It’s understandable that many people who are considering switching from a traditional office job to a work-from-home contract have a reasonable question: “Do remote jobs pay less than traditional jobs?”

Let’s explore this topic by looking at minimum remote work salaries and state laws that apply to remote employees.

Labor Laws for Remote Employees

FLSA rules for remote nonexempt and exempt employees represent employment laws that apply to remote worker:

- FLSA Rules for Remote Nonexempt Workers

- FLSA Rules for Remote Exempt Employees

Both federal and state laws must be taken into account for employment standards, and companies must ensure compliance with both sets of regulations when it comes to remote workers.

FLSA Rules for Remote Nonexempt Workers

Nonexempt means the remote worker isn’t excluded from overtime pay rules under the FLSA (Fair Labor Standards Act). According to the FLSA, all remote workers (both hourly and salaried) must not be paid anything less than the federal minimum wage. This minimum amount is currently set at $7.25 per hour, but it’s usually higher in other states, as you have seen for California state. Now, if a remote employee earns less than $684 a week, they are entitled to overtime pay. If they logged over 40 hours in a workweek, their overtime pay must be 1.5 times their usual rates.

The FLSA doesn’t indicate that remote nonexempt employees must be provided with short breaks throughout the day. However, if you choose to give them short breaks, you should pay them for that time. Note that this only applies to short breaks but not meal periods.

