When it comes to delivering a service or product, you have a reputation to maintain if you want to attract more prospects and keep your current customers in your court. As a freelancer or business owner, satisfying your clients’ needs is your top priority. That’s precisely why you strive to deliver quality work every time.

However, there’s always the hard part – getting paid.

Ideally, you expect to be paid on time, every time. Sadly, it is not uncommon for businesses and freelancers to wait for payment longer than initially agreed upon. When this happens, how do you politely ask for payment?

Regardless of your line of work, you know the crippling effects outstanding payments can have on your business. You can’t take on new projects, you may lose employees, your revenue stagnates, and you may lose your competitive edge, not forgetting the fact that you have bills of your own to pay. In short, your business doesn’t grow.

According to a 2016 study by the U.S. Bank, 82% of small businesses fail due to unpaid invoices. The survey estimated that small businesses have a whopping $825 billion in outstanding invoices. You can imagine this phenomenon’s tremendous impact on the economy.

So, how do you prevent late payments from happening? Well, one thing you can do is send payment reminders via email. If you are a remote worker and email is your only medium for requesting payment, then you want your message to come across as professional as possible. Offering multiple payment options can also facilitate timely payments by catering to clients’ preferences and increasing the likelihood of prompt payment. Additionally, providing clear information about available payment methods can prevent delays and ensure client satisfaction.

Let’s take a closer look at how to politely ask for payment while maintaining professionalism and fostering positive client relationships.

Introduction to Payment Requests

When dealing with clients, it’s essential to understand the importance of timely payments and how to ask for payment politely and professionally. A payment request email is a crucial step in maintaining a positive client relationship and ensuring that your business receives the payment it deserves.

In this section, we will discuss the basics of payment requests, including the different types of payment methods and how to create an effective payment request email template. By following these guidelines, you can improve your chances of receiving timely payments and avoid late payments.

Understanding the Challenge of Late Payments

Late payments can be a significant challenge for businesses, freelancers, and contractors. According to a QuickBooks study, 89% of small businesses experience hindered growth due to overdue payments. On average, small businesses get paid 8 days later than the deadline agreed upon in the payment terms, as reported by Xero. This can lead to cash flow problems, delayed projects, and strained relationships with clients.

Late payments not only disrupt your cash flow but also create a ripple effect that can impact your ability to take on new projects, pay your own bills, and maintain a steady revenue stream. Understanding the gravity of this issue underscores the importance of sending timely and polite payment request emails to ensure your business remains financially healthy. Additionally, it is crucial to establish clear payment terms to proactively prevent late invoice payments.

Instead of manually chasing invoices, many freelancers use platforms like Useme to automate payment reminders and streamline transactions. Services like this act as a secure intermediary, releasing the legal usage rights only after payment is confirmed, which helps reduce payment disputes and late invoices.

How to Politely Ask for Payment

Building a strong customer relationship is a very important step in any business. However, most business owners get intimidated when payment is overdue and they need to ask for payment. There is a common myth that you can’t ask for payment and improve your customer relationship at the same time. However, this couldn’t be further from the truth. The fact of the matter is, you shouldn’t wait too long to ask for payment after you deliver your projects.

Communication is key here.

Learning how to professionally ask for payment will strengthen your relationship with your client. Freelancer email etiquette is a crucial skill to learn and will come to play frequently in your professional career.

Keep in mind that clients can misinterpret your words if you’re not clear and succinct. Even though you may feel angry when you don’t receive payment weeks after the due date, the tone of your emails is very important to getting results. Clearly outlining due dates in contracts and invoices, offering various payment options, and maintaining positive client relationships can help ensure the client pays on time, prevent late payments, and reduce misunderstandings.

The good news is that you can craft stronger payment requests that are a bit demanding, yet still professional and polite. It is even advisable to send a series of short emails at regular intervals before and after the payment due date.

How to Write Email for Payment Request – 4 Easy Steps

These tips will help you to write a professional letter for requesting payment:

- Express gratitude for doing business with your client.

