The Fair Labor and Standards Act (FLSA) contains stipulations regarding overtime wages. Nonexempt employees who are compensated on an hourly basis must receive overtime pay for work exceeding 40 hours per week.

The amount should be one and a half of their regular hourly rate. Let’s say you’re paid $13 an hour and in a week, you worked for 45 hours. The extra five hours should be paid at a rate of $19.5 per hour. Use this overtime pay calculator to ensure you receive fair compensation for your extra hours worked.

Now, what if you’re paying your employee on a salary basis instead of an hourly rate? Well, instead of requiring them to work off-the-clock, your best option is following a Chinese overtime computation.

Also known as a variable workweek, Chinese overtime lets employers pay just half the regular hourly rate for the time exceeding 40 hours in a week. Naturally, you might wonder if this is legal.

In this post, we will share everything you need to know about this topic. We will also teach you how to calculate overtime pay when the hours are covered by a variable workweek.

What Is Chinese Overtime?

The FLSA permits the Fluctuating Workweek (FWW) method of overtime pay calculation. Most employers use it to cut operational costs. Let’s say you’re paying your employee a fixed salary every week and the work hours vary from week to week. In this case, you can still pay a fixed amount for the fluctuating workweeks.

Explore everything you need to know about Chinese overtime, including laws, practices, and implications for employers and employees. With Traqq’s insights, understand how Chinese overtime differs from standard practices in other countries and learn how to ensure compliance with local regulations.

While this FLSA overtime calculation is favorable to employers, certain conditions must be met. You can only use the Chinese overtime method in the following scenarios:

- The employee is working on a flexible schedule, and their work hours fluctuate from week to week.

- The employee is working on a fixed salary that is not subject to changes depending on the work hours per week.

- The base salary is not lower than the minimum wage of any given week.

- There is a mutual understanding between the employer and employee regarding the conditions of a fixed salary. Both parties should agree that the compensation will cover all the hours in a week, regardless of the actual work hours.

Note: We’ll discuss these conditions further in the article.

In this case, you can determine the regular rate by dividing the fixed salary by the number of hours worked in a week. The employee’s wages are supposed to compensate for all the hours they worked. The time exceeding 40 hours per week will only be paid at ‘half-time’.

By virtue of the salary, the employee has been compensated straight time. Since straight time can only be paid once, the overtime work will be paid at one-half the regular rate.

Essentially, you are still paying them time and a half. Now, if employees are working too much overtime in certain weeks, the regular rate will be lower. So, as the employer, you can enjoy a lower per-hour overtime cost.

However, there is still a caveat in this method. If work is slow and your employee is working around 30 hours per week, you should still pay the fixed salary.

How to Calculate Overtime Pay (Fluctuating Workweek Method)

In some systems, all the work hours, including those exceeding 40 hours per week, will initially be calculated at the regular rate. Then, the overtime hours will be calculated at .5 the regular rate. Here’s an example:

Fixed Salary Per Week = $700

Total Hours Worked for the Week = 50

In this example, we can conclude that the regular hourly rate is $14 ($700 / 50 = $14). Note that this particular employee is paid on a fixed salary basis and not at an hourly rate.

Now, when you compute the overtime pay, it should look like this:

10 hours x $7 = $70

Total Pay = $700 (Regular Weekly Rate) + $70 (Overtime Wages) = $770

How to Calculate Overtime for Day Rate Employees

Let’s say you’re computing overtime wages for an employee paid on a day-rate basis. The first thing you need to do is calculate the hourly rate. You will multiply the day rate by the number of working days for that week.

Once you’ve done that, you will divide the amount by the number of hours the employee worked for the week. As a result, you will get their regular hourly rate for that week. Now, when calculating the overtime pay, the amount will be half the regular rate. Here’s an example:

Day Rate = $140

Work Days for that Week = 5 Days

Work Hours = 45

Now, if we’re computing the regular hourly rate for this week, we need to multiply the day rate by the number of days:

$140 x 5 = $700

To get the regular hourly rate, we’ll divide the amount by the number of hours the employee worked for the week:

$700 / 45 = $15.6 (Regular Hourly Rate)

Now, we’ll calculate the overtime pay for the hours exceeding 40:

$15.6 x .5 = $7.8 (Overtime Rate)

$7.8 x 5 = $39

Total Pay = $700 (Day Rate Earnings) + $39 (Overtime Wages) = $739

Now, if your employees usually work more than 40 hours per week, this can be an advantage for you. Using the day rate system instead of the traditional hourly rate will help you cut down operational costs.

In this case, the overtime rate of your employee will not depend on the number of hours that exceed 40 per week. However, as the number of work hours increases, the overtime rate decreases.

How to Calculate Overtime for Non-Exempt Salaried Employees

If you’re managing non-exempt salaried employees, you need to compensate them for overtime work at a rate of 1.5 times their regular hourly rate. Now, computing this can be a bit tricky, which is why a lot of HR managers use a Chinese overtime calculator for this.

As you may have noticed, the regular rate for fixed salaries with fluctuating hours varies from week to week. We get the regular rate by dividing the salary by the number of work hours for that week. Do note that the amount cannot be less than the minimum wage. Since you’ve already paid straight-time compensation, the overtime hours can be paid at one-half the regular rate.

