A Paychex survey revealed that around 70% of employees leave their job because of low salaries. So, pay is not something companies should mess around with. Money matters to any type of worker, including those in the sales industry, especially within sales teams. For example, when My Indo Airlines lowered sales commissions, agents became disengaged. Consequently, sales went down in each region of the domestic area.

Whenever a sales agent makes a new sale, they get a percentage of the profit. Referred to as a “sales commission,” the additional compensation is a reward that companies offer to top performers. It is one of the ways businesses can incentivize employees and motivate them to bring in more sales. Who wouldn’t want to close more deals when they know that they can earn more?

However, it’s important to know that there are different commission models and you need to know them to calculate commission. Some companies provide agents with bonuses once they reach a certain revenue threshold. Meanwhile, others base the commission calculation on base salaries.

So, if you want to know the ideal commission structure for your sales agents, keep reading this article. We’ll share the pros and cons of each type of commission while discussing applicable team sizes and industries and explain how to calculate commission for each type.

Calculate Commission Using Formulas Below

Before you proceed, make sure you know the guidelines for commission taxes in your state, city, province, or country. You’ll have to calculate taxes on commission pay when you’re managing payroll. In any case, here are the different types of commission and how different commission types can be tailored to fit various business needs:

Calculating Straight Commission

Formula:

Earnings = Sale x Commission Rate

Calculating Base Pay + Commission

Formula:

Earnings = Base Pay + (Sale x Commission Rate)

Calculating Bonus Commission

Formula:

Earnings = Gross Sale x Commission Rate

Calculating Tiered Commission

Formula:

Earnings = Gross Sales x Commission Rate

Tiered commission example:

| Sales Tier | Commission Rate |

| $15,000 | 4% |

| $15,001 – $45,000 | 7% |

| $45,001 – $70,000 | 10% |

Calculating Gross Margin Commission

Formula:

Gross Margin = Total Sale Price – Cost

Earnings = Gross Margin x Commission Rate

Let’s look at these commission types in detail.