- Keep it short.

- Be simple and straightforward.

- Be as detailed as possible in your letter, including the project type, invoice number, amount due, and any other expenses.

- Use polite and courteous language.

- Mention details about payment agreement and options, such as direct deposit to a bank account.

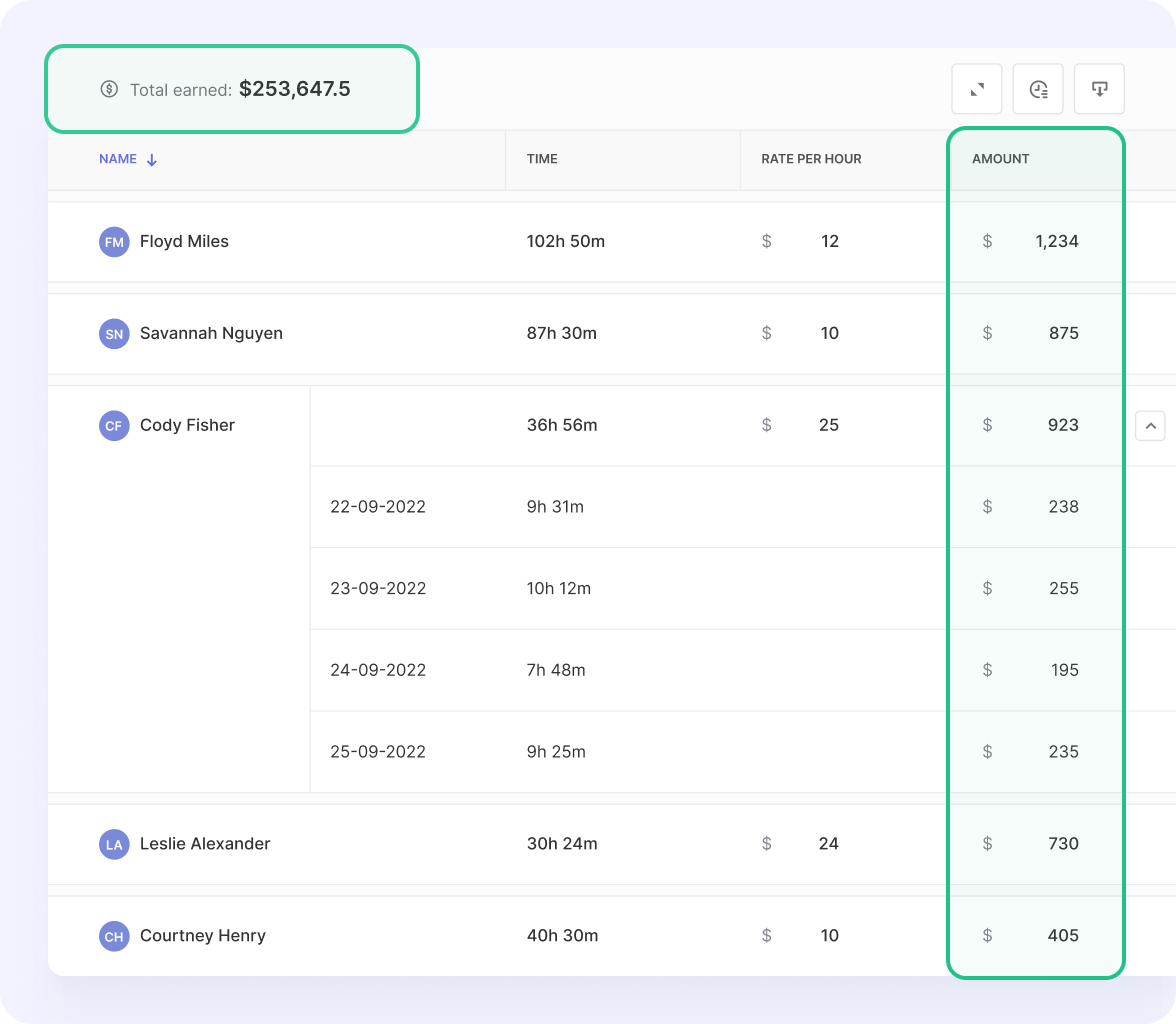

Use Traqq, a productivity monitoring tool, to track the time spent on each project. This tool provides detailed reports that you can attach to your payment reminder emails, adding transparency and professionalism to your requests.