Let’s say an employee is getting a fixed salary of $800 per week on a fluctuating workweek basis. If they work for 48 hours in a particular week, here is how you can calculate overtime pay:

$800 / 48 hours = $16.7 (Regular Hourly Rate)

The fixed salary already covers all 48 hours worked at straight time. As such, you will only pay half the hourly rate for hours exceeding 40:

$16.7 x .5 = $8.35

Overtime Pay = $8.35 x 8 hours = $66.8

Total Pay = $800 (Regular Rate) + $66.8 (Overtime Pay) = $866.8

Should You Include Bonuses When Computing Overtime Pay?

In general, the answer to this question is “yes”. Bonuses must be included when determining an employee’s regular rate per week. The only exception is if bonuses are out of the worker’s contract and you are not compelled to give them. Keep in mind that bonuses are not considered to be discretionary if they are tied to achieving certain requirements, quotas, or pre-set goals.

Do You Legally Qualify for Chinese Overtime?

If your employer pays you according to the concept of Chinese overtime, expect that anything exceeding 40 hours per week will be one-half of your regular rate. Naturally, you may wonder if you legally qualify for this computation. Here are some things to consider:

Are You Working a Fluctuating Workweek?

According to the U.S. Department of Labor, employees with fluctuating workweeks have varying schedules. So, their total number of work hours may decrease or increase from one week to the next.

Even so, it does not necessarily mean that you have unpredictable hours. According to various federal courts, employees with a regular schedule yet working on variable hours can be legally paid the Chinese overtime rate.

Let’s say for the first and second weeks of the month, you worked for 32 hours. Then, on the third and fourth weeks, you worked for 46 hours. In this case, under federal law, you have a valid fluctuating workweek schedule.

Are You Working on a Fixed Salary?

As we’ve mentioned, Chinese overtime can only be legal under the FLSA if you’re paid a fixed salary per week. No matter how many hours you log, you must still be paid the same amount.

Let’s say your fixed salary per week is $350. For the first week of the month, you were scheduled to work for 36 hours. In the second week, you get to work for 28 hours. Despite the difference in the logged time, you still get $350 for each week.

In this case, the FLSA considers you working a fluctuating workweek. Consequently, your employer is allowed to pay you a Chinese overtime rate.

Do You Earn at Least the Minimum Wage?

Usually, the hourly wage of employees with fluctuating workweeks changes, depending on the number of hours they work. Even so, their pay must meet the minimum wage requirements.

Let’s say for the first week, you worked for 30 hours and you earned $350. In this case, your hourly rate for the week is around $11.67. As of this writing, the Department of Labor states that the federal minimum wage is $7.25 per hour.

Even if your hourly pay for the second week amounts to $9.50, your earnings still remain above the minimum wage. As long as your hourly rate is at least $7.25, your employer is entitled to use the Chinese overtime computation.

Did You Have a “Mutual and Clear Understanding” With Your Employer?

Your employer should inform you that:

- Regardless of the number of hours you work, your salary remains the same for every week.

- Your overtime pay will be one-half your regular hourly rate. This will only apply to weeks wherein you worked for more than 40 hours.

Usually, employers are not required to get your consent. In most cases, they only need to inform you about the computation.

What Are Some of the Common Concerns that Come with Chinese Overtime?

Like any other wage-related topic, Chinese overtime is not spared from controversies. Here are some of the issues that may come with this calculation:

Misclassification

On the surface, Chinese overtime computation may seem simple. In reality, it is quite stringent and many companies end up misclassifying their employees. Employers may resort to abusing this option to save on labor costs.

Even if a person’s hours do not fluctuate every week, an organization may consider them eligible for Chinese overtime. This defeats the very nature of the practice’s name – Fluctuating Workweek Method.

Ethnocentric and Derogatory Term

The FWW method is more popularly known as Chinese overtime. In reality, fluctuating workweeks are not originally a Chinese business practice or idea.

According to corporate attorney Craig Dorne, the term “Chinese overtime” is probably meant to associate the practice with the principles of a communist government. It may be a way to disconnect the overtime calculation from the “American Dream”.

Lack of Transparency

One of the common mistakes that companies make is neglecting to inform their employees about the fluctuating workweek calculation. Of course, the lack of transparency can lead to potential lawsuits.

This can be easily resolved by ensuring that the policy for computing overtime is included in the contract. Alternatively, the agreement can be recorded in a signed document.

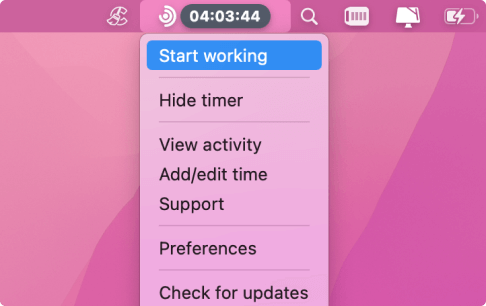

The Easy Way to Track Overtime Hours

As you can see, computing regular and overtime hours can be complicated. If only some of the admin tasks could be lifted off your shoulders. Thankfully, there is an easy way to monitor your employees’ working hours. You can automate time tracking by using Traqq. This tool works both offline and online, making it convenient for your workers to track their billable hours.

What’s more, Traqq has a feature that lets you create invoices automatically. All you need to do is set up invoicing by inputting the required details (Pay Rate, Currency, etc.). Within a few clicks, you’ll be able to generate invoices with ease.

Conclusion

Calculating regular and overtime rates can be complicated, especially since you need to comply with the stipulations of the FLSA. While this guide provides detailed instructions for computing Chinese overtime, it is still best that you consult with a professional legal team. This way, you won’t get into trouble with the law when compensating your employees.