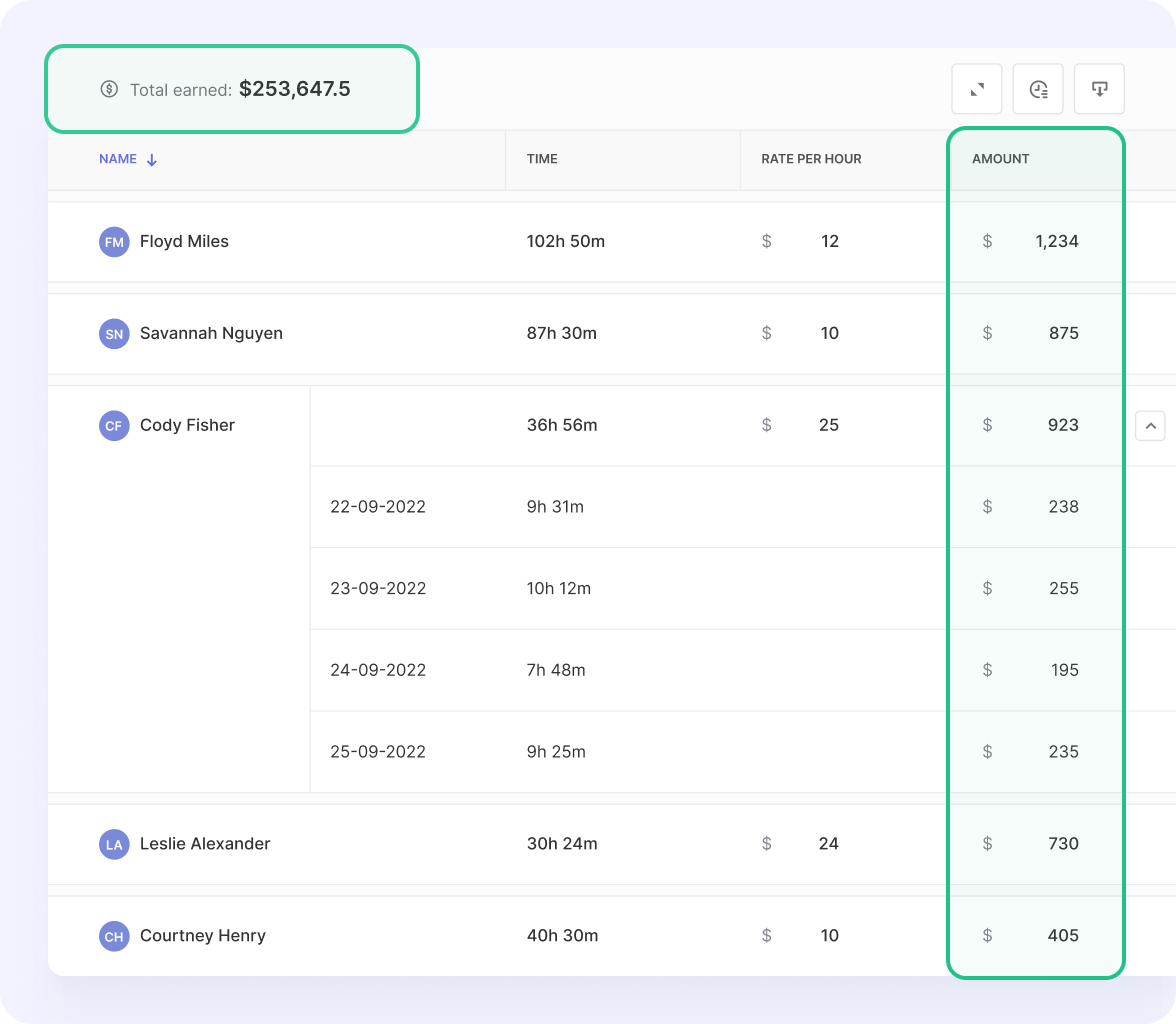

To accurately calculate commissions, use Traqq time tracker to record the hours spent on each task or with each client. This can help your company manage workflows more effectively and plan sales strategies for future projects.

Tracking time and activity not only helps with accurate commission pay calculations, but also helps you identify employee productivity patterns.

Straight Commission

Also known as a commission-only structure, a straight commission is the only pay a sales rep gets. In this pay model, there are no hourly wages or salaries involved. Instead, the compensation will be based entirely on the deals they close.

What’s more, there will be an agreement on the percentage of the sales amount that will go to the commission. This means that if the agent is not generating business, they will not be paid. Here’s a sample scenario:

A sales agent has a commission rate of 10%, and they bring in $40,000 of business in a month. In this case, they will receive $4,000 (excluding taxes).

What are the advantages of a straight commission?

What’s great about this commission structure is that it encourages agents to bring in more sales because their entire income depends on it. They’re likely to close as many high-value deals as possible. This structure keeps the sales team motivated to close as many high-value deals as possible.

Moreover, they can have some control over how much they want to earn. Along that line, they will be able to clearly assess their job performance.

On the other hand, if the agent is not bringing in business, the company is not obliged to pay them. As a result, an organization can keep its sales department profitable.

What are the disadvantages of a straight commission?

If a salesperson happens to go through a dry spell, a straight commission structure may be precarious for them. Companies that use this model may have a high turnover as their people quit jobs to find more security elsewhere. In some cases, companies may offer a draw amount to provide some financial stability, which is later deducted from future commissions.

As sales agents leave, the organization also spends more money on recruitment. What’s more, because of the lack of income security, HR practitioners in this field have smaller applicant pools.

Another drawback of this sales commission model is how it mostly creates a cutthroat environment for salespeople. To close a deal, agents become willing to do whatever it takes. So, you’ll end up with agents who are more focused on making money than professionally representing your company.

Where does the straight commission structure work?

If you’re running a startup with a limited budget for agents, using the commission-only model is ideal for you. It’s also a good option for businesses with short sales cycles. This structure won’t be problematic for agents if they can make a substantial commission from a single deal.

One industry that benefits from this model is the real estate sector, where real estate brokers enjoy earnings only when they sell a house. Even so, their substantial commission justifies their time and effort.

Similarly, the travel and insurance sectors can benefit from having a commission-based salary. An insurance agent gets a percentage of the sales from an expensive plan. The same goes for a travel agent who sells a luxury vacation package. Many people with these roles work as independent contractors.

Base Pay + Commission

In these commission plans, each sales agent receives a salary plus a bonus for every closed deal. In most cases, the base pay is relatively low, but the employee still gets a reasonable commission from each sale.

As a result, the agent gets to raise their income substantially as they bring in more sales. Companies can decide on a commission percentage and a base pay that works for them.