Now, with those tips in mind, here are the steps to follow when you need to ask for payment politely without damaging business relations. We have included payment email samples for each step to give you an idea of how to write email for a payment request:

Step 1: Initial Request: One Week Before Due Date

It is important to check in with the client to see if they received the invoice and if they have any questions about it. Normally, the first payment reminder letter is sent about a week before the due date. Sending the initial invoice well in advance allows clients adequate time to prepare their payments and ensures they acknowledge receipt to avoid delays.

Sending a payment reminder email is crucial to ensure timely payments and maintain professionalism. Keep the email short, informative, and error-free. Remember, you are sending the email to remind the client of the upcoming payment, and that you look forward to working with them.

Email template:

To: gladwell@business.com

Subject: Payment reminder for invoice #1008

Hi Gladwell,

I hope all is well since we last spoke.

I really enjoyed working on the recent project and wanted to give you a quick heads up that invoice #1008 is due one week from today.Here’s the link to the invoice (include invoice link), including the different payment methods.

Please contact me if you have any questions regarding the invoice, payment methods, or services rendered.

Best Regards,

John Timber

Abbey Designs

Step 2: Payment Request Email on the Due Date

On the due date, send a short reminder with a clear call to action. Express your availability to answer any questions regarding the payment methods or any other potential questions, and emphasize the importance of providing clear payment details to facilitate timely payments. Ensure that the subject lines of your emails are clear and polite to maintain a professional tone and avoid any misunderstandings. For example:

Email template:

To: gladwell@business.com

Subject: Friendly Reminder: Invoice #1008 Due Today

Hi Gladwell,

I hope you are having a great day. I’d like to say again how I enjoyed working on our project together. This is a gentle reminder that invoice #1008 is due today at the discussed fee of (invoice amount).You can make payments via (payment options). Please note that, as discussed in our agreement, payment is due within (number of days) upon receipt of the invoice.

Please contact me if you have any questions.

Thanks again, and I look forward to working together in the future.

Kind Regards,

John Timber

Abbey Designs

Step 3: Past Due Requests – One Week Overdue

If you don’t get any reply from your client one week after the payment due date, try to use a firmer tone, with an emphasis on the late payment. It is crucial to address the overdue invoice promptly to maintain a professional relationship and ensure timely payment. Since it is the first reminder, give the client the benefit of the doubt. Maybe the invoice was faulty or it wasn’t delivered.

Email template:

To: gladwell@business.com

Subject: Friendly Reminder: Invoice #1008 One Week Past Due Date

Hi Gladwell,

My records show that I haven’t received payment for invoice #1008 of (invoice amount), which is now one week overdue. Attached is a copy of the original invoice with the amount due and due date.Would you mind looking into this for me?

Please let me know if there is someone else I can contact to make payment easier on your end.

If you have already made the payment, please ignore this email. If you haven’t and have any update on when the payment will be disbursed, I’d appreciate the information.

Thanks,

John Timber

Abbey Designs

Step 4: Past Due Requests – Two Weeks Overdue

As the second direct email about the invoice being overdue, you’ll need to use an even firmer tone. It is crucial to address overdue payments effectively to maintain cash flow and business relationships. Ask the client to confirm receipt of the invoice and also include a copy in the attachment, in case the client had trouble opening the previous ones.

If the client is intentionally ignoring your emails, a clear call to action and requesting the client to view their own records will give them a reason less to ignore your payment request emails.

Remember to close the letter with “Thanks” or “Best Regards” to maintain a polite and friendly tone.

