Offering compensatory (comp) vs. overtime pay for employees who work more than 40 hours can be a difficult decision.

An independent survey of 500 employers commissioned by TSheets found that one-third of employers give overtime-eligible employees comp time vs overtime pay. Many employers (17.4% of those surveyed) don’t offer overtime or compensatory time at all.

Surprisingly, many employers don’t understand that offering employees comp time in lieu of overtime pay is illegal in many situations. It is a violation of the Fair Labor Standards Act (FLSA) could land them in court. In this post, you will learn what comp time is, if it is legal, and who is eligible for it. We’ll also share a comparison of compensatory time vs. overtime.

What Is Overtime Pay?

Overtime pay is additional compensation that employees receive for working hours beyond the standard 40-hour workweek. Under the Fair Labor Standards Act in the United States, non-exempt employees are entitled to receive overtime pay at the rate of one and a half (1.5) times their regular hourly wage for any hours worked over 40 in a week. This ensures fair remuneration for those who work extra hours and discourages excessive working hours.

Double time vs. overtime

Double time is a pay rate that is two times the employee’s regular hourly wage for specific hours worked, such as holidays, weekends, or in extreme overtime situations. This compensation is more generous than the standard overtime rate, which is one and a half times the regular hourly wage. Different industries and employers have different double time policies, which are often outlined in employment contracts, union agreements, or company policies.

What Is Comp Time?

Comp time, or compensatory time, is an alternative to overtime pay, where employees are granted additional time off rather than monetary compensation for the additional hours they work. For example, if a worker works eight hours overtime, they may earn eight hours of comp time, which they can use later as paid time off. This practice is more common in the public sector, and its legality and implementation can vary depending on local labor laws and company policies.

U.S. labor laws require that employees work eight hours per workday, which accumulates to 40 hours per workweek. Any extra hours worked beyond the standard 40-hour workweek must be paid either in comp time or overtime.

Let’s say your employee works 48 hours a week. Normally, you are supposed to pay overtime rate for the eight extra hours that they worked. However, if you decide to give the employee one day off at a later date to compensate for the eight hours, you could be in violation of federal or state laws.

What is a comp day?

A comp day, also known as a compensatory day, is a day off granted to a worker as compensation for additional hours worked, typically beyond their regular work schedule. This may be earned through accumulating overtime hours or through a special arrangement with the employer. For instance, a worker who works on weekends or holidays may earn a comp day that can be used at a later time.

Comp Time Vs. Overtime

The FLSA is mandated to ensure fair pay to employees for hours worked. Given the option, the majority of employees would rather take time off to spend with their families or to just sleep in instead of taking a higher paycheck. This is especially true if they have been working late hours for a couple of days.

An employee may prefer to get comp time instead of extra pay, and the employer is willing to oblige. However, overtime laws are restrictive and employees, in general, have little say in their hours. In other words, an employer cannot give comp time even if it is mutually agreed to. FLSA is clear that unless an employee is non-exempt and is working in public sector, comp time cannot be used for hourly employees.

If compensatory time applies in your case, it must be paid at the same rate as overtime pay. That means one-and-a-half hours of the comp time for each hour worked. As an employer, flaunting FLSA guidelines could set you up for a potential lawsuit.

