In recent years, digital currencies have been gaining traction, and despite the fluctuations in the value of bitcoin and other cryptocurrencies, more and more people start seeing cryptocurrency as a viable investment option. For example, Bitcoin, which is the most popular cryptocurrency, has taken over the digital currency market, and some of the largest businesses around the globe, including Microsoft, Overstock, and AT&T, now accept it as a method of payment. Nowadays, you can buy and sell cryptocurrency easily.

The most outstanding characteristic of cryptocurrency is that it is independent of any government or central bank. In other words, investors can ‘hide’ their wealth in the form of cryptocurrency without the fear of their governments confiscating it.

But not everyone is for investing in cryptocurrencies. Some groups and individuals have been, and still are, skeptical about the whole idea to the extent of dubbing cryptocurrency a ‘bubble’ that will eventually burst. However, the crypto market proved to be more than just a passing fad, and the benefits of investing in cryptocurrency are known to be profound.

Cryptocurrency, just like any other investment with the potential for high returns, is a risky venture. So, if you are new to the world of investing and you are considering investing in the virtual currency, it is important to evaluate the costs and benefits of doing so before adding cryptocurrency to your investment portfolio. In this post, we take a closer look at the advantages and disadvantages of cryptocurrency to help you get a clear view of what to expect.

What Are the Pros of Cryptocurrency in 2024?

1. Anonymity

The thing is, when you do business using cryptocurrency, your transactions cannot be traced. That means no government or authority can monitor your source of funds. It is a great option for people who like to keep their financial activities away from prying eyes.

Perhaps the biggest advantage of remaining anonymous when performing transactions is that no one can steal your identity. Unlike credit cards where your information is shared with the recipient, cryptocurrency allows you to send money without exposing any personal details. In other words, transacting in digital currencies is a more secure payment method.

However, while anonymity is a great benefit, it also attracts criminals who, for obvious reasons, would want to send large sums of money without the fear of the transactions being traced back to them.

2. Portability

Since cryptocurrency is a digital currency, you can carry around billions of dollars in Bitcoins on a memory drive, and no one will know it. Carrying the same amount of cash in physical money is obviously not an option, considering the risks involved.

3. Transparency

In the world of cryptocurrency, all the transactions are stored in an open ledger known as the blockchain. While your anonymity will not be revealed, people can view all the transactions instantly and see the exact sums that were transacted.

Think of it as a transparent banking system where your identity is kept private. Plus, no one can manipulate the data, making cryptocurrency a very secure payment method.

4. Accessibility

Since cryptocurrency is decentralized and not regulated by any government or authority, anyone can access it regardless of their location. This has made making payments or investments in cryptocurrency a simple and straightforward process, even for people in remote regions.

One more thing. You can access your funds not only from your laptop but also from your mobile phone, tablet, or iPad – whenever and wherever you are. Thanks to technology, cryptocurrencies like Bitcoin can now be used anywhere across the globe.

5. No Third-Party Involvement

In a normal business transaction – for example, when buying a property – you have to go through a long process that involves lawyers and other third-party entities. As a result, you can expect slow processing or delays in payments.

With cryptocurrency, things are quite the opposite. Without the need for approval, payments can be processed fast, and closing deals no longer has to be a tedious and frustrating process.

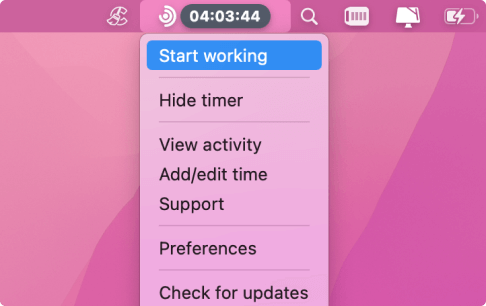

Freelancers who use time tracking systems like Traqq may one day enjoy fast, seamless, and convenient payments if using Bitcoin as a payment method is approved.

6. Huge Potential

Despite being a new market, cryptocurrencies have shown the potential for being more profitable than most other forms of investment. Bitcoin’s value has been known to explode several times, like in Christmas 2017 when it almost touched the $20,000 mark per coin.

While it has declined, you can still earn high returns if you pay attention to market trends and use tools like a crypto calculator to calculate profits or losses on your cryptocurrency trade.

7. Autonomy

With cryptocurrency, your money is yours alone and you have full control over it. That means you can choose what to spend it on, where to spend it, and whom to send it to. Unlike with banks where you are at the mercy of other people, you don’t have to worry about bankruptcy or robbery.

8. Low Risk of Inflation

Inflation causes many currencies to lose value with time, but cryptocurrency approaches it in a unique way. When a cryptocurrency is launched, it is released with a fixed amount. Take bitcoin, for example. There are only 21 million bitcoins around the world. This means that as its demand increases, its value will also increase to keep up with the market. In turn, this protects it from inflation.

9. High Liquidity

One of the first features of an asset or an instrument you should look at before you invest in it is its liquidity. That is, how easy you can buy or sell it with minimal slippage. Technology makes the process even smoother, and you don’t have to depend on third parties or external forces to buy or sell digital currency close to the market rate. You even can run your own crypto currency exchange via buying a white label for cryptocurrency wallets that support the function of buying / selling popular cryptocurrencies using Visa / Mastercard bank cards.

