Time Tracking App for Remote and On-site Teams

Track your team’s work hours and productivity to generate reports for easier billing and payroll.

Loading...

How Traqq Works

Click once to start or stop tracking time

Traqq will automatically log billable time and upload it to a neat online timesheet in your account.

Track team productivity and performance

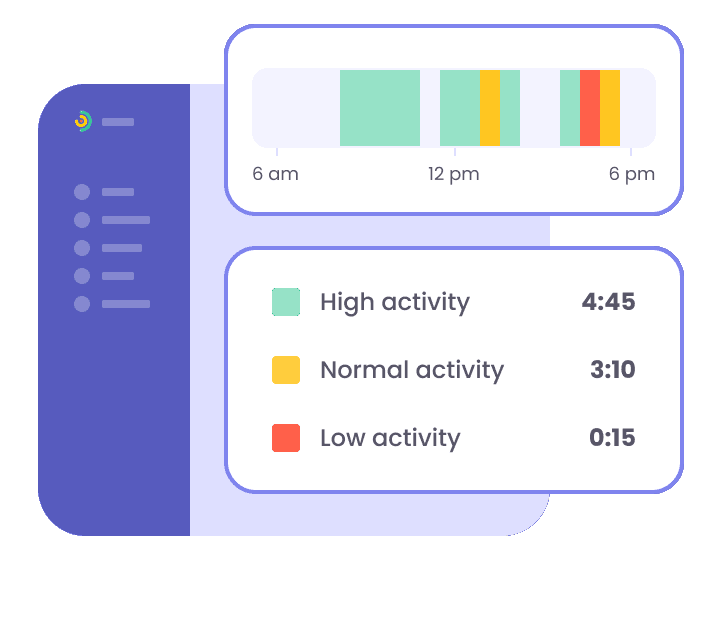

The time tracker measures and analyzes activity levels based on keyboard clicks and mouse scrolls.

