What Is a Flat Rate?

A flat rate is a pay system where the business charges a fixed fee for a specific product or service. And the rate stays the same, regardless of:

- The actual cost you spent to provide the product or service

- The situation, place, resources, or time it took you to complete product or service.

- The number of tasks the employee needs to finish the project.

In other words, the flat rate system never changes even when there is variation in expenses. The flat rate pricing makes it easy to price structures, increase transparency for customers, and makes budgeting easier.

Most industries use the flat rate pay system, especially the service-based businesses like consulting, maintenance, or subscription-based services. For example, Spotify is a subscription-based service with a monthly subscription of $10.99 for its Premium Individual plan. This flat rate stays the same whether you listen to a little or a lot of music. It never changes!

What Is an Hourly Rate?

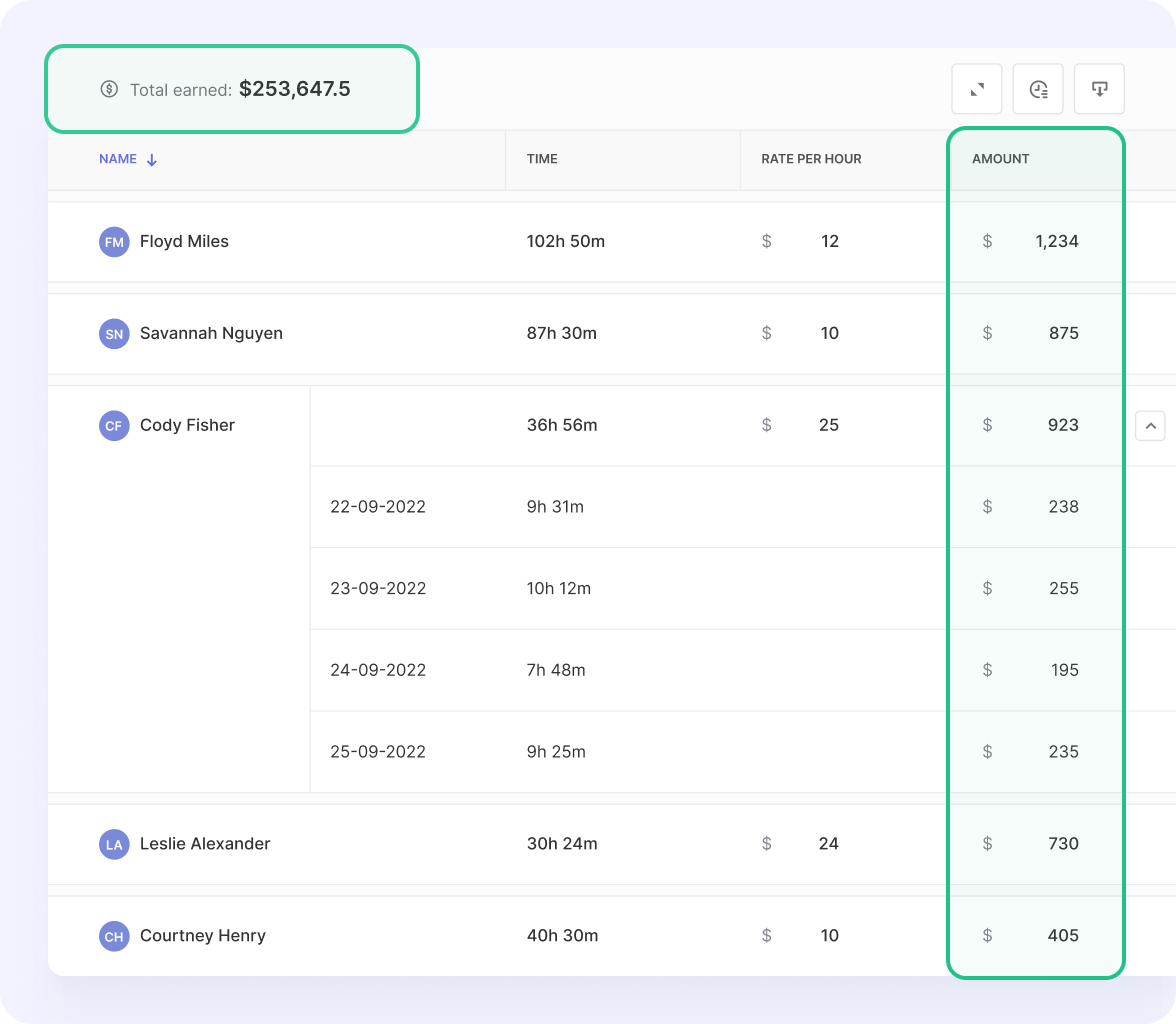

An hourly rate is the amount of money that an individual earns for each hour of work completed. Flat rate is commonly used to compensate employees, freelancers, and contractors, and it provides a straightforward way to calculate earnings based on the actual time spent working.

