For most people, saving money can be difficult, especially amidst the current global situation. It’s easy to say that we will put away cash. However, as mere mortals, we are easily enticed into spending all of our earnings. It’s gratifying and fun to buy things that make us happy. Indeed, we need a stronger motivation than just having money saved for a rainy day.

It is alarming to discover that not many Americans have been seriously saving money. According to a survey conducted by GoBankingRates, about 45% of the respondents do not have anything in their savings accounts. Out of the 55% who do have money saved up, 70% say that what they’ve put away is less than $1,000. Clearly, delayed gratification is not something that most Americans can handle.

The good news is, today is always a good time to make a change. To give you the boost you need, we’ve compiled a list of foolproof money-saving challenges. These are practical tips that you can easily apply to your daily/monthly budget.

52-Week Money-Saving Challenge

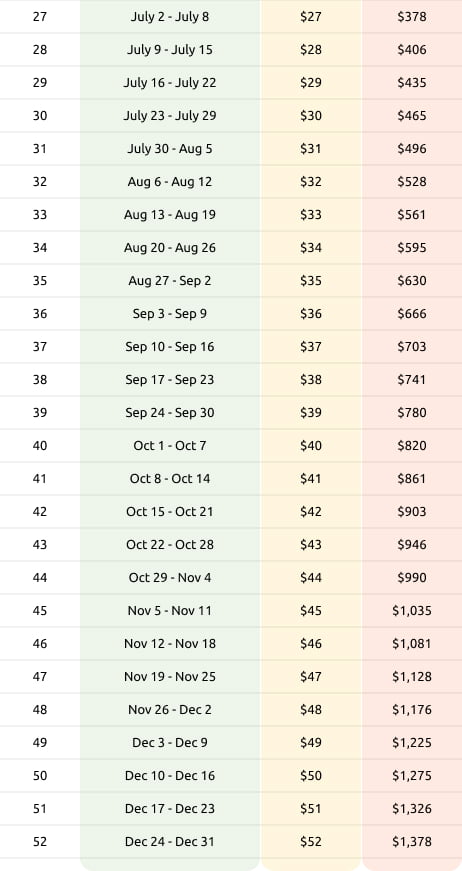

Introduced by the owner of the ‘Life as You Live It’ blog, the 52-Week Savings Challenge will help you get into the savings habit. You’re going to put away money every week, but the amount will increase by increments. You can start with as little as $1, and by the end of the year, you’ll have over $1,300! What’s great about this challenge is you can set increments depending on your goal and what you’re comfortable with.

How to Do the 52-Week Money Challenge

You’ll begin by setting a goal. You need to ask yourself why you’re saving money. You also need to determine how much you want to have by the end of the year. Without answering these questions, attempting to save money will be pointless. You can refer to it as a challenge if you don’t have a goal in mind.

The challenge should also have a physical focus. Of course, you always have the option to put the money in a bank account. However, if you see a jar starting to fill up week by week, you are motivated to keep pushing forward. You can use any type of transparent storage, like a jar. Then, you’ll need to create a money-saving template that you’ll print out and stick onto the jar. Here is an example:

The Envelope Challenge

If you’re not fond of time-limited money challenges, then the Envelope Challenge is ideal for you. Unlike the previous challenge, this one will give you more freedom on when and how long you want to put away your money.

How to Do the Envelope Challenge

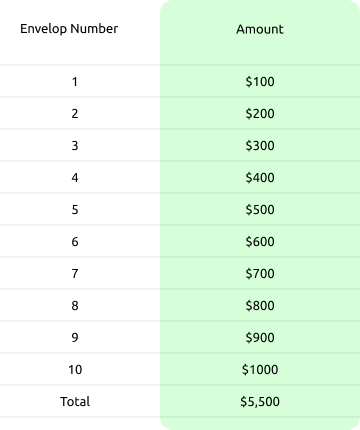

This saving challenge is straightforward. All you need to do is collect as many envelopes as you want. Then, you will label the envelopes with different amounts that you are comfortable putting away. The amounts must vary, and they can increase in increments that you deem won’t compromise your monthly obligations. Once you’ve filled the envelopes, you can deposit the total amount to your bank account.

The challenge here is to fill each envelope according to the amount written on it. Even so, there is no time pressure. You don’t have to set deadlines to fill any particular envelope. Basically, you can save at your own pace as long as you follow the amounts on the envelopes. Here’s an example:

With this money-saving challenge, there is less pressure on your monthly expenses. However, the lack of deadline pressure may also mean that you may be unable to fill all the envelopes. Without the right motivation, you might look inside those envelopes and take a dollar or two from time to time. Even so, it doesn’t mean that this challenge won’t be effective. There are still people who prefer a non-structured method of saving money, and this plan will work for them.

Zero-Cost Weekends

We always associate weekends with rewarding ourselves. After a week of stressful work, we get time to relax and enjoy ourselves. However, we can easily lose control and spend money on activities that will eat up our budget. So, why not challenge yourself to have Zero-Cost Weekends? You can do this for an entire month or several months. If that is too difficult for you, you can do it every other week or every two weeks. You can collect the money you would’ve spent on a particular weekend and add it to your savings.

Once you start exploring zero-cost activities, you will be surprised at how many things you can do without spending money. For instance, you can try some breathing exercises or yoga. You can also do some gardening, baking, or decluttering. If you want to go out, you can hike or visit free museums. Just make sure you bring a packed lunch with you to ensure that you won’t spend money on nearby cafes or restaurants.

The downside of this challenge is it is very lenient. There’s no sense of urgency or deadline. What’s more, it may not work for those who are used to the lavish weekend lifestyle. However, if you have room for becoming more frugal, this challenge will work for you.

Saving money is called a ‘challenge’ for a reason. It will force you to step out of your comfort zone and make changes to your lifestyle. Like time tracking, monitoring your savings will require some level of discipline. However, once you’ve set your goal and focused on it, things will slowly flow naturally for you.