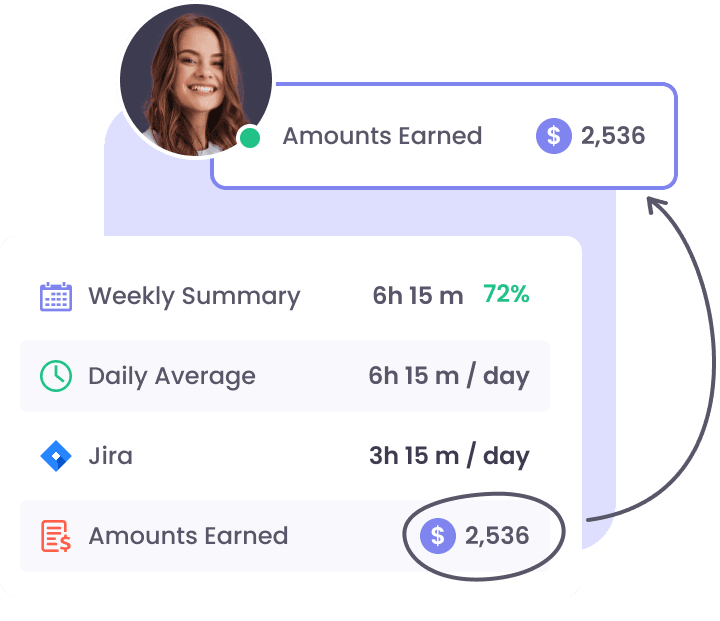

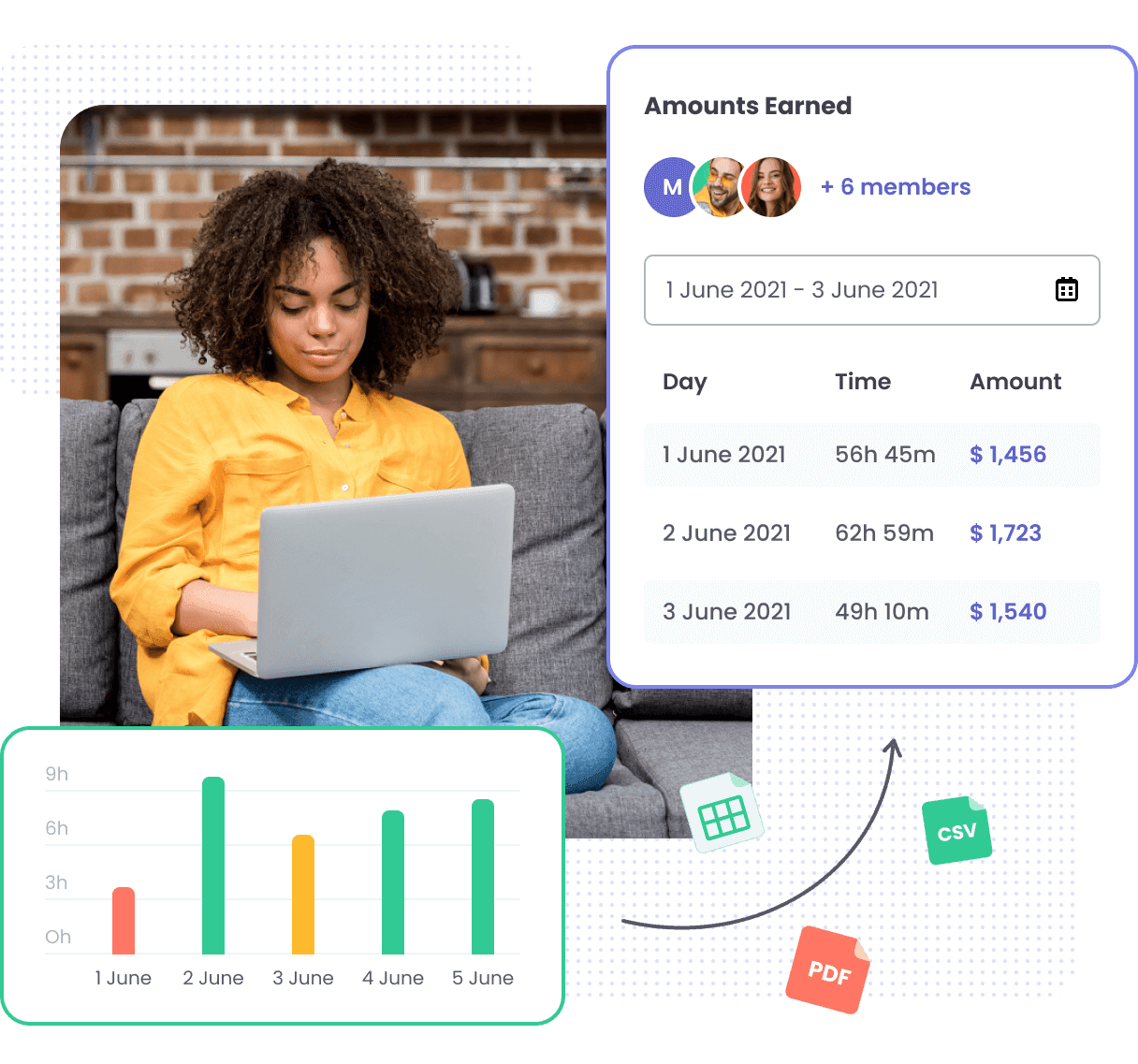

Generate reports and calculate payroll

Generate stats on activity levels and amounts earned to determine productivity and calculate payroll.