Email template:

To: gladwell@business.com

Subject: Friendly Reminder – Invoice #1008 Two Weeks Overdue

Hi Gladwell,

I just want to confirm that you have received the invoice #1008 of the amount (invoice amount) as I can see it is now two weeks past the due date. Please be advised that, according to our terms of the agreement, late payments may incur additional fees. such as a late fee.Again, if you have any questions or would like to discuss the invoice, please contact me.

Otherwise, if you could please arrange payment by (set date three to four days ahead), I would appreciate it.

If you have already made the payment, thank you and please disregard this email.

Best Regards,

John Timber

Abbey Designs

When to Ask for Payment

Timing is crucial when it comes to asking for payment. Sending a payment request email at the right moment can help avoid awkwardness and ensure timely payments. Here’s a suggested timeline for sending payment request emails:

Before the Due Date

Send a polite reminder a week before the due date to give your client a heads-up.

On the Due Date

Send a payment request email on the due date to remind the client that payment is due.

A Few Days After the Due Date

Write a follow-up email with a gentle reminder if the payment is a few days overdue.

Two Weeks After the Due Date

Send a more firm reminder if the invoice remains unpaid two weeks past the due date.

One Month After the Due Date

If the invoice is still unpaid after a month, send a stern reminder outlining the consequences of late payment, such as late fees. Frame this reminder as a final notice to convey the seriousness of the situation and make it clear that immediate action is required to address the overdue payment.

By following this timeline, you can maintain professionalism while ensuring that your outstanding invoices are addressed promptly.

Crafting a Polite Payment Request Email

When crafting a payment request email, it’s essential to strike the right balance between being polite and firm. Here are some tips to help you write an effective payment request email:

Be Polite and Professional

Always start with a friendly greeting and express gratitude for the client’s business.

Use a Clear Call to Action

Clearly state what you need the client to do, such as making the payment by a specific date, and explicitly request confirmation on when you can expect payment to settle their outstanding dues.

Include a Link to the Invoice

Make it easy for the client to access the invoice by including a direct link.

Be Firm but Not Aggressive

While it’s important to be clear about the payment terms, avoid using harsh or confrontational language.

Use a Polite Subject Line and Greeting

A courteous subject line and greeting set the tone for the email and increase the likelihood of a positive response.

Keep the Tone Friendly and Non-Confrontational

Maintain a friendly tone throughout the email to preserve the client relationship.

By following these guidelines, you can craft payment request emails that are both effective and respectful.

Payment Methods and Bank Account

Offering several payment options is crucial in today’s digital age. Clients appreciate the flexibility of being able to pay via various methods, such as credit cards, online payment portals, or direct deposit into your bank account. When setting up your payment system, make sure to consider the fees associated with each payment method and clearly outline the payment terms in your contract.

This will help avoid any confusion or misunderstandings about the payment process. Additionally, having a clear and concise invoice payment and receipt process in place will help you keep track of payments and avoid overdue invoices.

Invoice Payment and Receipt

An invoice is a critical document that outlines the payment terms, due date, and amount owed. When creating an invoice, make sure to include all relevant information, such as the invoice number, date, and payment options. It’s also essential to send the invoice promptly after completing the work or delivering the goods.

A payment reminder email can be sent to remind clients of outstanding invoices, and it’s crucial to follow up with a phone call or additional email if the payment remains unpaid. By having a clear and efficient invoice payment and receipt process, you can reduce the risk of late payments and improve your cash flow.

Payment Deadline and Follow-up

When sending a payment request email, it’s crucial to include specific details and follow up regularly to ensure timely payments. Here are some tips to help you manage payment deadlines and follow-ups:

- Include the Invoice Number and Your Business Name on the Subject Line: This makes it easy for the client to identify the email and the associated invoice.

- Use a Polite Email Template to Remind the Client of the Approaching Due Date: A friendly reminder can prompt the client to make the payment on time.