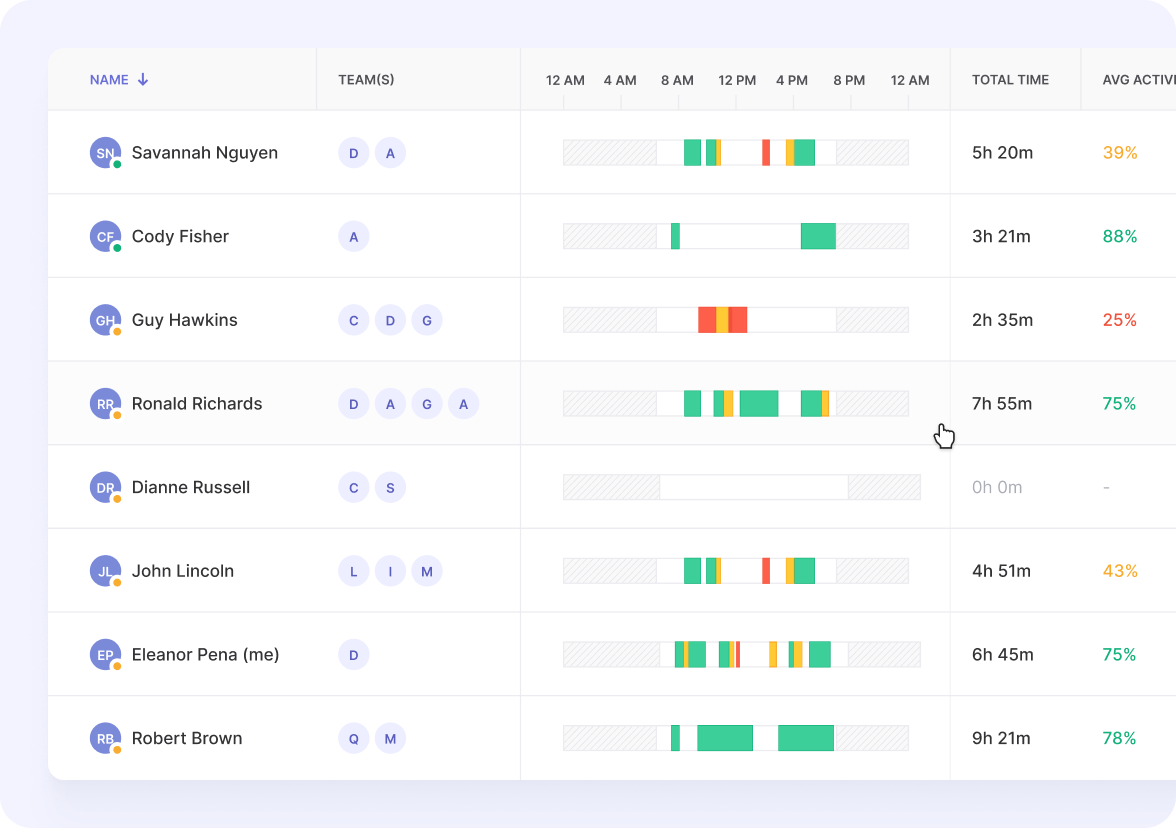

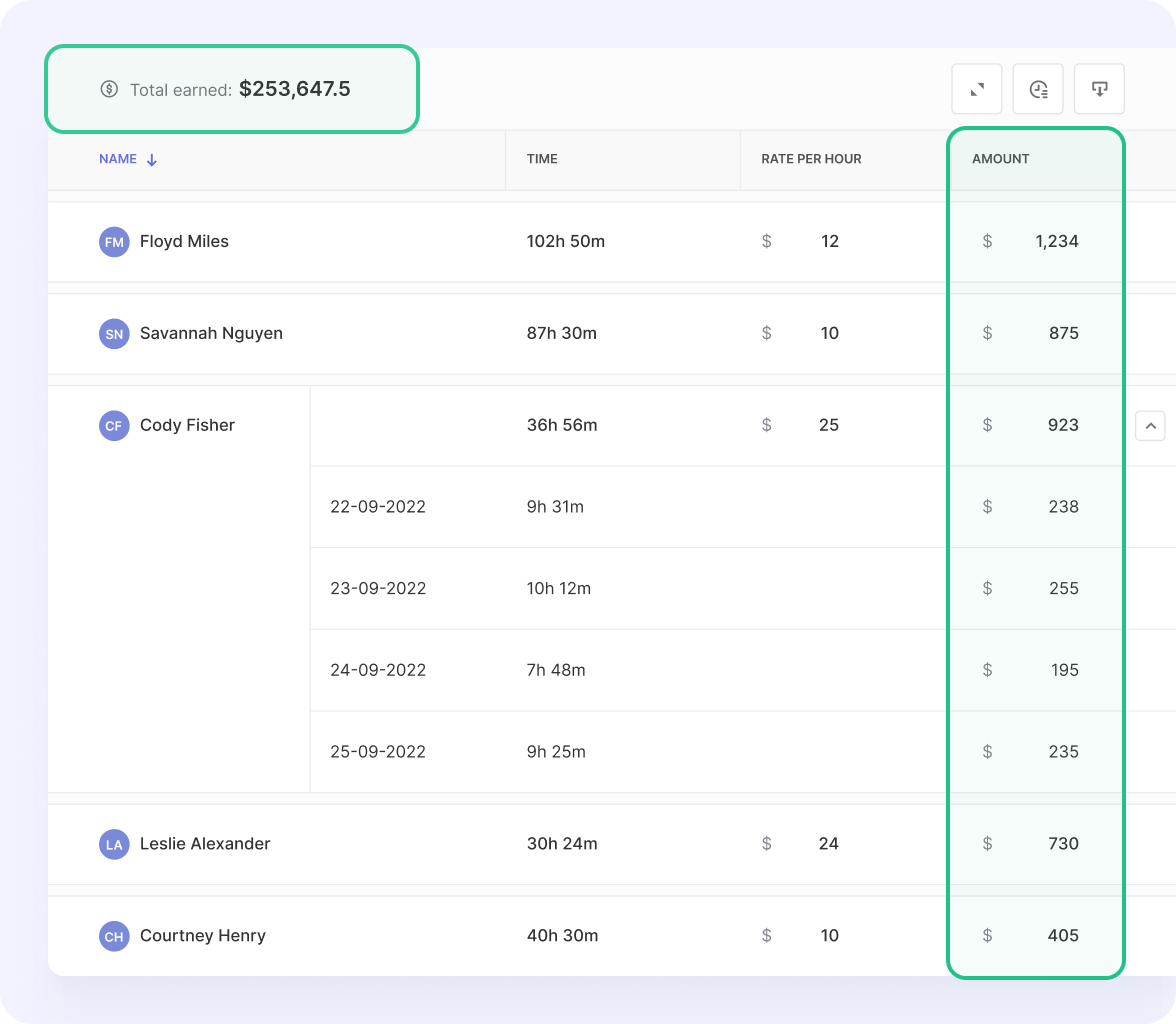

As an employer, you also need to track the work hours of these employees and keep records of their wages. To achieve this, you can try a reliable time tracking app like Traqq to track the number of hours they work daily.

It is important that you develop clear policies regarding the minimum work hours expected, breaks, and allowed overtime. This way, every employee knows what’s required of them and the consequences of breaking the rules.

FLSA Rules for Remote Exempt Employees

According to FLSA rules, remote exempt employees don’t need to be paid overtime even if they work for over 40 hours a week. However, employers must pay these workers their full salary for every week they work. FLSA rules dictate that remote exempt employees must get a weekly pay of at least $684.