Simple and free tool for keeping record of work time

Time Tracker for Enterprises

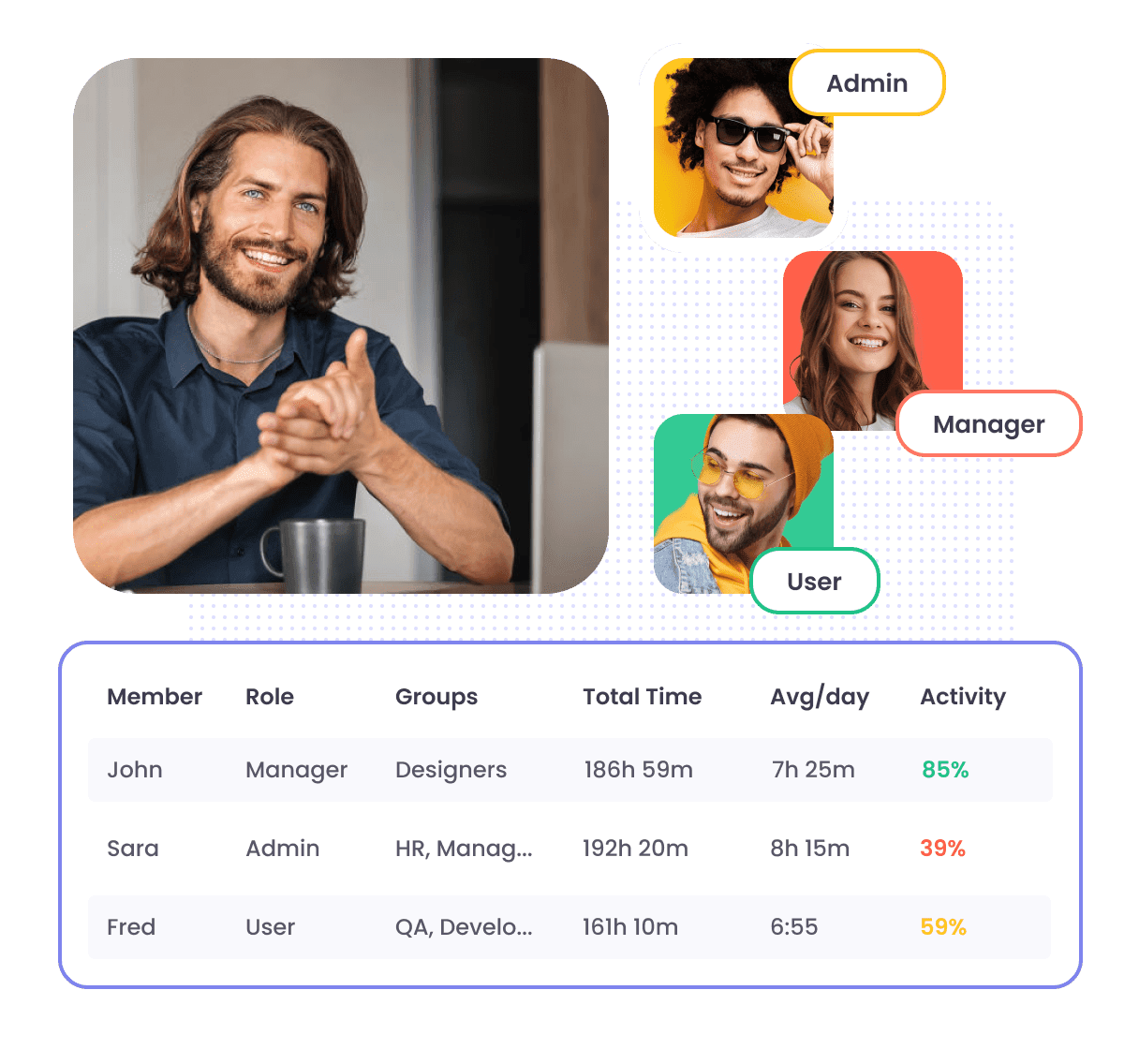

Gain comprehensive insights into time spending, manage your workforce, and plan resources in the best and most efficient way — all using a single timesheet tool.

Assign managers to monitor their teams and projects, use automated productivity assessment features, and keep track of project expenses while enjoying 24/7 support and custom onboarding.

Learn moreTimesheet Software for Businesses

Manage your company’s human resources and cash flow from a single dashboard. Use the Traqq app to track your staff’s performance, keep an eye on the outsourced workers with optional screenshots and desktop recordings, manage your groups, calculate labor costs, generate statistics, and more.

Learn moreEmployee Time Tracking Tool for Agencies

Track time for everyone on your team in the best way, including on-site staff, remote workers and freelancers.

Identify overwhelmed workers and see who can take on more tasks. Review activity levels and website/app usage to ensure that every minute worked is a minute paid.

Learn moreTime Tracking Software for Teams

Manage local and remote workers, boost productivity, and plan resources efficiently — all using a single free timesheet app.

Traqq lets you create groups or teams and assign managers to monitor workers. By optimizing efficiency, you can ensure your business’ success.

Learn moreConvenient Time Tracking for Freelancers

Never again get underpaid for the time invested in your clients’ projects. Traqq’s free app accurately records the total time you spend on specific projects.

It lets you create online timesheets, export data, and send it to your clients for easy project invoicing.

Learn moreKeep tracking billable time even when switching between devices or working offline

Time Tracking

Online and offline time tracking allows you to see how your or your staff’s time is spent.

Smart alerts and notifications will keep you tuned in to ensure you record every billable minute and save it in your account.