Here’s a sample scenario:

Let’s say the commission rate is 4% and the employee brings in $40,000 worth of sales in a month. In this case, they will receive their salary plus $1,600 (minus taxes).

What are the advantages of base pay + commission?

With the base pay + commission structure, companies can avoid some of the caveats of the commission-only model. Sales agents will have the security of a monthly salary. At the same time, they will still find the motivation to close as many deals as they can. A sales manager can use this structure to balance motivation and security for their team.

On the other hand, since an agent won’t be in a rush to make a sale, they will have more time to build rapport with potential customers. With less pressure, they will be able to cultivate relationships and nurture leads that can bring long-term benefits and bigger revenue to the company.

Many sales agents hate performing ad hoc tasks because they eat up valuable time that could be used for closing deals. However, with the guarantee of a monthly salary, they will be motivated to handle internal tasks like attending team meetings, updating databases, and responding to emails.

What are the disadvantages of base pay + commission?

One of the downsides of having the base pay + commission structure is a lower sales commission. Agents cannot expect their cut to be as high as what they’d get from a commission-only model.

Moreover, since there is always a base salary to fall back on, many agents tend to be less driven. Aside from that, a company has to have a bigger budget upfront.

Even if agents aren’t closing deals right away, they still have to get paid. Finance teams need to ensure that the budget can support the base salaries even during low sales periods.

Where does the base pay + commission structure work?

Almost any type of business can benefit from using the base salary + commission model. However, it works best for companies that don’t offer much variability in their products.

For instance, a startup business may provide one type of SaaS program with very little difference between subscription packages. In this case, using the base pay + commission structure for their sales agents would be the ideal option. Understanding the sales cycle is crucial for determining the appropriate base pay and commission rates.

To determine if you’ll need to use a commission calculator regularly, you must have a straightforward commission structure. So, if you’re going to choose this model, you’ll need an adequate budget for paying your sales agents’ base salary. What’s more, you’ll need enough resources for handling additional administrative work.

Bonus Commission

One of the best opportunities to reward top-performing employees is by offering them bonus commissions based on the total amount of sales they achieve. When they exceed a specific sales target, they get an additional amount on top of their base salary. The bonus can be awarded to individual employees or entire teams. Here’s a sample scenario:

Let’s say an employee’s sales quota for a month is $9,500 and they get a 5% bonus commission if they reach or exceed $10,000. If they bring in sales worth $11,000, they will receive $550 (minus taxes) on top of their base pay.

What are the advantages of a bonus commission?

If paying a commission for every closed deal seems tedious to you, this model is a great option for you. You can incentivize your employees to reach and exceed their sales targets. What’s more, this commission structure makes it easier for companies to estimate a monthly budget.

Aside from that, there won’t be a big difference between what the agents are earning. This model simplifies the entire process of rewarding employees for their performance.

What are the disadvantages of a bonus commission?

Once they’ve earned their bonus, sales agents may become less driven. Another scenario is when an employee’s commission rate increases when they reach a certain target. If the agent is consistently stuck between tiers, they may get discouraged.

Let’s say that for every $15,000 worth of sales, you give a $1,000 bonus to an employee. Now, if they reach $20,000, they can get a $2,000 bonus. If an agent consistently makes between $16,000 to $18,000, they might feel deflated.

After making their first $15,000, the employee may start dragging their feet. Because of this, your company may miss opportunities to bring in new business. If agents consistently earn the same amount of bonus, they may become less motivated to exceed their targets.

Where does the bonus commission structure work?

The bonus commission model is frequently used in various sectors, including wholesale, technology, financial services, and manufacturing. The commission structure works in these industries because instead of making one-off deals, agents are focused on selling large volumes of products.

To put it simply, it’s easier for companies to give a substantial one-time bonus once an employee has reached a target.

Let’s say an employee knows that they can only get a bonus once they’ve sold 20 freezers to a chain of restaurants. The agent will work harder to reach that target and earn that commission based on the sales price of the products.

Tiered Commission

Also known as a graduated commission, a tiered bonus focuses on performance. Moreover, it is similar to the base pay + commission structure. A business can establish different tiers, and when an agent reaches each level, they will be paid the associated commission. In this model, there are different tiers to motivate agents to reach the next benchmark.