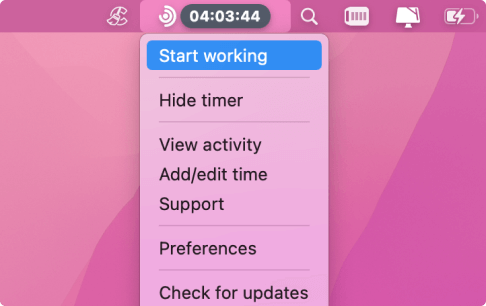

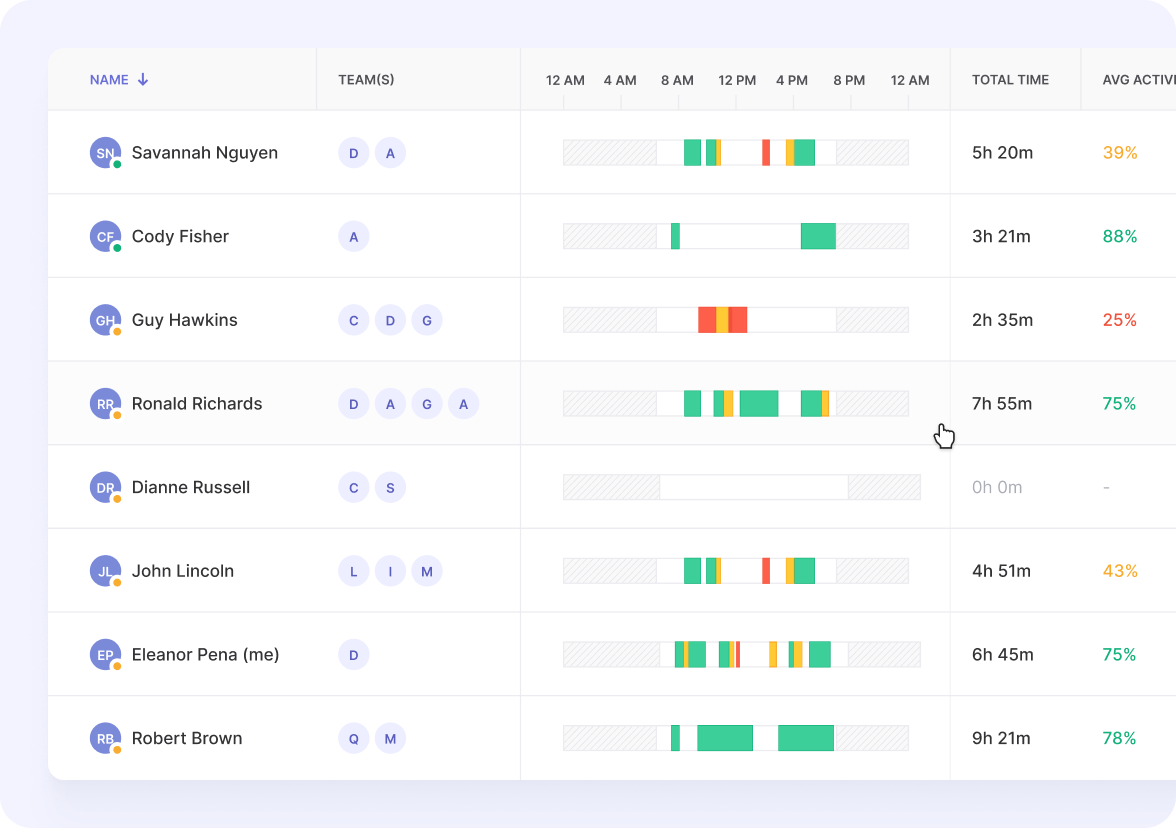

Documenting every minute of an employee’s work is the best way to ensure both the employer’s and the worker’s rights in case of a conflict of interest. Using Traqq – a comprehensive time and productivity tracking system is a transparent way to accurately calculate work hours and provide evidence in case of disputes.

Comp Time Legal?

In the U.S., laws on comp time off vary by state. While it is generally legal for public sector jobs, it is considered illegal in the private sector, including private sector nonprofit institutions. The legality also depends on whether:

- The employee is exempt or nonexempt

- The employee works for the federal, state, or local government

- The employee is salaried or hourly

In other words, it is illegal for a private-sector employer to compensate non-exempt employees with comp time instead of overtime. Public sector employees, on the other hand, who earn less than $684 per week are eligible for comp time.

According to the FLSA guidelines, private sector non-exempt and overtime-eligible employees must be paid for all the extra (overtime) hours worked. This means they are not eligible for comp time. However, some states might have guidelines allowing the use of compensatory time. Check with the state department of labor in your locality to get details on which laws are applicable.