Learn more

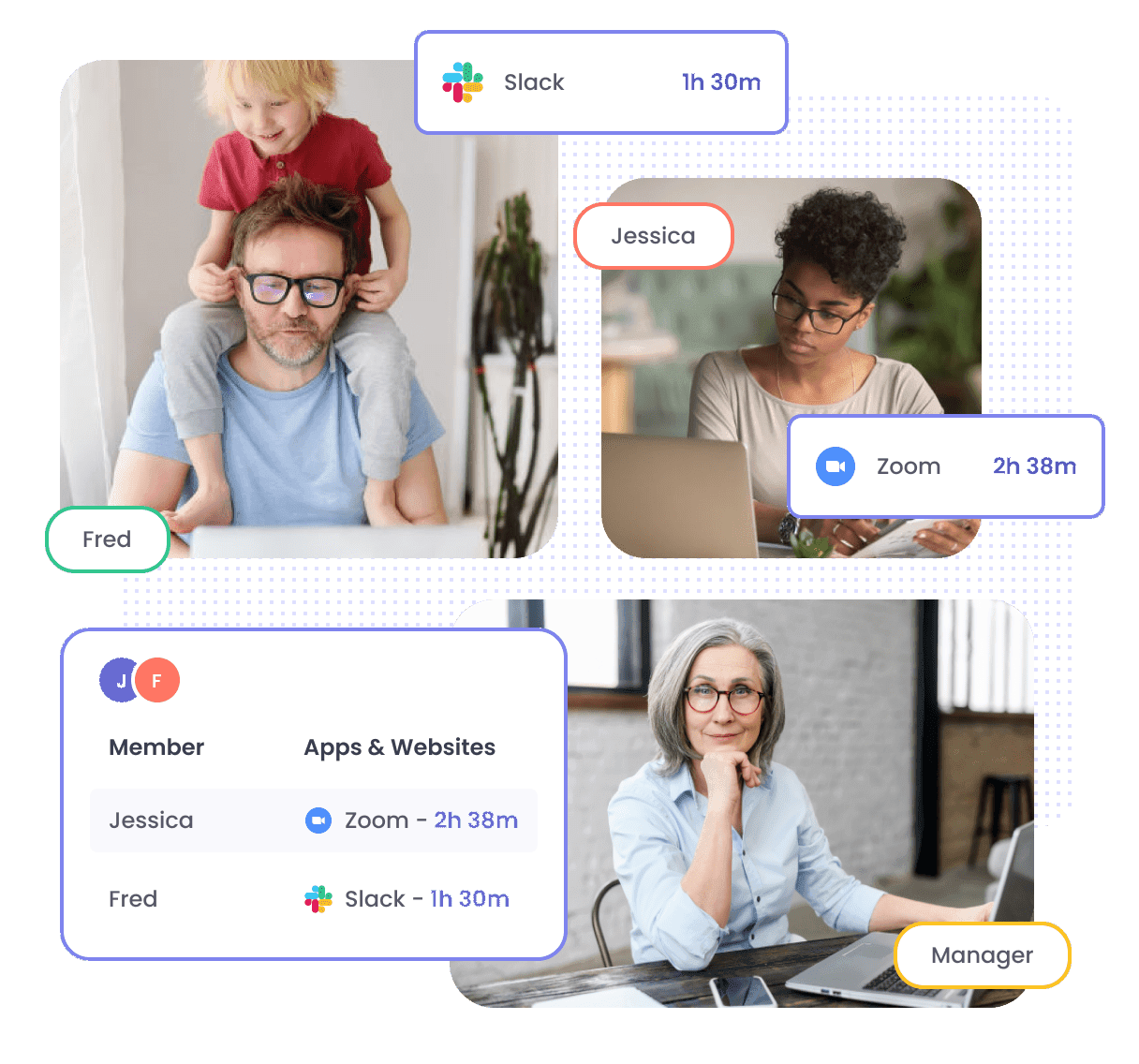

Employee monitoring

Ethically monitor staff performance via screenshots and screen recordings; activity levels; and app and URL usage.

Tracking settings are flexible, screenshots are always blurred, and workers and contractors choose when to let Traqq monitor their activities.

Learn more

Team management

Manage all your staff by dividing people into groups. Create as many groups as you need, give them custom names and add users to groups.

Compare performance stats and spending between departments and groups to optimize profitability.

Learn more

Team analysis and reporting

Detailed performance statistics and accurate online timesheets allow you to measure and analyze the performance of everyone on your account in the best way.

Generate, schedule, and export multiple insight reports for your staff, based on their recorded time, activity levels, app and URL usage, idle time, amounts earned, and much more…

Learn moreTrack your staff’s work hours and performance ethically!

Flexible tracking settings

How you track your staff’s work time is totally up to you. You may choose to track just the work hours, or enable screenshots and/or short video recordings for better monitoring.

Screenshots are intentionally blurred, and workers have full access to them

All screenshots and video recordings taken by the app will remain blurred to keep passwords and private messages hidden. On top of that, any person may, at any time, review and delete their screenshots along with the recorded work time attached to them.

Workers choose when to start the time tracker

It is up to individual users to choose exactly when to start working and when to take a break with one simple click.

- About ethical tracking

Get a competitor discount

If you use another time tracker or employee monitoring

software,

you can get Traqq

at up to 30% off.

off