What Is Biweekly Pay?

Biweekly pay is a payroll model in which workers are paid every two weeks a month.

According to this model, there are 26 pay days in a year, which consists of 52 weeks. Such an approach ensures that employees earn more frequently, as opposed to the traditional monthly payment system. The payroll ratio, in this case, is 26:12 during the year.

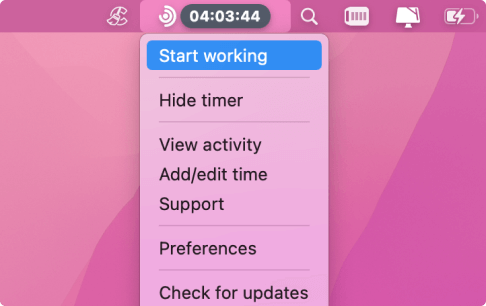

The biweekly pay model suits businesses that choose automated billing processing with an automated time tracker such as Traqq in their financial planning.

How Does Biweekly Pay Work?

In the biweekly payroll system, employees receive their pay every two weeks, based on a 14-day payment period. As a rule, it happens on a specific day of the week, for example, Friday. Each paycheck is the salary for work done in the previous two-week period. Interestingly, under this approach, employees sometimes technically receive three monthly paychecks instead of two. The calendar adjustment explains such “oddness” as some months are 30 days long, and some are 31 days long, taking into account that the biweekly period is always 14 days long. Besides, February is the shortest month of the year. It lasts 28 or 29 days a year, impacting the overall payment schedule.

Biweekly Example

For instance, a company pays its employees biweekly, setting Thursday as the payday. In this case, a worker will receive their paycheck every other Thursday, which can be the first and third Thursdays of the month. If the employee’s gross annual salary is $52,000, then each biweekly paycheck before deductions would be equal to $2,000. In other words, the annual salary consists of 26 biweekly periods in a year.

Semi-Monthly vs. Biweekly

It is important to understand that semi-monthly and biweekly pay schedules are not the same. They differ primarily in the overall frequency of paychecks per year.

Semi-monthly pay means that paychecks are issued exactly twice a month, usually on the 1st and the 15th, resulting in 24 pay days a year.

On the other hand, biweekly pay involves paychecks every two weeks, totalling 26 pay periods a year instead of 24 in the semi-monthly format.

This leads to biweekly employees occasionally receiving three paychecks in a month. It may look odd, but getting paid biweekly means that workers sometimes receive their salaries more often than twice a month. Yet, getting paid semi-monthly means receiving wages strictly twice a month strictly. This also means a semi-monthly payout should be higher than a biweekly one on a year-based calculation. So, though both systems look alike, there are slight differences in payment frequencies.

How Many Paychecks Are There in a Year?

In a biweekly pay structure, there are 26 regular paychecks in a year because employees receive their wages every two weeks, and the year, of course, consists of 52 weeks.

You can compare it to the semi-monthly payment model, with employees receiving only 24 paychecks a yearly, as their payments happen strictly twice a month. So, because of the calendar alignment, the biweekly pay model means 26 paydays a year. Arguably, the increased payment frequency compared to monthly or semi-monthly payroll models often leads to higher employee satisfaction.

How to Calculate Biweekly Pay?

Calculating biweekly pay from an annual salary is easy. In this case, you must divide the total yearly salary by 26. For example, if workers earn a gross annual salary of $104,000, their biweekly pay before any deductions would be $104,000 ÷ 26 = $4,000. For each paycheck, an employee receives $4,000 before any taxes or other deductions are applied.

On the other hand, biweekly pay is calculated by multiplying an employee’s daily or hourly rate times the number of days or hours they are paid.