Let’s say you purchased equity in a startup and you want to cash out. You will have to look for someone to buy it from you. But with cryptocurrency, you have total control of your funds, and you can cash out almost instantaneously.

10. Affordability and Efficiency

When you transact with cryptocurrency, you send money directly to a merchant’s wallet. There are no intermediaries, which means lower transaction fees. Furthermore, regardless of the amount of money you are sending, you can be guaranteed that the process will take seconds rather than days, which is the case when using the traditional banking system.

This makes cryptocurrency a more efficient and convenient payment method for large asset purchases. Additionally, you can transfer funds with a few clicks of a button, and payments can be received in real time due to the high number of miners that process cryptocurrency computations.

What Are the Disadvantages of Investing in Cryptocurrency?

1. Volatility

Cryptocurrencies fluctuate a lot. Take a look at the statistics below, for example.

As of December 17, 2017, you needed $20,000 to purchase one bitcoin. Just a few days later, on the 24th, the price dropped to $14,626. As of November 6, 2018, buyers could not sell their investment for more than $6,461. Currently, one bitcoin costs approximately $9,337.36.

As you can see, the bitcoin market is highly unstable and the ripple effect can lead to financial losses. That’s why you need to be vigilant and invest wisely. For instance, instead of making one big investment, make small investments that will grow with time.

2. Cybertheft

Cryptocurrency operates online, and as you may be aware, hackers are always devising advanced techniques to steal confidential data and money. Cyberattacks are real and even more dangerous in the cryptocurrency world.

Most of the losses happen during exchanges. That’s why you need a reliable and robust cryptocurrency wallet that will keep your transactions safe. Luckily, we are already seeing stringent measures being taken to enhance the security of the cryptocurrency infrastructure.

3. Financial Losses

Hacking is not the only threat you need to worry about. Payments made with cryptocurrency are final and cannot be reversed. If you forget or misplace your key, your wallet remains locked along with the funds inside. That means you cannot retrieve your coins.

Additionally, the lack of cancellation options means that if you mistakenly send funds to the wrong wallet, you can say goodbye to your coins. As you can imagine, this could lead to massive financial losses.

Keep in mind that currently, there are no mechanisms to help you recover lost bitcoins.

4. Complexity

Cryptocurrency relies entirely on technology, and people who are not familiar with the basics of how it works can find the whole process confusing and challenging. What’s more, the terminology in use can be too complicated for some people, especially those who don’t have any idea about what digital currencies are.

Plus, there is a lot of skepticism and doubt surrounding the world of cryptocurrency, and most people even associate it with fraud, criminal activities, and hackers.

That’s why it is highly advisable to invest in cryptocurrency only if you have some knowledge of how it operates.

5. Uncertainty

Although cryptocurrencies enjoy the freedom of being decentralized, they’re still run and controlled by certain organizations that can manipulate the coins to bring about large swings in prices. Take bitcoin, for instance, whose value doubled several times in 2017. This was likely due to manipulation by its creators.

What Are the Best Cryptocurrencies to Invest in?

Now that you understand the advantages and disadvantages of cryptocurrency, here is a list of the best cryptocurrencies to invest in in 2024. We based our list on digital currencies that show the potential for sustainable growth in the coming months. We highly recommend that you research each coin further to fully understand all the aspects involved.

- Bitcoin. Undeniably the world’s most popular cryptocurrency, Bitcoin continues to dominate the cryptocurrency market. Although it is highly volatile, it has also proven to grow steadily and still manages to maintain high liquidity levels.

- Litecoin. Litecoin (LTC) is another cryptocurrency to keep your eye on. It is one of the most affordable cryptocurrencies when it comes to online transactions. Currently placed third in market capitalization after Bitcoin and Ether, Litecoin has huge potential for growth and might just be the investment opportunity you have been waiting for.

- Ether. While Bitcoin is the most popular cryptocurrency, Ether is the most influential. The fact that it is easily accessible as an investment instrument makes it a good option for investors planning to start this journey. Ethereum, the blockchain platform behind Ether, introduced smart contracts to allow developers to launch decentralized mobile and desktop applications (dApps) using blockchain technology. This enables it to run without downtime, interference, or control from a third party. Financial experts predict that Ether has the potential to remain a strong investment with increasing value in years to come, thanks to its loyal customers. Considering that Ether fuels the dApp ecosystem, millions of companies, businesses, and developers will require it to launch their applications and support their smart contracts. In turn, investors stand to gain when they sell their Ether coins.

- BAT (Basic Attention Token). BAT, another type of utility token, is utilized by Brave Browser, and you can use it to pay anyone who gives you any kind of assistance online. Since most people turn to the internet for information or help, BAT tokens have a broad scope of application. We have seen many coins collapsing, but BAT has remained consistent, which is a good sign.

Other cryptocurrencies to invest in in 2024 include:

- Ripple (XRP)

- NEO

- EOS

- Tron (TRX)

- Binance Coin (BNB)