On the other hand, it is still different from the base pay + bonus structure. Instead of earning a lump sum after reaching a certain tier, an employee gets a percentage of the sales until they get to the next benchmark. Usually, their cut gets bigger whenever they reach a new tier. Here’s a sample scenario:

Let’s say the commission rate is 4% for the first tier of $15,000. Meanwhile, the second tier ($25,000) comes with a 7% bonus rate. Now, for a particular month, an agent’s sales amounted to $40,000. In this case, the commission calculation will look like this:

- 15,000x.04 = 600

- 25,000x.07= 1,750

- 600+1,750 = 2,350

The agent’s total commission for that month is $2,350.

What are the advantages of a tiered commission?

Even when they’ve reached their sales target, an agent will be motivated to continue making sales. Of course, this can help your company reach its business goals. Indeed, any type of bonus can be encouraging for employees.

However, when you’re raising commissions according to different tiers, there’s a stronger motivational boost. It’s likely for your agents to strive for more closed deals so they can move to higher levels and earn higher commissions.

What are the disadvantages of a tiered Commission?

As more agents reach higher tiers, you will notice a fluctuating trend in your sales payroll. So, if your company is not prepared to give commissions during special, high-sale seasons, you may be caught off-guard.

If you’re going to choose this commission model, make sure you have enough resources to cover the bonuses of top-performing agents. Companies must be prepared to manage fluctuating payrolls during each commission period.

Where does the tiered commission structure work?

If you have a well-established and larger sales team, using the tiered commission model will work for you. For example, companies like Coca-Cola and Apple have the budget for compensating agents whenever they exceed quotas. This model is particularly effective as the team grows and more agents reach higher tiers.

Now, if you want to ramp up sales and fuel your team’s enthusiasm, a tiered commission structure will work for you. Your agents will always be motivated to overperform until they reach the next tier.

Gross Margin Commission

With the gross margin (also sometimes referred to as gross profit) commission model, a company considers the expenses related to creating a product. Instead of calculating the bonus from a percentage of a sale, you will compute the commission based on the net profit from each sale. Here’s a sample scenario:

Let’s say a product is worth $1,000 but the profit from that is only $400. If an agent gets an 8% commission from each sale, then their bonus in this scenario is $32.

What are the advantages of a gross margin commission?

With this model, you can ensure that you’re only giving bonuses that you can afford. It means that you’re not spending more than you’re making. Besides, this structure allows your agents to see the value of every potential client and sale. This way, they understand which transactions are more important. This ensures that the commission earned is always aligned with the company’s profitability.

What are the disadvantages of a gross margin commission?

Because of the lower commission rate, agents may be discouraged from offering discounts or freebies to potential customers. Of course, discounts are only advisable for certain situations. Even so, they can still help an agent win a new client’s trust. Relying on manual calculations can lead to significant errors, making it crucial to use automated tools.

Discounts can be a great way to encourage potential customers to try your product or service. With fewer deals, agents could miss the opportunity to build long-term relationships with clients.

Where does the gross margin commission structure work?

In industries where product costs vary depending on various factors, the gross margin commission model is ideal. When negotiating with potential customers, sales agents will work harder to raise the price of the product. After all, it is the only way they can get a bigger commission from the deal.

Choosing the Right Commission Calculation Structure

When an agent feels they’re adequately compensated, they’re likely to work harder and stay with the company. So, you need to take the time to choose a commission structure that aligns with the expectations of your employees.

Calculate Sales Commissions With Online Calculator

Whether you’re managing sales teams, working as a real estate agent, or optimizing commission payments for your reps understanding how to calculate commission accurately is essential for building a fair and motivating compensation plan The easy-to-use calculators below will help you break down total sales, apply the right commission percentage, and account for the various structures that apply to your business model.

Whether you’re trying to calculate real estate commissions, split payments between team members, or factor in bonuses and draws, these tools can handle it. Simply enter the sales amount, select the appropriate model, and get a clear view of the commission earned for the period. This quick and easy tool is perfect for analyzing gross profit commission, setting fair commission splits, or comparing different commission plans.

Use the dropdown below to choose a calculator that fits your scenario and see how different strategies can motivate reps and support smarter sales operations.

This blog provides a comprehensive overview of different commission structures, offering valuable insights for businesses looking to motivate their sales teams effectively. It highlights the advantages and disadvantages of each type, helping companies make informed decisions to align with their specific needs and industry. The clear formulas and examples make it easy to understand and implement. Overall, it’s a useful resource for businesses aiming to boost sales performance and retain motivated employees.