Keep in mind that violation of the law relating to overtime pays not only sends the wrong message to employees, but it can also be viewed as wage theft, an offense that can have you slapped with a heavy fine or imprisonment in some states. Plus, if a company has a reputation for skirting overtime pay, it will be difficult to attract and retain top talent.

Comp Time for Exempt Employees

Under FLSA section 207(o), private sector employers are allowed to offer exempt employees comp time. The way they create the comp time policy is up to them. However, they are under no obligation to provide comp time to exempt employees because such employees are not eligible for overtime pay.

Comp Time for Nonexempt Employees

According to FLSA guidelines, nonexempt employees are legally required to be paid overtime (one and a half times the normal rate). They should get monetary compensation for any hours worked outside the standard 40-hour workweek.

Private employers will be in violation of federal laws if they give nonexempt employees the option to choose between comp time and paid time off. However, some states may have a provision for this. It is advisable to check with the agency for wage and hour/labor standards in your state for clarification.

Comp Time for Government Employees

According to the Department of Labor, state or government agencies may give employees compensatory time off instead of cash overtime pay. However, they can only do so if the following conditions are met:

- An agreement is arranged by union representatives

- The government employer and employee must agree to the comp time arrangement before the extra hours are accrued, not after

- Comp time must be awarded at the one-and-a-half-hour rate (1.5 hours). For example, if John accrues 10 hours of overtime, he is entitled to 15 hours of comp time (10 x 1.5 = 15 hours).

Employees in fire protection, law enforcement, and emergency response personnel can accrue up to 480 hours of comp time.

All other state and local government employees are allowed to accrue up to 240 hours of compensatory time.

FLSA Penalties

The FLSA guidelines are enforced by the Wage & Hour Division of the U.S. Department of Labor. Violating the FLSA can result in various penalties, which include:

- A fine of up to $10,000 for willful violators

- Repeat offenders risk imprisonment or civil money penalties up to $1,000 for each violation.

- Violators will be liable to pay legal fees if a lawsuit is successfully prosecuted.

- Firing or discriminating against an employee for filing a complaint or blowing the whistle on wage and hour violations will result in additional fines.

Remedies for Compensatory Time Conflicts

As noted earlier, an employer risks being slapped with steep penalties for disregarding FLSA regulations relating to overtime pay.

Keep in mind that as an employee, you have the right to file a claim for unpaid wages. If you don’t know how to proceed, you can hire an employment law attorney. They can provide you with legal advice relating to the compensation time issue. You can also go to the Wage-Hour Division for assistance.

However, sometimes hiring an attorney may not be a viable option, especially if the amount of unpaid wages is too small for your lawyer to file a case against your employer on your behalf. In such a scenario, you can contact federal and state government agencies to get help.

If you do not get help from the agencies, you can try your luck in a small claims court. This is an inexpensive and quick way to pursue a claim against your employer, plus you won’t need a lawyer.

If an employer willfully violates the statute, they may be liable to the payment of back wages and liquidated damages (which essentially means twice the damages).

As an employer, it is important to be conversant with the comp time regulations in your state. You can contact the U.S. Department of Labor’s Wage and Hour Division for clarification on the same.

To avoid legal battles with employees regarding comp time, an employer can offer flexible working hours to allow workers to have better work-life balance. For example, the employer can rearrange an employee’s weekly work schedule. One option is to let the employee work a 10-hour shift Monday through Thursday, instead of the normal 8-hour shift. In exchange, the employee will take time off on Friday. Still, they will have worked a 40-hour week. Alternatively, an employee can work one extra hour each day, and leave four hours early on Friday.

Note that, under federal law, each workweek stands alone. This means that a worker could not put in an extra 10 hours in one week and then use the purported accrued “comp time” to work less in a different week.

In our example above, since you have adjusted your employee’s working hours (based on the agreement between you and your employee), the employee still works the normal 40 hours a week. This means you don’t owe them pay overtime wages. However, this is only applicable if you operate in a state that requires you to pay overtime wages.