Indeed, working from home has become the norm for so many employees around the country. With many people using their personal resources for work, it’s only natural for anyone to ask this question:

What expenses should my employer pay if I work from home?

As a nation, there is no single employee expense reimbursement law that addresses what expenses companies are required to cover. Because of this, the field of decision is wide open to interpretation and negotiation. Some states have laws in place that require employers to reimburse business expenses for remote employees. Meanwhile, others do not have set mandates.

The Hidden Cost of Working from Home

We’ve seen case studies about the work-from-home movement brought savings in money, time, gas, and even carbon emissions. However, in reality, there’s a hidden cost that many fail to admit. According to a working paper from the National Bureau of Economic Research, employees who found themselves without an office spend more on housing.

The study further discussed that the transition to a permanent home-office lifestyle could translate into $15 billion worth of additional housing costs yearly. That amount is on top of non-housing expenses like no-longer-free snacks, new equipment, and ergonomic office furniture.

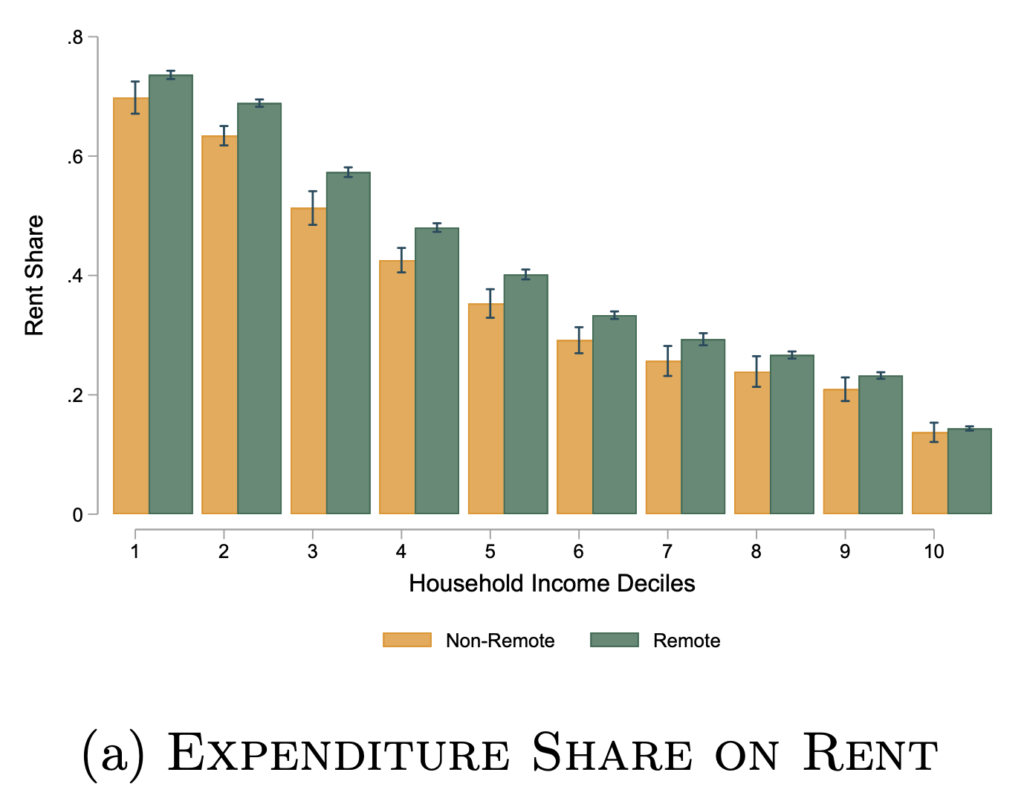

For high earners, the extra housing costs aren’t much of a trouble. However, for work-from-home employees at the lower-end of the spectrum, the additional expenses can be a burden. As evident in the chart below, these remote workers are already spending a bigger chunk of their salary on housing.

Of course, as a remote worker, you might wonder if your employer is legally required to cover at least some of your business expenses. So, in this post, we are going to discuss the following:

- The types of expenses employers should or maybe should not be covering

- Which states have laws in place to ensure remote employees are supported financially

- Tax rules around reimbursements

- The best states for remote work

At the end of this, we invite you to participate in a brief poll around remote work and expenses. This way, you can get better insights into how employers and employees stand in this subject amidst the new normal.

Work-from-Home Reimbursement

To kick things off, let’s start with an excerpt from an article written by The National Law Review in California:

Employers should consider what supplies and equipment are truly necessary. Allowing employees to submit expenses for reimbursement is just one option. Allowing employees to take home office supplies and equipment on a temporary basis (e.g., computers, printers, printer paper, pens, company-owned mobile hot spot, etc.) is one of several options worth consideration. Whatever solution an employer chooses, it should aim to avoid the need for employees to go out and purchase these items on their own. Note that if the employee wants to purchase supplies or upgrade equipment solely for his or her own convenience (e.g., an extra monitor, a wireless mouse, or an ergonomic chair) such expenses are generally deemed not “necessary.”

