly in the background and automatically log the hours you worked. At the end of the day, week, or month, you can check the Reports section of the dashboard. There, you will see an accurate record of all the hours you worked for a given period. You can even export the data to a CSV file to get the information you need to generate your invoice.

Transparent Details

It’s important to include all the details about the work you’ve done in the invoice. You need to indicate the calculations that led you to the final sum of the amount payable. Also, remember to itemize the services you’ve performed for the client. Aside from that, you need to indicate the payment terms that both parties agreed upon. Of course, you shouldn’t leave out invoice information, including the issue date and due date. Now, if you do not know how to assign invoice numbers, you can review the information below:

In the UK, tax law requires invoice numbers to be sequential. However, in the US, there are no overriding legal regulations on what an invoice should contain. In any case, you can follow the methods of assigning invoice numbers listed below:

- Sequential (e.g. 1, 2, 3, and so on)

- Chronological, by date (e.g. 20200909-001, 20200909-002, and so on)

- By assigned client number (e.g. 31-0001, 31-0002, and so on)

- By assigned project number (e.g. 165-001, 165-002, and so on)

- By date + assigned client number (e.g. 20200909-31-001, 20200909-31-002, and so on)

If you’re following legal guidelines on invoice numbering, you shouldn’t include gaps or repeats in the sequence. In general, it is advisable to be specific when assigning an invoice ID. Adding the month and the year of issuance would make the invoice easier to track. In one of the examples above, we used the date (20200909) followed by the number of the invoice (01, 02, and so on).

Meanwhile, if you don’t issue several invoices a day, you can simply include the year and month in the invoice number. The same goes for when you occasionally generate invoices in a year. For example, you can number your invoices 2020-001, 2020-002, and so on. Using this system will allow you to quickly see which year and month you issued the invoice. At the same time, you’ll still be able to follow sequential numbering.

How About Alphanumeric Invoice IDs?

Invoice IDs do not have to contain numbers only. You can also assign unique codes that include letters. You can even use special characters like dashes (-) and slashes (/). Adding characters and letters to your invoice number series will simplify the identification and organization of records. Even so, you should still follow the same rules that apply to regular invoice numbers when you’re using an alphanumeric system. Of course, IDs should be assigned sequentially and the sequence should not contain gaps.

You can use letters to identify various types of documents. For instance, if you issue quotations, you can assign the abbreviation ‘QUOT’ to your invoice numbers. Now, for actual invoices, you can include ‘INV’ in the number. However, these letters should be consistent and only the numbers should increase. Here are some examples of alphanumeric invoice IDs:

- 2020/QUOT/001

- 20-INV-001

Invoice Issuance Schedule

Discuss with your client how often you will issue an invoice. Creating invoices every month is the most convenient option, but you can also do it bi-weekly. No matter what schedule you choose, ensure that the interval between the invoices is not too long. This way, you can maintain a regular cash flow.

Payment Due Date

You also need to set a deadline on when the client should settle the invoice. It is common practice to require payments 10 to 14 days after the other party has received the invoice. However, the due date will still depend on what you and your client agree upon.

Payment Method

Once you and your client have agreed on the invoice schedule, you need to choose a payment method that’s convenient for both parties. There are plenty of options—from credit cards to money transfer services like PayPal.

Invoice Templates

These days, you can easily find professional-looking invoice templates online. There are also free invoicing tools that you can download for free. Using apps like these can help you streamline your billing process.

What Are the Best Practices for Hourly Billing?

Freelancers and remote workers have been billing on an hourly basis for as long as the gig economy existed. Here are some of the best practices they recommend:

- Rounding up time – Let’s say you had a conference call that lasted for about 34 minutes. However, before even taking the call, you needed to get off your computer and prepare the documents for the meeting. In this case, you can round up the task to at least 45 minutes. It’s common practice to round up to the nearest 15 minutes, 6 minutes, or hour. However, make sure that your client has agreed on this before you submit your total billable hours.

- No charge for mistakes – If you have committed errors and need to fix them, you shouldn’t charge your client for them. If you’re using a time tracker, you should perform the corrections off the clock.

- Detailed items in the bill – To avoid confusion and unnecessary emails, make sure that you add a description to every item in the bill. Clients naturally get curious about ambiguous entries in bills. So, you have to ensure that every detail you add to a bill is accounted for.

Creating an Invoice for Hourly Work Is Easy

Just because you’re dealing with numbers, it doesn’t mean that creating invoices is a complicated process. As long as you record your billable hours with Traqq, you will get the accurate information you need. Consequently, you’ll create a correct invoice and ensure that you get paid on time.