The total cost is calculated by multiplying the hourly rate by the number of hours worked. If you’re searching for a flexible rate that works for you and the client, the hourly rate pay is the best option.

With the hourly rate pricing, you get paid for the time you invested, and you pay your clients for the actual hours they wired. It’s a clear-cut way to make sure there is a fair compensation for the time and expertise, especially when the work’s duration or scope is unpredictable.

Pros and Cons of Flat Rate

| Pros | Cons |

| Flat rate is more stable and predictable since you get a specific amount for a service or product. There is a set price. | Service providers may wrongly calculate the time and effort needed for a project. You could lose profit if the work takes longer than originally planned. |

| Because the flat pay rate comes with the total cost upfront, clients can budget and avoid expected expenses. | There’s a high chance of losing money if the client doesn’t use the service often, like in the case of Spotify, or if they complete a project earlier than expected. |

| Clients can simplify their time tracking software since it’s not directly tied to their billing. | The flat rate system doesn’t account for the actual time spent on a project. This can make it challenging to allocate resources and manage projects. |

| The flat rate system creates more efficiency and productivity because service providers or clients must work within the fixed rate to avoid extra cost. | The scope of work or additional services offered within the flat rate comes with potential limitations. |

For businesses that charge a flat rate, logging hours with an hours tracker app can help justify the fixed fees.

Clients appreciate seeing where time goes – and this inspires their trust and builds confidence in your services.

Pros and Cons of Hourly Rate

| Pros | Cons |

| The hourly pay rate ensures the payment is fair because you get paid for the actual time you spent on a project. | The income changes depending on the scope of work and the rate charged per hour. |

| Clients pay according to the actual time they spent on a project. This creates transparency in billing, knowing you’re being paid what you deserve. | There may be some issues with the final cost if the project takes longer than expected. |

| Since the hourly rate pricing comes with detailed time tracking, you get all the details you need to know to assign resources and check the project’s status. | Needs a lot of administrative effort to track client’s time and bill them accurately. |

| You can adjust the scope of work according to the actual requirements of the project. | There’s a risk of inefficiency if the client works more hours than the required hours. |

Flat Rate Formula

The formula for the flat rate returns the flat rate price by multiplying the average cost of services by the set rate:

average cost of services x set rate = flat rate price

Let’s explain each variable:

Average cost of service: This is the cost you charge your client for providing a service like overhead, labor, materials. It also includes any other expenses the client incurred during the service delivery process.

Set rate: This is the cost per hour, item, or project a service provider charges for their services. Several factors affect the set rate, such as market rates, expertise, overhead costs, and the expected profit margin.

How to Calculate Flat Rate Price

Here’s an example to see how the formula works to calculate flat rate price. Let’s say the average cost of service is $200 and the set rate is 30$.

$200 x $30 = $6,000

So the flat rate pricing is $6000.

This means that the customer will pay a flat price rate of $6,000 no matter how much time the service provider actually spends on the service.

Flat Rate Example Cases

Here are some flat rate examples cases to help you get an idea of how it works:

Graphic design studio

When you visit a graphic design studio website, you’ll see the cost of their logo design services. Those are the flat rate packages.

So if a client chooses a package that offers a custom-design log, three rounds of revisions, and final files in various formats, they still get a fixed fee.

Since it doesn’t matter how long it takes for the studio to complete and they usually set time for the client to receive the product, they become more efficient and productive.

Also, the flat rate makes the pricing easy for clients and provides transparency on costs.

Landscaping company

Some landscaping companies may give clients a seasonal lawn maintenance service for a flat rate fee.

This may include trimming, mowing, and removing the leaves every week through the spring and summer.

The client can check the company’s flat rate packages and know what to expect and budget accordingly.

Tech Support Services

Small businesses usually need IT support services every now and then, and that’s where a tech support company comes in.

They could offer software updates, remote troubleshooting, and system maintenance for a flat rate fee. This pricing model can help the business to budget their cost without any unexpected fees.

Photograph Studio

A photography studio may offer a one-hour photo shoot, editing of the client’s selected images, and digital photo copies for a family photo shoot session at a flat rate fee.

The client can go through and choose the package that goes with their budget without unexpected costs.

Consulting firm

A consulting firm can offer a flat rate package for a project like developing a marketing strategy for a client.

The package may include competitor analysis, market research, and a detailed marketing plan. This makes budgeting easier for the client and they know what to expect from it.