Most states do not have laws requiring companies to have an employee expense reimbursement policy. Even so, many employers are choosing to cover some of the costs of working from home. In cases like this, companies are generally considering what the employee needs to create a better work environment. They also look into tools they’ll need to perform their job successfully, and how they can help offset at-home expenses. Here are the two ways companies compensate for these additional costs:

- Stipends – While offices began closing down and employees were scheduled to begin working from home, some employers took it upon themselves to give stipends. They endeavored to help their employees create a productive work environment within their homes. People could enjoy an internet stipend or budget to cover their cell phone expenses. Some companies would even pay for the costs of work stations, ergonomic equipment, and software. Stipends tend to be very straightforward. Usually, employees are aware of the budget their employer sets to cover anything that will fulfill their home office setup.

- Reimbursements – Work-from-home reimbursement meant that remote employees would continue to pay their normal bills. They’d have to provide proof of expenses to let their employer reimburse their money. Usually, the amount is added to their paychecks. Something that employers had to account for were things such as a cell phone or internet reimbursement policy. Some employees were on limited cell phone plans and had lower internet speeds when employers needed more bandwidth from both. This meant remote workers needed to beef up their contracts, and some companies were willing to cover that extra cost.

Even so, it is worth noting that while many promises to reimburse their employees, not many stay true to their commitment. Owl Labs’ 2020 State of Remote Work report reveals that around 20% of companies provide home office reimbursement.

Meanwhile, when purchases are made by way of company stipends or reimbursements, those items could potentially still end up being the property of the employer. It is important to understand what an employer’s reimbursement policies are for work-related expenses. After all, this can determine what types of operational costs will be covered. Moreover, it clarifies where ownership lies if an employee decides to part ways with a company.

For employers, it is commonplace to be able to tag a majority of reimbursements as tax-deductibles, but the allowable amount may be limited. So, before creating a policy in covering expenses, companies and employees need to review state regulations. They need to look into what items are tax-deductible, and what the maximum deduction amounts are. These are the factors anyone should consider even before they answer the question, “How long do employers have to reimburse expenses?”

It’s common for workers to expect cell phone reimbursement. In reality, there are more expenses that remote employees deem necessary in order to fulfill their job. Here are some of the costs of working from home:

- An internet plan

- Home utilities

- A work computer

- Travel expenses

- A phone plan

- Workspace items – desk, chair, and office supplies

- Subscriptions, memberships, and association fees

Requiring Work-from-Home Reimbursement

Can an employer refuse to reimburse expenses? Well, there has been an ongoing debate on whether or not a company should be covering the costs of working from home. However, it’s worth noting some states are requiring this very thing.

Before the COVID-19 pandemic, employers could decide if they would cover the business-related expenses of their workers. If they chose to do so, they would get the final say on what they would cover and how much they would shell out. For instance, in remote work, time tracking and employee monitoring apps are essential operational tools. Most companies would pay for these programs for their WFH to use. However, since many companies would hire people as contractors, they aren’t obliged to cover expenditures like office furniture, computer, and equipment.

Nulab people operations manager Analisse Dunne shares her thoughts on this practice:

“In the past, many employers offered reimbursement for traditional office supplies; however, with the ongoing pandemic, businesses are navigating new territory when it comes to expenses related to working from home.”

It is worth mentioning that employers can refuse to reimburse expenses. Of course, this fact further fuels the debate of what work-from-home expenses should or should not be covered.

The Fair Labor Standards Act does state that employers cannot require their employees to cover work expenses. This becomes effective when the cost of working from home will bring a person’s take-home salary below the state’s minimum wage threshold.

Currently, the majority of states within the U.S. do not have requirements or laws around employers covering remote employee business expenses. As of March 17, 2021, there are at least ten states that require employers to reimburse certain operational costs for remote work. Below, we’ll highlight some of the states that have implemented these requirements, with a brief overview of what is expected from employers.

Best States for Remote Workers

So, what states are ideal for this new era of remote workers? This question is asked all around the country. Moreover, the trends show that many WFH employees find themselves fleeing the state they were based in, in favor of something new or different.

This question is quite subjective, and the answer comes down to personal preference. Indeed, some states require employers to reimburse a work-from-home employee’s expenses. Even so, this hardly covers the spectrum of what makes a state great for the remote workforce. Walkability, public transportation, and weather are some of the factors people consider when improving their lifestyle. Obviously, working from home equates to less commuting. For some, this means owning a car becomes unnecessary. So, walkability, public transit, and weather will become more important for them.

Other considerations include the housing market, cost of living, and state taxation laws. For those considering moving to a different state, it could be a good idea to research these items, especially as they relate to income.