As an employer, you don’t have to worry about tracking the working hours of these employees since you pay them fixed salaries. However, you can set a minimum number of hours that they should work within a week. Since you won’t be tracking their work hours, you can use software that helps in managing remote employees. With Traqq, you can determine your employees’ daily performance and give them useful tips to help boost productivity.

Factors That Determine Remote Work Minimum Wage

Companies use different strategies to determine how much their remote workers should be paid. The main factors that come into play are:

- The Company’s Location: Many companies pay the hourly rates or salaries that a particular job gets in their specific location. If the company is in an expensive area, that may translate to better pay. The vice versa also holds.

- The Employee’s Location: Do remote jobs pay based on location? The answer is “Yes”. You need to consider the minimum wage in your remote worker’s location. Moreover, you need to check if there are any updates to the compensation laws.

To use this method as an employer, you must first thoroughly research the cost of living in different places. That way, you can come up with a fair rate for the employee.

- General Market Trends: A company may also look at the salary data and type of work you do and then come up with a suitable pay rate. For this, remote workers get a fixed salary or hourly rate despite their location.

Remote Work Minimum Wage in California

The table below illustrates the California remote work minimum wage across 13 localities for companies with 25 or fewer, 26 or more workers. Companies are expected to follow the provided minimum wage directives by the local authorities.

| City | Employers with 25 or ferewer employees | Employers with 26 or more employees |

| Alameda | $15.00 | $15.00 |

| Berkeley | $16.07 | $16.07 |

| City and County of Los Angeles | $16.84 | $16.84 |

| City and County of San Francisco | $13.50 | $15.00 |

| Emeryville | $14.25 | $15.00 |

| Fremont | $14.25 | $15.00 |

| Malibu | $15.40 | $15.40 |

| Milpitas | $13.00 | $14.00 |

| Novato | $14.25 | $15.00 |

| Pasadena | $16.07 | $16.07 |

| San Leandro | $15.00 | $15.00 |

| Santa Monica | $14.25 | $15.00 |

| Santa Rosa | $14.00 | $15.00 |

The new minimum wage set in California cities amounts to $54,080 a year for companies with 26 or more workers. For employers with 25 or fewer employees, theirs equals $49,920 per year. Novato city is the only locality to set a minimum wage for businesses with 100 or more employees.

Benefits of Remote Work for Both Employees and Employers

Working from home may be seen as if it benefits employees only, but that’s not completely true. Employers also get to enjoy some benefits from it.

Here are the advantages of working remotely for employees:

- Flexibility: Working from home gives employees the freedom to plan schedules that fit their daily lives. That way, they can allocate time to do chores, take care of kids, and even travel while working. Also, in case of an emergency, a remote worker is able to quickly attend to it and get back to their duties.

- More Savings: Commuting to work daily can be pretty expensive, especially if your office is a bit far from home. If your company doesn’t offer transit benefits, you are forced to allocate some of your income to transport expenses. Additionally, you have to regularly buy office clothes, which are also costly.

- Increase Productivity: A traditional workplace forces you to put up with the usual noises of machines, ringing phones, and chit-chat. This can be pretty distracting, especially if you focus better in silence. When working from home, you can easily set up your office in the most quiet part of your house. That way, you can be more focused and creative, allowing you to be extra productive.

For employers:

- It’s Cheaper: When employees are working from the office, you must be ready to pay for rent, regular machine repairs, and cleaning, among other things. However, when they’re working remotely, you can even move to a smaller office and save so much on rent and other expenses.

- Less Absenteeism: According to a Gallup survey, remote workers are usually less likely to ask for vacation days. After all, their working conditions are flexible enough. Sick workers are more likely to prefer working while taking breaks instead of taking the entire day off. If those workers were to go to the office in the same conditions, most would probably call in sick.

- Easier Management: Many employers feel like remote work robs them all their control. That is not necessarily true, especially with time tracking software like Traqq. This tool enables you to easily track your employees’ activities. This allows you to see how they spend their time during work hours. That way, you can easily tell whether or not they are maintaining their productivity.

Wrapping Up

Working from home is easy and difficult at the same time. It just depends on the kind of work you do. When it comes to the hourly rates and salaries that remote workers get, they also vary. Every company pays different rates and uses a unique strategy to determine the best ones for their employees. You can also use sites like PayScale and Salary.com to check the pay to expect for different remote jobs.