In the complex world of personal and business finance, understanding the difference between gross and net income is fundamental to achieving financial health and making informed decisions. This critical distinction impacts everything from an individual’s paycheck to a small business owner’s evaluation of their company’s overall profitability. Gross revenue represents the total funds generated from sales of goods and services before any expenses or deductions, while net income reveals the true financial picture after direct costs, taxes, and court-ordered payments have been subtracted.

For businesses, metrics like gross profit margin and net profit margin serve as vital indicators of business performance during any given period. Whether you’re calculating your annual gross income, analyzing a pay period’s gross earnings, or determining your company’s net profit after the cost of goods sold, mastering the difference between gross and net provides the foundation for sound financial planning and improved business outcomes.

What Is Gross Pay?

An employee’s gross pay, also referred to as simply “gross” is the total amount a worker receives before any payroll deductions are made and plays a crucial role in payroll calculations. It is an essential metric for evaluating financial performance and making informed decisions about investments, savings, and spending. Among the deductions are insurance payouts, such as health insurance, retirement contributions, taxes and other payments. Gross pay covers all forms of compensation to an employee, including wages, bonuses, and various types of other payments and describes the initial amount used for tax calculations to determine net pay, also known as the “net.”

How to Calculate Gross Pay?

To correctly determine gross pay, you should sum up all the earnings made by an employee before any deductions are applied.

Here’s the basic condition: a worker makes $1,000 per week and receives an overtime payment of $200. They also enjoy a weekly bonus of $150. The calculation looks like this:

$1,000 + $200 + $150 = $1,350

Understanding the payroll process is crucial for accurately calculating gross pay, ensuring all earnings and necessary deductions are correctly accounted for.

Gross Pay Considerations

When calculating gross pay, it is essential to consider various factors, including hourly rates, annual salaries, pay periods, and overtime hours. For salaried employees, it is typically calculated by dividing the annual salary by the number of pay periods in a year. For hourly employees, gross pay is calculated by multiplying their hourly rate by the number of hours worked during a pay period.

Additionally, employers must consider payroll taxes, including social security and Medicare taxes, as well as other deductions such as health insurance premiums and retirement plan contributions. Accurate calculation of gross pay is critical for determining net pay, which is what the employee receives after all deductions.

What Is Gross Income?

An employee’s gross income is not their gross pay but a wider definition. It is the total income an employee earns before taxes and other deductions taken out. Individual workers’ total gross income includes not just wages, salaries, and bonuses but also other revenues like rental income, tax refunds, and dividends from stock and bonds. For a company, gross income is the total amount a business earns before any deductions are made. Understanding that gross income and gross pay are not the same is essential in economics and finance.

Using an hours tracker app like Traqq is a powerful method to precisely record your employees hours worked. This will help you calculate total gross income providing transparent salary budget planning.

For a business owner, understanding gross income is crucial in making informed financial decisions that affect both their employees and the overall health of their business.

How to Calculate Gross Annual Income?

To calculate gross annual income, you have to sum up the yearly income before any deductions. For instance, an employee earns a salary of $48,000 annually, a yearly bonus of $7,000, and $10,000 from his separate online business.

In this case, the gross annual income calculation would be:

$48,000 + $7,000 + $10,000 = $65,000

How to Calculate Adjusted Gross Income?

To calculate adjusted gross income (AGI), you have to take out allowable adjustments from gross income. For example, the worker’s gross income is $75,000, and they get $10,000 in 401(k) contributions and $3,000 in loan interest payments.

In this example case, the calculated AGI would be:

$75,000 – $10,000 – $3,000 = $62,000

What Is Net Income?

The net income includes money received after all expenses, taxes, and deductions are taken out. For individuals, it’s often defined informally as “take-home pay.” For businesses, it is calculated after deducting operating costs, taxes, and other expenses from gross income.

Sometimes known as net earnings in the context of a net worth tracker, net income is used by executives and entrepreneurs as the foundation for creating estimates and long-term business strategies. Net income is also known as ‘the bottom line’ since it is the last line of an income statement.

How to Calculate Net Income?

Net income is calculated by deducting all taxes and other payments from the gross income. Gross profit, which is the revenue a company makes after subtracting direct costs, is a crucial profitability metric. For instance, a company’s monthly gross income is $40,000, and the total monthly amount for LLC taxes, operating expenses, and employee-related deductions is $12,000.

In this case, the business’s net income would be:

$40,000 – $12,000 = $28,000

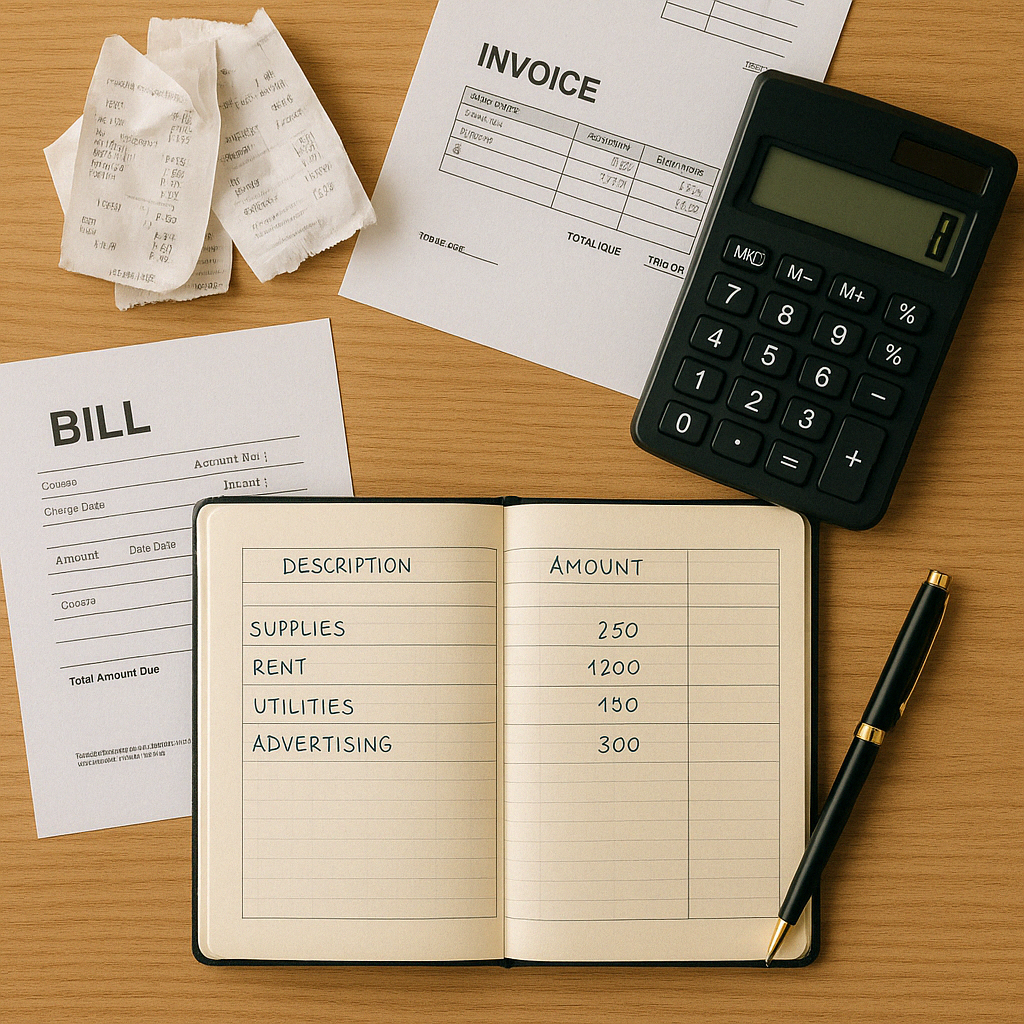

Business Expenses

Business expenses are a crucial aspect of calculating net income, as they directly impact a company’s financial performance. Direct expenses, such as the cost of raw materials and labor, are subtracted from gross revenue to determine gross profit. Indirect expenses, such as rent, utilities, and marketing costs, are then subtracted from gross profit to determine net profit.

Small business owners must carefully track and manage their expenses to ensure accurate calculation of net income and to make informed decisions about cost cutting and resource allocation. By analyzing business expenses, companies can identify areas for improvement, optimize their operations, and improve their overall profitability.

Employee Benefits

Employee benefits, such as health insurance, retirement plans, and paid time off, can significantly impact an employee’s gross and net pay. Employers must consider the cost of these benefits when calculating gross pay and must also comply with relevant laws and regulations, such as those related to payroll taxes and employee contributions. This can also affect an employee’s paycheck, as some benefits may be subject to taxes or other deductions.

By offering competitive employee benefits, businesses can attract and retain top talent, improve employee satisfaction, and enhance their overall financial performance. Additionally, employee benefits can provide a more accurate picture of an employee’s total compensation package, which can be useful for discussing compensation and making informed decisions about career development.

Difference Between Gross and Net Income

While gross and net income are derived from a company’s profits, there are some key differences that business owners should understand. Gross income represents the total earnings before any deductions are made. It is all the incoming money for an individual or a business entity: not just wages, but, for example, dividends and rental income, too. On the other hand, net income is the remaining amount after all applicable taxes and other expenses are made. Gross income evaluates overall earnings, while net income is the actual disposable income.

What Is Net Pay?

An amount of money an employee actually earns after all deductions have been made from the payroll. Such deductions include taxes, insurance payments, retirement contributions, and any other expenses. Understanding the impact net pay has on people’s lives is essential, as it is the actual money an individual earns.

A pay stub should accurately reflect all wages, deductions, and net pay, highlighting the importance of automated payroll software in simplifying these calculations for employers.

What Affects Net Pay?

Factors affecting net pay include:

- Federal, state, and local taxes

- Social Security and Medicare contributions

- Health insurance premiums

- Retirement fund contributions

- Union dues

- Wage garnishments

State income tax brackets: Gross pay determines the federal and state income tax brackets that apply to an individual’s earnings, impacting the net pay.

How to Calculate Net Pay?

The net pay formula is defined as “gross pay minus all deductions,” such as taxes, federal payouts, retirement payments, interests, dividends, and other types of income.

If the gross pay is $5,000 and the total deductions are $1,700, then the net pay would be:

$5,000 – $1,700 = $3,300

Net pay can also be expressed as a percentage by dividing the net pay by the gross pay and multiplying by 100. In this example, the net pay percentage is ($3,300 / $5,000) * 100 = 66%.

Gross Pay vs. Net Pay

Gross pay is the total revenue an employee gets before any deductions are withheld. It consists of earnings, such as salaries, bonuses, dividends from stocks and bonds, etc. Net pay, which some people call “take-home pay,” is the remaining amount a worker receives after subtracting all deductions from their gross pay.

These deductions include taxes, health insurance payouts, and retirement contributions. It is essential to understand that while the gross pay is what an employer initially owes an employee, the net pay is what the employee actually earns.

Additionally, understanding the gross profit margin is crucial in evaluating financial performance, as it measures how effectively a company generates profit relative to its revenues.