- Follow Up with a Phone Call or Direct Message if the Client Doesn’t Respond: Sometimes, a more personal approach can be more effective than emails alone.

- Consider Revoking Access to Deliverables or Using Social Media to Request Payment if the Client is Unresponsive: These measures can encourage the client to settle the outstanding payment.

- Keep Track of Payment Deadlines and Follow Up Regularly: Consistent follow-ups show that you are serious about getting paid and help ensure that payments are made on time.

By incorporating these strategies into your payment request process, you can improve your chances of receiving on-time payments and maintaining positive client relationships.

When Polite Payment Requests Don’t Work

If your request for payment doesn’t succeed in getting the client to settle balance, it is time to consider alternative methods of reaching your client, for example, calling them directly.

Managing outstanding payments can be challenging, but maintaining professional communication is crucial to ensure timely payments. No matter how late your payments are, keep your frustrations in check and try to keep lines of communication open. More importantly, avoid being confrontational.

There could be a number of reasons why your emails were ignored. First, it is possible that you are sending your invoice to the wrong person or department, especially if it’s a big organization. On the other hand, your client may have changed email addresses, or accidentally provided you with an incorrect one.

If for some reason your client ignores your emails and calls, you have four options: As a last resort, you might consider involving a debt collection agency, but this should be done only after all other methods have failed.

Either way, calling a client takes a more personal approach than sending them emails. Plus, they won’t hide behind their computers! This makes it much harder for them to ignore your requests for payment for a project delivered on time.

Additionally, a phone call gives you the chance to hear their side of the story firsthand, clearing any misunderstandings.

As with emails, try to be friendly and keep your cool. You don’t want to tarnish your reputation by demanding payment right away and using a harsh tone. Plus, you may blow your only chance of getting paid.

Making the Polite Call

When making the call, be sure to:

- Introduce yourself and offer an explanation as to why you are calling.

- Speak clearly and remember to be polite and concise.

- Have all the relevant information on hand.

- Use correct grammar and avoid getting personal.

- Address the overdue payment directly and provide details such as the overdue amount and payment methods.

Worried about not knowing what to say? Don’t fret. Here is a script to help you speak like a professional.

“Hello, Mrs. Gladwell. It’s John from Abbey Designs. Great to talk to you today. I worked on “The Grand Design” project with you about a month ago. I have sent you a couple of emails requesting payment, and they may have gone unnoticed. Have you received them?”

From that conversation starter, your client may follow up on the emails or inform you that none of the emails got through. If you’re lucky, the client may even process the payment immediately.

If for some reason your client ignores your emails and calls, you have four options:

- Be annoyingly persistent

- Hire a collection agency

- Cut all ties with the client

- Review your legal options

Common Mistakes to Avoid

When asking for payment, there are several common mistakes to avoid. These include being too aggressive or demanding, making assumptions about the client’s financial situation, and not providing clear payment terms. It’s also essential to avoid using generic payment reminder email templates and instead customize them to fit your specific needs and client relationships.

By being polite, professional, and persistent, you can improve your chances of receiving timely payments and maintaining a positive client relationship. Additionally, offering multiple payment options and providing a clear payment schedule can help reduce the risk of late payments and improve your cash flow.

Tips to Avoid Late Payments

Using a payment request email template can help ensure your communication is clear, professional, and consistent. Apart from clearly communicating the payment terms, here are more tips to help you avoid late payments:

- Make sure the work is 100 percent complete before requesting payment.

- Create a legally binding contract with all your clients before you start working on a project.

- Offer early discount payment terms on your contract.

- Invoice promptly. Don’t delay sending payment request emails and reminders.

- Keep all communications friendly but firm to show your clients that you are serious about getting paid.

- Emphasize the importance of timely payments for ongoing work and ensure future payments are secure by requesting deposits upfront or cutting off future projects for clients who consistently pay late.

You can search for legal templates online or consult a legal professional to draft a contract tailored to your specific needs.